GLO_CWM_LVL_1 AAFM Chartered Wealth Manager (CWM) Global Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM GLO_CWM_LVL_1 Chartered Wealth Manager (CWM) Global Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Which of the following are the rights of the beneficiaries?

Roger deposits Rs. 10,00,000 in a bank account on 1st March 2005 and another Rs. 5,00,000 on 1st March 2011. He wants to withdraw all of this money with interest on 1st March 2015. If the account pays ROI of 11% P.A. compounded quarterly what amount can he withdraw from this account?

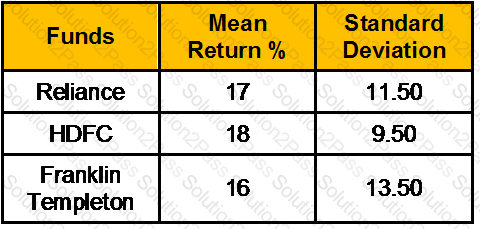

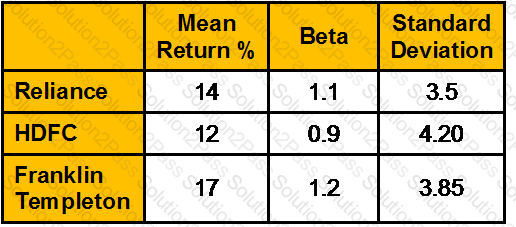

From the following data on mutual funds, Calculate the Sharpe Ratio.

Risk free return is 8%.

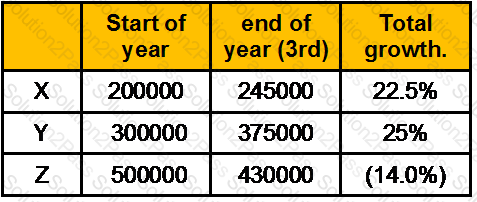

You own 3 scripts with their market value at

Calculate the CAGR of portfolio.

A portfolio consists of 3 securities.

What is the standard deviation of the portfolio?

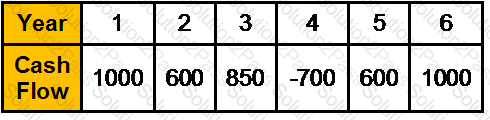

What is the present value of the following cash flows,if the Interest rate is 8%

What amount needs to be deposited today in an account that would pay Rs. 1,10,000 per year for the first 10 years and Rs. 2,25,000 for the next 5 years. If the ROI for the first 10 years if 10.75 % p.a. compounded annually and 13% p.a. compounded quarterly for the balance period.?

Samantha celebrated her 21st birthday today, her father gave her Rs. 6,25,000/- which is deposited in a account that pays a ROI of 12.25% p.a. compounded monthly. If she wants to withdraw Rs. 7,50,000 on her 31st. Birthday and balance on her 41stBirthday. How much can she withdraw on her 41st. birthday.?

Your client, a businessman has a house worth Rs. 2.1 crore and a farm house worth Rs. 85 lakh. His business is worth Rs. 10 crore as per last balance sheet. He has two other partners in the business having stakes of 24% each. He has two cars purchased at Rs. 40 lakh and Rs. 20 lakh, the latter being in personal account. The cars have depreciated/market value at Rs. 30 lakh and Rs. 8 lakh, respectively. His joint Demat account, wife being primary holder, has stocks worth Rs. 1.65 crore. The business has taken Keyman‟s insurance on his life of value Rs. 1.5 crore. He has himself insured his life for an assured sum of Rs. 1.5 crore. You evaluate your client’s estate in case of any exigency with his life as _____.

Which of the following option illustrates an advantage of the probate process?

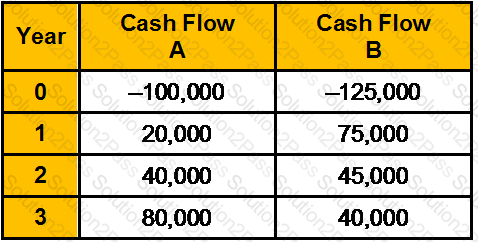

You have a choice between 2 mutually exclusive investments. If you require a 15% return, which investment should you choose?

