3I0-012 ACI Dealing Certificate Free Practice Exam Questions (2026 Updated)

Prepare effectively for your ACI 3I0-012 ACI Dealing Certificate certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

What happens when a coupon is paid on bond collateral during the term of a sell/buy-back?

For which one of the following disputes is the Chairman and members of the ACI’s CFP ready to assist through the ACI’s Expert Determination?

A transaction that entails market price risks may be entered into in the absence of a market price risk limit...

When a broker needs to switch a name this should be done:

You are quoted the following market rates:

Spot EUR/USD 1.3097-00

0/N EUR/USD swap 0.08/0.11

TIN EUR/USD swap 0.29/0.34

S/N EUR/USD swap 0.10/0.13

Where can you buy EUR against USD for value tomorrow?

If you sell forward USD to a client against EUR, what is the first thing you should do to cover your exposure to exchange rate movements?

What is Funds Transfer Pricing in the ALM process?

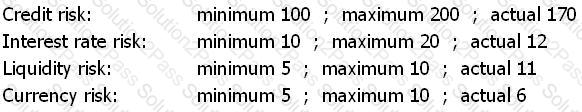

You have prepared the following economic capital table for the next ALCO meeting:

For which of the following risks should you consider actions?

How is an outright forward FX transaction quoted?

What is the major difference between a CD and a deposit?

What is the maximum maturity of a US Treasury bill?

Which of the following is a Model Code good practice regarding the passing of names?

Using the following rates:

3M (90-day) EUR deposit 0.25%

6M (180-day) EUR deposit 0.50%

What is the rate for a EUR deposit, which runs from 3 to 6 months?

In dealing terminology, what does “my risk” refer to?

What are financial market professionals not explicitly required by the Model Code to clarify and agree to in writing?

Which of the following is a measure of a bank’s gross exposure to foreign exchange rate risk?

How can material divergences between the value of cash and collateral be managed in a documented sell/buy-back?

How is a USD Overnight Indexed Swap (OIS) settled?

What is the recommended follow-up procedure in case of a settlement discrepancy?

In foreign exchange markets, the first currency in a currency pair is:

A long collar is:

You quote your customer EUR/USD 1.3070-73, However they need the rate quoted in EUR per USD. What do you quote?

What is the name of a swap in which the counterparties sell currencies to each other with a concomitant agreement to reverse the exchange of currencies at a fixed date in the future at the same price, and where the interest rates for the two currencies are reflected in the two exchanges but paid separately?

Four banks provide you with quotes in CHF/SEK. Which is the best price for you to buy SEK?

What are de minimis claims?

In the unforeseen event that a particular maturity date is declared a public holiday, what is standard market practice for spot FX?

Which SWIFT message should be used to advise the netting position of a currency resulting from FX, NDF, options and other trades?

Under what circumstances are banks allowed to “park” deals or positions with a counterparty?

Which of the following will tend to have the higher yield?

After having quoted a rate of 1.5005-10, the quoting bank says, “Your risk”. This means: