3I0-012 ACI Dealing Certificate Free Practice Exam Questions (2026 Updated)

Prepare effectively for your ACI 3I0-012 ACI Dealing Certificate certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

How many USD would you have to invest at 3.5% to be repaid USD125 million (principal plus interest) in 30 days?

Which of the following statements reflects the Model Code on gambling or betting amongst market participants?

Where answer phone equipment is used for reporting and recording of off-premises transactions, it should be:

You quote a price to a broker on EUR 100 million. Your price is hit for EUR 50 million. What does the Model Code say about this situation?

An option granted by the seller that gives the buyer the right to enter into an underlying interest rate swap transaction is ca lied:

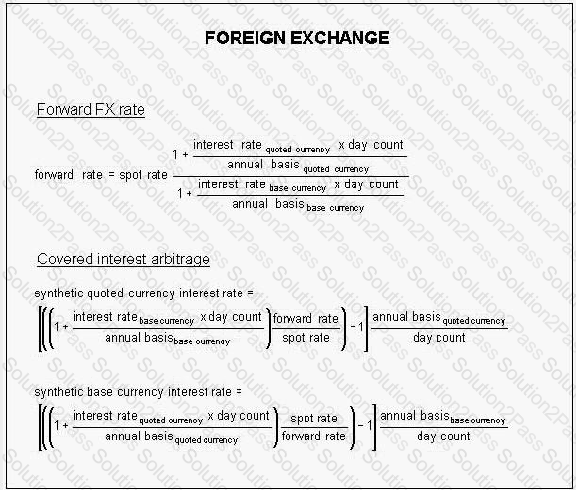

The torward points are calculated from:

A forward-forward loan creates an exposure to the risk of:

A dealer does the following deals in EUR/USD:

buys EUR 1 m at 11020

sells EUR 3 m at 1.1022

buys EUR 2 m at 1.1002

buys EUR 1.5 m at 1.1012

What position does the dealer now have?

You request use of funds from your agent bank for 1 day on an amount of EUR 100,000,000.00, EONIA was 0.812% and the ECB deposit facility rate is 0.50%. What use of funds settlement amount should you expect?

A 7% CD was issued at par, which you now purchase at 6.75%. You would expect to pay:

Hybex Electrics is a highly rated company with a considerable amount of fixed rate liabilities and would like to increase the percentage of floating rate debt. Which of the following is the best course of action?

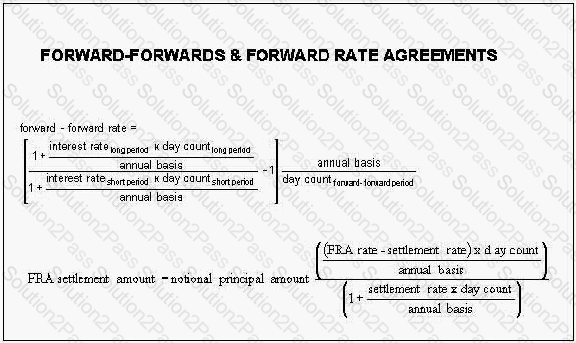

The market is quoting:

6-month (182-day) CAD 1.25%

12-month (366-day) CAD 1.55%

What is the 6x12 rate in CAD?

What is the maximum maturity of an unsecured USCP?

Which of the following scenarios offer an example of wrong way risk?

Voice-brokers in spot FX act as:

Which one of the following statements about interest rate movements is true?

How many GBP would you have to invest at 0.55% to be repaid GBP 2,000,000.00 (principal plus interest) in 90 days?

Which of the following CHF/JPY quotes that you have received is the best rate for you to buy CHF?

Which of the following is true?

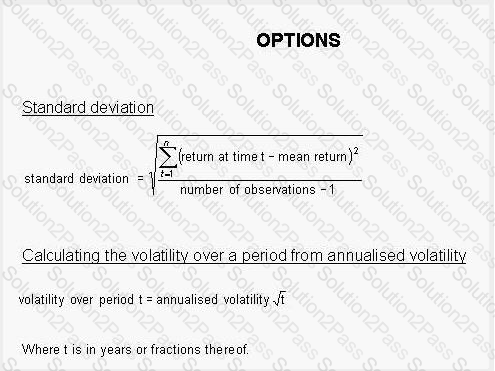

The seller of a put option has:

Under Basel rules, what is the meaning of EEPE?

Today’s spot value date is Friday 27th February. What is normally the 1-month maturity date? Assume no bank holidays.

EURODOLLAR futures are:

What is the Overnight Index for EUR?

Which of the following is a Eurocurrency deposit?

Which of the following does the Model Code mention with regards to recording telephone conversations?

A CD with a face value of EUR 10,000,000.00 and a coupon of 3% was issued at par for 182 days and is now trading at 3.10% with 120 days remaining to maturity. What has been the capital gain or loss since issue?

What is EONIA?

Which of the following is typical of liquid assets held by banks under prudential requirements?

If the value date of a forward USD/JPY transaction is declared a holiday in either New York or Tokyo, the correct value date will be: