AHM-520 AHIP Health Plan Finance and Risk Management Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AHIP AHM-520 Health Plan Finance and Risk Management certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

The Fairway health plan is a for-profit health plan that issues stock. The following data was taken from Fairway's financial statements:

Current assets.....$5,000,000

Total assets.....6,000,000

Current liabilities.....2,500,000

Total liabilities.....3,600,000

Stockholders' equity.....2,400,000

Fairway's total revenues for the previous financial period were $7,200,000, and its net income for that period was $180,000.

From this data, Fairway can determine both its current ratio and its net working capital. Fairway would correctly determine that its

The following statement(s) can correctly be made about a health plan's cash receipts and cash disbursements budgets:

Doctors’ Care is an individual practice association (IPA) under contract to the Jasper Health Plan to provide primary and secondary care to Jasper’s members. Jasper’s capitation payments compensate Doctors’ Care for all physician services and associated diagnostic tests and laboratory work. The physicians at Doctors’ Care, as a group, determine how individual physicians in the group will be remunerated. The type of capitation used by Jasper to compensate Doctors’ Care is known as:

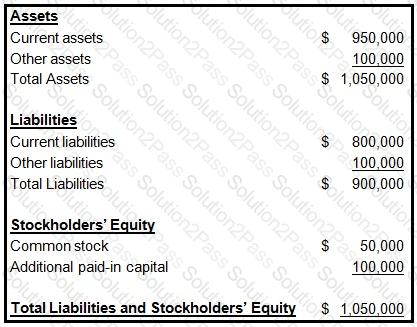

The following information was presented on one of the financial statements prepared by the Rouge Health Plan as of December 31, 1998:

Rouge’s current ratio at the end of 1998 was approximately equal to:

The Swann Health Plan excludes mental health coverage from its basic health benefit plan. Coverage for mental health is provided by a specialty health plan called a managed behavioral health organization (MBHO). This arrangement recognizes the fact that distinct administrative and clinical expertise is required to effectively manage mental health services. This information indicates that Swann manages mental health services through the use of a:

Correct statements about the financial risks associated with benefits that health plans provide to the Medicare and Medicaid markets include:

The sentence below contains two pairs of terms enclosed in parentheses.

Determine which term in each pair correctly completes the statement. Then select the answer choice containing the two terms that you have selected. In analyzing its financial data, a health plan would use (horizontal/common size financial statement) analysis to measure the numerical amount that corresponding items change from one financial statement to another over consecutive accounting periods, and the health plan would use (trend/vertical) analysis to show the relationship of each financial statement item to another financial statement item.

The Jamal Health Plan operates in a state that mandates that a health plan either allow providers to become part of its network or reimburse those providers at the health plan’s negotiated-contract rate, so long as the non-contract provider is willing to perform the services at the contract rate. This type of law is known as:

The following statements are about the Health Insurance Portability and Accountability Act (HIPAA) as it relates to the small group market. Three of these statements are true and one statement is false. Select the answer choice containing the FALSE statement:

The following information relates to the Hardcastle Health Plan for the month of June:

Incurred claims (paid and IBNR) equal $100,000

Earned premiums equal $120,000

Paid claims, excluding IBNR, equal $80,000

Total health plan expenses equal $300,000

This information indicates that Hardcastle’s medical loss ratio (MLR) for the month of June was approximately equal to:

The following statements are about the capital budgeting technique known as the payback method. Select the answer choice containing the correct statement:

Companies typically produce three types of budgets: operational budgets, cash budgets, and capital budgets. The following statements are about operational budgets. Select the answer choice containing the correct statement.

The Arista Health Plan is evaluating the following four groups that have applied for group healthcare coverage:

The Blaise Company, a large private employer

The Colton County Department of Human Services (DHS)

A multiple-employer group comprised of four companies

The Professional Society of Daycare Providers

With respect to the relative degree of risk to Arista represented by these four companies, the company that would most likely expose Arista to the lowest risk is the:

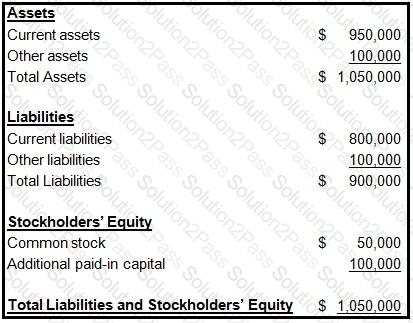

The following information was presented on one of the financial statements prepared by the Rouge health plan as of December 31, 1998:

When calculating its cash-to-claims payable ratio, Rouge would correctly divide its:

All publicly traded health plans in the United States are required to prepare financial statements for use by their external users in accordance with generally accepted accounting principles (GAAP). In addition, health insurers and health plans that fall under the jurisdiction of state insurance departments are required by law to prepare certain financial statements in accordance with statutory accounting practices (SAP). In a comparison of GAAP to SAP, it is correct to say that:

A health plan may experience negative working capital whenever healthcare expenses generated by plan members exceed the premium income the health plan receives.

Ways in which a health plan can manage the volatility in claims payments, and therefore reduce the risk of negative working capital, include:

1. Accurately estimating incurred but not reported (IBNR) claims

2. Using capitation contracts for provider reimbursement

A financial analyst wants to learn the following information about the

Forest health plan for a given financial period:

One typical characteristic of zero-based budgeting (ZBB) is that this budgeting approach

One difference between the internal and external analysis of a health plan's financial information is that

Analysts will use the capital asset pricing model (CAPM) to determine the cost of equity for the Maxim health plan, a for-profit plan. According to the CAPM, Maxim's cost of equity is equal to