G1 CIMA Gateway Exam Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA G1 CIMA Gateway Exam certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

The Marketing Director stops you in the corridor and says the following:

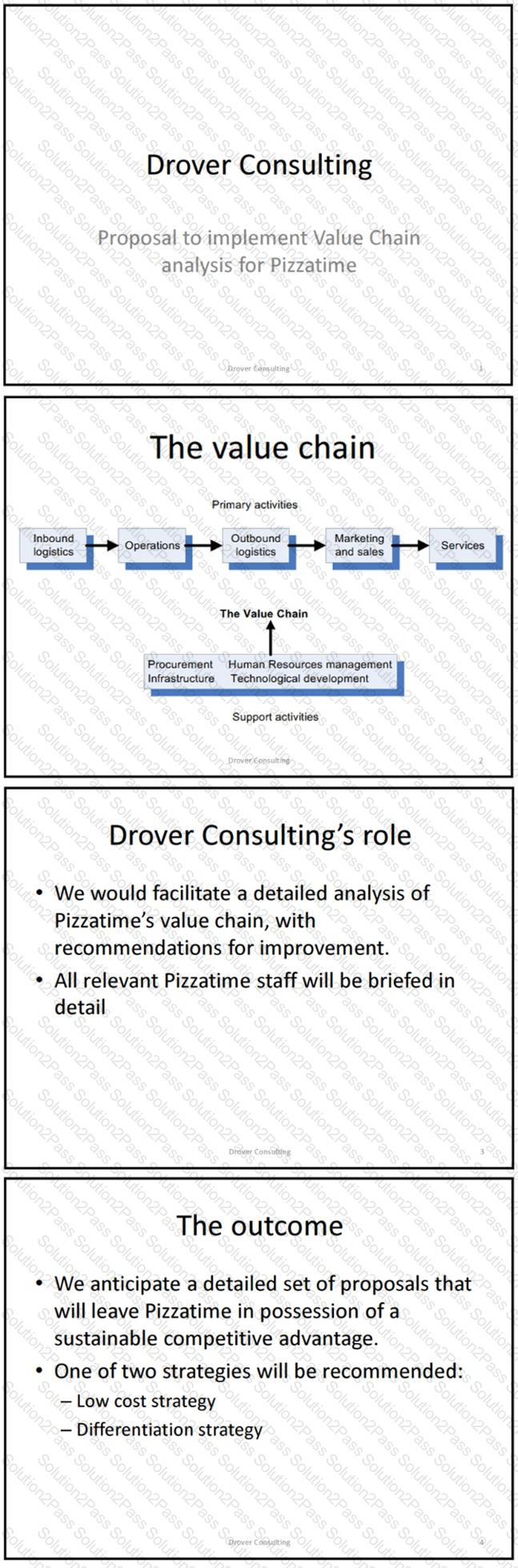

"I need your help. A firm of consultants has pitched a proposal to the Board to conduct a value chain analysis for Pizzatime. The Chief Executive is interested, but he would like us to discuss the proposal further at the next Board meeting before we decide whether to brief the consultants. He also feels that there are other areas we should explore, particularly the strategic focus of the company. I have left a copy of the consultants' presentation on your desk.

The Chief Executive has asked me to prepare a board paper on two issues.

Firstly, what would a value chain analysis involve in the case of Pizzatime and how might we involve our staff more in creating value?

Secondly, the Chief Executive is unsure whether we should focus our value chain analysis in a low-cost strategy or a differentiation strategy.

Please draft the board paper for me. I will review it and present it at the next board meeting."

You have received the following email:

From: Matt Spot, Finance Director

To: Financial Manager

Subject: all-day opening proposal – CONFIDENTIAL

Hello

I have just had an interesting meeting with Bilal Mukherjee, our Marketing Director. Bilal has been thinking of ways to put our restaurants to work during the day. At present, most of our restaurants are closed all morning and the afternoon between the end of lunch and the start of the evening rush. We are all well aware of the rapid growth of coffee shops in I-land over last 12 months; please see the attached newspaper article.

Bilal believes that we should open our restaurants to sell snacks, coffees, and light meals from early morning until early evening, with the exception of lunchtime when we would offer restaurant meals, so we wouldn't be interfering with our core business.

The main issue is the surprising expense required to start this venture. We would have to invest heavily in advertising and other promotions and would also need to seek separate permission from local government. Finally, we would have to buy a sophisticated coffee machine and equipment to heat and serve hot snacks for each restaurant. Our restaurants are equipped to cook pizza, not hot breakfast. Needless to say, we can't just buy the equipment and plug it in.

We will have to adapt our premises to make space for the new equipment. Bilal is suggesting that we introduce more family-friendly seating areas, removing a number of tables and replacing them with sofas and a toy kitchen area for young children to enjoy.