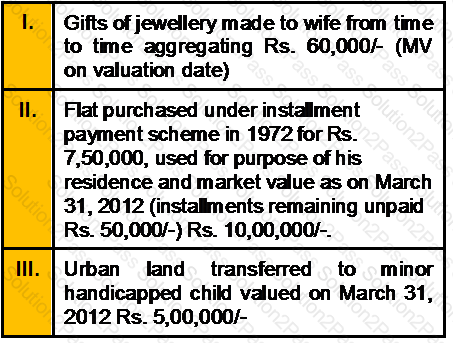

X furnishes the following particulars for the compilation of his wealth-tax return for assessment year 2012-13.

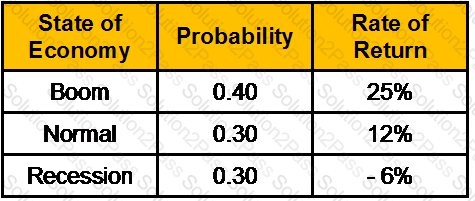

The probability distribution of the rate of return on ABC stock is given below:

What is the standard deviation of return?

The list of managing body needs for be fixed with Registrar of Joint Stock companies

Ankur Kalra is 33 years old finance professional. The house hold expenditure of Mr. Kalra is 20,000/- p.m. to maintain his current living standard. He assumes that his living standard will increase 1.5% annually until his retirement at 60. His life expectancy is 70 years. At retirement he needs 75% of his last year’s expenses. Inflation rate for the next 45 years is expected to be 4% p.a.

Calculate how much would Mr. Kalra require in the first year after his retirement, and how much he has to save at end of every year to accumulate this corpus, if the return on investment is 7% p.a.?

Ram deposits Rs. 12,500 in an account that pays a ROI of 20% pea compounded annually on 5th. Of March 2010. Calculate the date on which the balance in his account would be Rs.35,338/-.

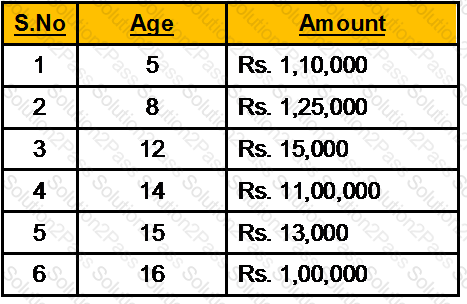

Mr. Shikar wants to invest his savings in an account that pays an interest rate of 9.25% p.a. compounded annually at different ages of his son whose current age is 4 years. Please calculate for him the Future Value of these investments when his son turns 18.

Dhruv contributes Rs. 25,000 every year starting from the beginning of the 4th year from today till the begning of 12th year in the account that gives a ROI of 11.40% p.a. compounded half yearly. Calculate the Present Value of his contribution today.

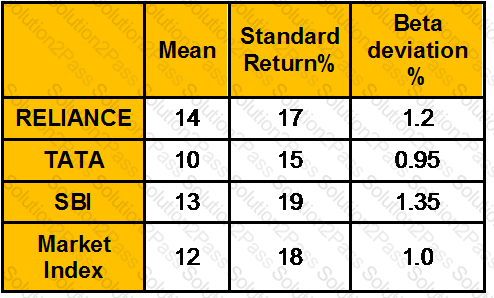

Mentioned below is the information regarding three mutual funds - Reliance, TATA, SBI and the Market Index.

The Risk free return rate is 5%. Calculate the Jensen Measure of RELIANCE, TATA, & SBI Fund.

Mr. Kadam is entitled to a salary of Rs. 25000 per month. He is given an option by his employer either to take house rent allowance or a rent free accommodation which is owned by the company. The HRA amount payable was Rs. 5000 per month. The rent for the hired accommodation was Rs. 6000 per month at New Delhi. Advice Mr. Kadam whether it would be beneficial for him to avail HRA or Rent Free Accommodation. Give your advice on the basis of “Net Take Home Cash benefits”.

Saurabh contributes Rs. 10,000 every year starting from the end of the 5th year from today till the end of 12th year in the account that gives a ROI of 7.75% p.a. compounded half yearly. Calculate the Present Value of his contribution today.

Mr. M is an employee of Z Ltd. His basic pay is Rs.24,000 p.a., Dearness Allowance Rs.12,000 p.a; Medical Allowance (fixed) Rs.10,000 p.a.; Conveyance Allowance Rs.6,000 p.a.; Professional Tax deducted from his salary Rs.1,000 p.a.; Free lunch provided during office hours valued at Rs.12,000 for a 300-working day year; free education for two children in a school owned and maintained by the employer – school tuition fee for both the children is estimated at Rs.18,000 p.a.

