CCP AACE International Certified Cost Professional (CCP) Exam Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AACE International CCP Certified Cost Professional (CCP) Exam certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

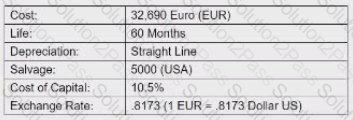

An American company plans to acquire a new press machine from a Dutch manufacturer under the following conditions. One question remaining to be answered is the expected amount of capital recovery when salvage is accounted for.

The following question requites your selection of Scenario 1.4.150 from the tight side of your split screen. using the drop down menu, to reference during your response/choice o' responses

The present worth interest factor for this purchase in the fifth year would be:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

A contractor must purchase a piece of equipment for $150,000. It has an estimated life of 10 years with no salvage value at the end. Ten years from now it will be necessary to purchase another piece of equipment, but this time it will cost $250,000. How much will the contractor need to invest at the end of each year in order to have the right amount?

When using a fixed-price./lump-sum contract, which of the following; situations can a payment be made for the adjustment of fluctuations in the cost of of construction resources?

A breach of contract can only occur when which of the following conditions is (are) present?

1. The item must be contrary to the intent of the parties

2. The item must be contrary to the contract terms and conditions

3. The injured party must actually sustain additional or excess costs

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is a method for figuring estimate at completion (EAC)?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the 25 year after tax present worth of this project?

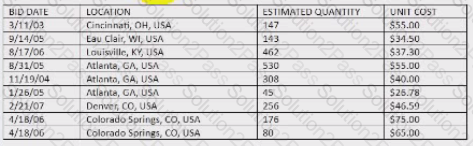

You are analyzing historic unit costs for 18'' Class 5 reinforced concrete pipe is a database. The unit costs include all costs-material, labor, equipment, and other, for the excavation, bedding, pipe and backfill. Refer to the following table:

What is the median unit cost?

Which of the following is NOT an aspect of quality management?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

In Rensis1 4 model system, the exploitative-authoritative management style is one in which:

When a person hears the words being said to him/her, but does not receive the message of the words, it is called

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following would NOT be considered part of a project cost and schedule forecast?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Taxes due at the end of year five (5) would be:

If two alternatives with different useful lives are to be compared considering all costs, which of the following methods is most appropriate?

Which statement best describes the constructability review for a project?

A _________contract allows the contractor to freely employ whatever methods and resources it chooses in order to complete the work.

Which of the following is a disadvantage to using target contract as a method of contracting?

What do you call a person authorized to represent another (the principal) in some capacity? He/she can only act within this capacity or "scope of authority" to bind the principal.

What relationship more accurately defines a situation model of parallel activities that require a partial start of one activity?

In a fixed price contract the:

refers to the process of calculating and reporting the non-monetary functions of the strategic asset portfolio.