Bilal is concerned that the heavy outlays on advice for the local government applications, along with the significant investment in property, plant and equipment, will mean that this venture will have a very low accounting rate of return (ARR) for the first year. I rarely look beyond the net present value of a project, but he may have a point.

Please reply as soon as possible on the following:

Firstly, is this proposed all-day opening venture consistent with our strategic objectives?

Secondly, draft an explanation that I can take to the Board on possible reasons why the project's forecast ARR in the first year is so poor. Are forecast ARR results likely to give a good indication of the overall performance of the venture?

Matt

Partial transcript of television documentary entitled 'Did you enjoy that?'

You have received the following email:

From: Monica Lall, Chief Executive

To: Financial Manager

Subject: television documentary

Hi,

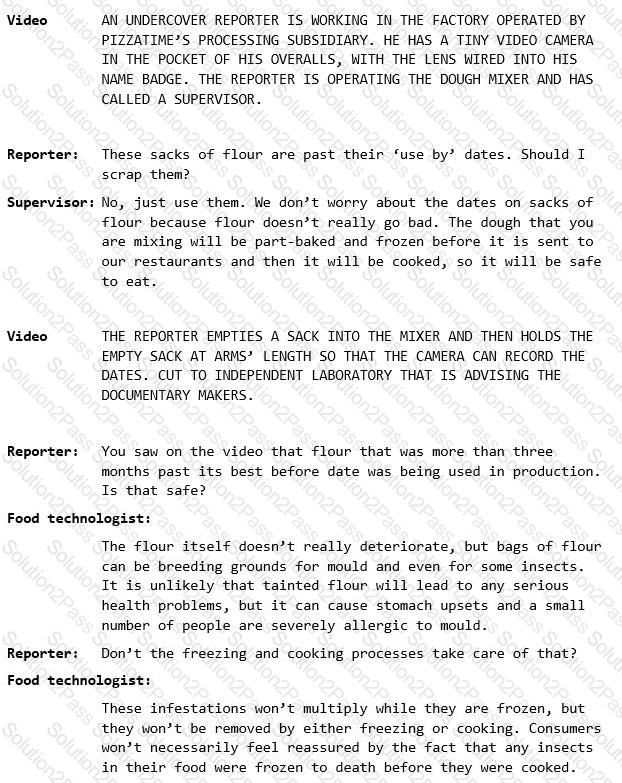

I have attached a transcript of a documentary on food hygiene that was broadcast last night. The broadcaster did not seek our response and so we were unaware of it until it was broadcast.

We have only had a few hours to investigate but the basic story appears to be true. The manager in charge of the factory has interviewed the supervisor who was filmed and it appears that the main flour supplier is guilty of shipping goods that are almost at, or even slightly beyond, their 'use by' dates. We operate on a just-in-time basis and so our factory would have to suspend production for anything up to 24 hours if a shipment was rejected.

We will, of course, check all inventories immediately. We will also find a new flour supplier for our factory in I-land. That will mean closing every restaurant for at least 72 hours until the factory can recommence production.

We have consulted our lawyers, who believe that we can expect large numbers of claims from customers. We can expect to be blamed for almost any form of ill-health suffered after eating one of our pizzas, regardless of whether we were to blame, as well as for psychological distress. Even though the year end is several months away, we will have to be ready to make a provision in the financial statements for the year ended 31 December 2016. This presents the company with a significant risk from our supply chain, which we need to consider.

I need you to email me your thoughts on the following:

How can we organise our supply chain better to prevent a recurrence? Clearly, flour is only one of many ingredients that we purchase.

How can we address the inevitable claims that we have acted unethically and against the public interest?

What are the accounting issues associated with determining the need for a provision in the financial statements?

Regards

Monica Lall

Chief Executive

Pizzatime

Two weeks have passed since your conversation with the Finance Director. You have received the following email:

From: Matt Spot, Finance Director

To: Financial Manager

Subject: proposed delivery business

Hi,

The working party has agreed that we need to develop some more detailed plans before we make any final decisions about proceeding with the proposal to offer a home delivery service.

Most members of the working party believed that there would be a steep learning curve associated with this new venture. I disagree, but I was in a very small minority so perhaps I was mistaken.

The implementation of this project will be a major undertaking in itself and we will need to think about the most efficient way to break it down into sensible phases. I need you to reply to this email with your thoughts on the following questions:

What are the significant learning curve issues associated with providing a home delivery service? Also, how would you establish the learning rate?

What are the major stages in this project's implementation and how might we organise these?

Matt

Forecast financial statements for the year ended 31 December 2016

You have received the following email:

From: Monica Lall, Chief Executive

To: Financial Manager

Subject: projected profits

Hi,

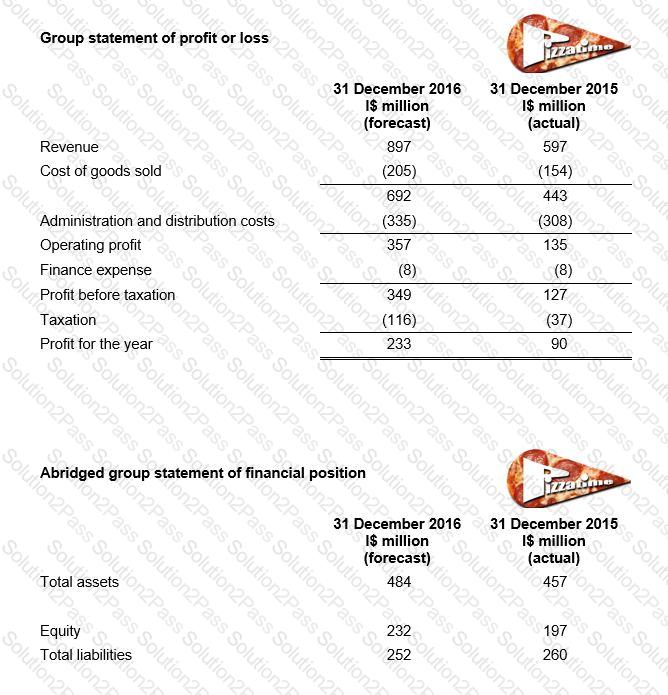

The controversy over Town Logistics continues. The Board is feeling a little sensitive to criticism over their management of Pizzatime's relationship with the company. With that in mind, I have had the Finance Director prepare a set of forecast financial statements, which I have attached to this email.

The new home delivery service will have been fully operational for almost six months by the year end. The service has already been hugely successful and has significantly increased both revenue and profit.

The directors' bonuses are linked to reported revenue according to the financial statements. As a retail organisation, our survival depends on sales revenue. Also, our restaurant managers' revenue targets are based on total revenue, including home delivery sales, although many of them have refused to accept responsibility for these sales.

I need your advice on two matters:

The first is that we are planning to argue that the shareholders should take comfort from these figures and should relax and allow the Board to manage Pizzatime without undue interference. Do you agree that these figures show that the Board is excelling?

Can we argue that the present directors' bonus scheme continues to align our interests with those of the shareholders? On a related matter, is the refusal of the restaurant managers to accept responsibility for home delivery sales justified?

Regards

Monica Lall

Chief Executive

Pizzatime

Three weeks have passed since the television documentary was broadcast. During that period, Pizzatime closed all restaurants until they could be resupplied with freshly-made dough that had been made from flour that had been sourced from a new supplier.

You have received the following email:

From: Matt Spot, Finance Director

To: Financial Manager

Subject: FW: sales downturn

Hi,

I need your advice. Our restaurant managers are complaining that their bonuses are affected by the ongoing downturn in sales since the documentary. I have forwarded just one email to you, which is typical of the comments that I have been receiving. We need to decide on the following:

Should we relax the profit targets for restaurant managers' bonuses for this quarter on the grounds that costs and revenues are effectively beyond the restaurant managers' control?

Assuming that we decide to do so, how would be go about setting realistic targets?

Looking forward, beyond the present concerns about the documentary, should we consider linking the restaurant managers' bonuses to a balanced scorecard approach? What would the implications of that be?

Regards

Matt

From: Sally Collins, Jaytown Restaurant Manager

To: Matt Spot, Finance Director

Subject: sales downturn

Hello Matt

I have been manager of the Jaytown Restaurant for the past three years. During that time, I have regularly beaten sales targets and my restaurant has been highly placed in rankings based on customer feedback. I have enjoyed the challenge of working in this capacity for Pizzatime, but I am concerned that my reputation is going to be damaged by the current downturn ever since that terrible documentary was broadcast.

As a manager, I receive a salary and a quarterly bonus that is based on the profitability of my restaurant. I have always received the maximum bonus in the past, but I am unlikely to receive any bonus at all for this quarter. My restaurant was closed for four days while we were waiting for fresh dough. Our takings were down by over 40% in the first week after we reopened. Things have improved gradually since then, but only very slightly.

The quarterly bonus is a significant part of my income. I have to beat the targeted profit to earn any bonus at all. I only get the maximum bonus if I exceed the target by 20%. That is clearly not going to happen this quarter and it won't happen for the remainder of this year unless the targets are reduced in response to the crisis.

If you compare my position with that of a franchise owner then it is really unfair. The franchisees don't have a capped bonus, they get to keep as much profit as they can earn from their restaurants. They are also protected against downturns because their costs are smaller to match their reduced revenue. For example, Pizzatime does not permit me to lay off any of the staff in my restaurant, but I know that lots of the franchisees have done so since the documentary was broadcast.

I look forward to hearing from you.

Sally Collins

Jaytown Restaurant Manager

Pizzatime