What is Net Income of Mr. M and examine whether he is a specified or non-specified employee?

Consider the following information for three mutual funds:

Market Return 10%

Risk free return is 6%.

Calculate the Risk Adjusted Return on the basis of Jensen measure (%)?

Akash owns a piece of land situated in Kolkata ( Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-) On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.75 lakh. And X files an appeal under the Stamp Act and Stamp duty valuation has been reduced to Rs. 4.90 lakh by the Kolkata High Cout. [CII-12-13: 852,11-12: 785,10-11:711]

A mutual fund that invests in Indian Equities, foreign equities, Indian Corporate Bonds, Indian Government Gilts is subject to the following risks?

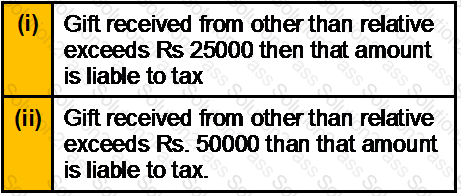

Which one of the above statements is/are correct?

Any income chargeable under the based "Salaries" is exempt from tax under Section 10(6)(viii), if it is received by any non resident individual as remuneration for services rendered in connection with his employment in a foreign ship where his total stay in India does not exceed a period days in that previous year.

PPF is a

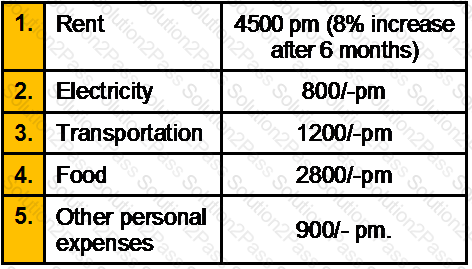

Suresh a 30 years old person has joined ABHG on 1/07/2006. His monthly salary (net salary) after deduction is payable Rs. 20500.His monthly expenses details are as follows:

Assume that Suresh has taken his flat on rent from 01/07/2006. On 01 /07/2006 he has cash in hand Rs. 2450. What will be his cash in hand on 31/03/2007.

Retiring early will ____________ the accumulation phase while ____________ the retirement phase

A hired a bicycle from B. The written contract contained a clause which read “Nothing in this agreement shall render the owner liable for any personal injuries to the rider of the machine hired”. Owing to a defect in the brakes of the cycle, A met with an accident and got injured. Can A recover Damages?

Which of the following is / are RBI conditions applicable for banks declaring dividends?

Mr. L Singh used machinery in his business. This is the only asset in the block. 20% of the usage is for personal purposes. The WDV of the block as on 31.3.2011 is —

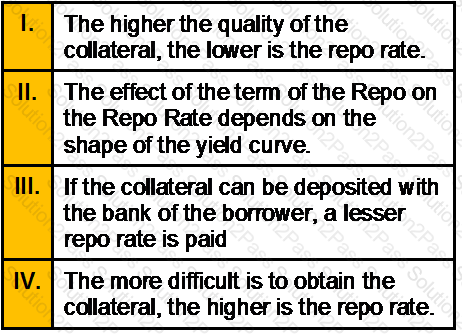

Which of the following statements in reference to REPO Rate is/are correct?

Sudhir has invested Rs. 60,000, 30% of which is invested in Company A, which has an expected rate of return of 15%, and 70% of which is invested in Company B, with an expected return of 12%. What is the return on Sudhir’s portfolio?

Yash pays health insurance premiums for himself, his wife and his two children aged 13 and 8. Premiums for which of these individuals will qualify as deductible from Yash’s taxable income?

Which one of the above statements is/are incorrect?

The first Mutual fund to offer Sarahia complaint fund IS

Calculate the premium for a policy of Rs. 10 lacs, if on an average out of 50000 persons aged 39,572 people die every year

Akash has only compulsory third party policy for his car. He jumped a red light and collided with another car and then with the boundary wall of a nearby house. Damage to his car was of Rs. 17,000/-, damage to other car was of Rs. 15,000/- and damage to the boundary wall of house was of Rs. 15,000. The insurance policy of Akash will pay: