ClaimCenter-Business-Analysts Guidewire ClaimCenter Business Analyst - Mammoth Proctored Exam Free Practice Exam Questions (2026 Updated)

Prepare effectively for your Guidewire ClaimCenter-Business-Analysts ClaimCenter Business Analyst - Mammoth Proctored Exam certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

What is the importance of a mock-up of the user interface (UI) design?

Succeed Insurance needs the ability to associate a primary hospital with an injury incident if the injured party received treatment. When treatment is needed, the primary hospital name should display on the injury incident screen along with other details about the injury and treatment received.

The primary hospital should be added to the injury incident in one of the following ways:

. Select the name from a list of medical care organizations already associated with the claim.

. Enter the contact details directly in the incident.

. Search the Address Book from the incident to locate a hospital.

Which two requirements must be documented to associate the primary hospital with the claim? (Choose two.)

Drivers for Rideshare companies need insurance that provides protection when they are driving the vehicle for personal reasons. This will be the Succeed Insurance standard Personal Auto Policy. However, they also need insurance to protect them from the increased risks associated with working as a Rideshare Driver. This would include when they are logged in to the Rideshare application waiting for a customer match, on their way to pick up a customer, but not when a customer has entered the vehicle.

When a driver is working as a Rideshare Driver, this new Rideshare coverage will protect them from the following types of risks, and there is a need to be able to collect the appropriate information about the losses:

. Injury to a first-party driver

. Damaged personal property of the third-party passengers

Which two exposures need to be configured? (Choose two.)

When capturing information about a damaged vehicle, Succeed Insurance requires that the total distance driven (miles/km) for the vehicle be captured as well. What is the best practice for a Business Analyst (BA) to determine if ClaimCenter already has a field to capture distance driven?

Satisfied with the outcome of a Requirements Workshop, a Business Analyst (BA) attributed the success to preparation. The assigned task had been to document the requirements for capturing details on vehicle incidents for Personal Auto.

Before the session, the BA reviewed ClaimCenter functionality by creating a new Personal Auto Claim involving physical damage to a vehicle.

During review, the BA saw that ClaimCenter did not have a graphical representation of a vehicle with clickable hot spots to identify the damage areas like they have in their current application.

Upon further research, the BA found that Guidewire does offer this functionality and even provides a Graphical Incident Capture Accelerator to ease implementation.

During the workshop, the BA was able to clearly present all options for capturing vehicle incident details. Instead of having to develop the Vehicle Incident Capture functionality from scratch, the team was able to make a quick decision to add this functionality and end the meeting 30 minutes early.

Which two outcomes demonstrate the importance of preparing for a Requirements Workshop by becoming familiar with the features and functionality of ClaimCenter? (Choose two.)

A catastrophe has been created in ClaimCenter for Tropic Storm Dorian. Succeed Insurance requires that all claims resulting from the storm be attributed to that catastrophe when they are entered in ClaimCenter. The completion target is within three (3) days of claim creation and should be escalated if it is not completed within five (5) days.

Which required element for a business activity rule is missing?

Succeed Insurance allows field Adjusters to write checks directly to the insured to cover damage costs for minor claims such as:

Personal auto claims involving cracked windshields

Homeowners claims involving minor glass breakage

The Adjuster uses the Manual Check Wizard to record the check number and amount against a reserve line. Succeed requires Supervisor approval for all manual checks to ensure that the paper checks are verified against the payment information in ClaimCenter.

Which two limits or rules must be configured in ClaimCenter to ensure that these manual payments are sent to the correct person for approval? (Choose two.)

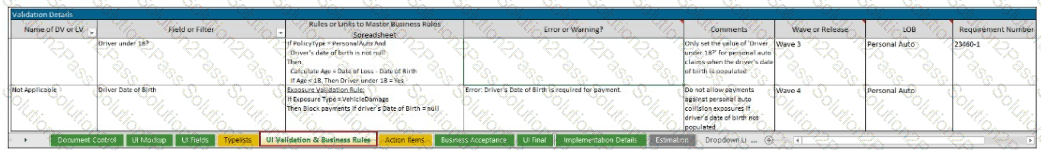

Succeed Insurance requires that a new 'Driver under 18?' field be added to the vehicle incident screen for personal auto claims to indicate whether or not the driver of the vehicle was a minor when the loss occurred. The field will be set by calculating the driver's age using the date of loss and the driver's date of birth.

There are two validation requirements:

The field must be set if the 'Date of Birth' field for the driver is not null.

No payments can be made for collision exposures if the 'Date of Birth' field for the driver of the vehicle is null.

A Business Analyst (BA) documents the validation requirements in the validation tab of the User Story Card 'Adjudicate - Update Maintain Vehicle Incident for Personal Auto Claims' as shown in the exhibit.

What information in the two validation examples is either missing or incorrectly documented? (Choose two.)

A sales executive and business traveler has a full coverage auto policy through his insurance company. The executive lives in Detroit, Michigan and often drives across the border to visit client offices in Canada.

While driving in downtown Toronto, the executive's car was hit by a truck coming the wrong way. He called his insurance company to report a claim for this accident. However, the Customer Service Representative (CSR) cannot confirm there is an active policy on file.

How should this claim be handled?

Succeed Insurance is implementing a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the standard user interface to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to improve efficiency and the expediency of claims processing in its region.

Under which ClaimCenter theme will the User Story Card be found for documenting these requirements?

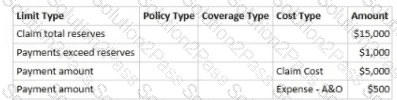

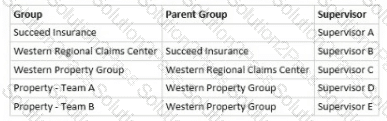

An Adjuster at Succeed Insurance is handling a homeowners claim with a dwelling exposure for damage to the insured's home. The Adjuster's Authority Limit Profile has the following limits:

The table below is a view of the property claims organization within Succeed Insurance. The Adjuster is a member of the group Property - Team A.

The Adjuster creates a payment in the amount of $6,500 for repairs to the insured's home. How will it be processed assuming that the claim has sufficient reserves for the payment?

An Adjuster at Succeed Insurance increases the reserve on a claim's exposure from $1,000 to $1,500 to account for inflation in repair costs. A week later, a Supervisor reviews the claim and wants to know specifically who made this change, the exact date and time it was made, and what the previous value was.

The Supervisor needs a chronological audit trail of changes to the claim file without navigating through complex financial ledgers.

Which screen in the ClaimCenter user interface should the Supervisor access to find this information?

Which two components are necessary to create the check(s) using the wizard? (Choose two.)

What is a reason to assign a unique identification number to each User Story Card in ClaimCenter implementation projects?

Succeed Insurance is expanding into California, Texas, and Arizona which have large Spanish-speaking customer bases. Currently language is not considered in assignment. Succeed wants the ability to assign claims to appropriate bilingual Adjusters. Succeed also needs the ability to identify the preferred language of the customers.

The company is planning to implement a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the existing user interface (UI) to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to enhance the operational efficiency and expediency of claims processing in its region.

Which two guiding principles apply to this implementation? (Choose two.)