PEGACPDC88V1 Pegasystems Certified Pega Decisioning Consultant 8.8 V1 Free Practice Exam Questions (2026 Updated)

Prepare effectively for your Pegasystems PEGACPDC88V1 Certified Pega Decisioning Consultant 8.8 V1 certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

U+ Bank, a retail bank, is cross-selling on the web by showing various credit card offers to its customers.

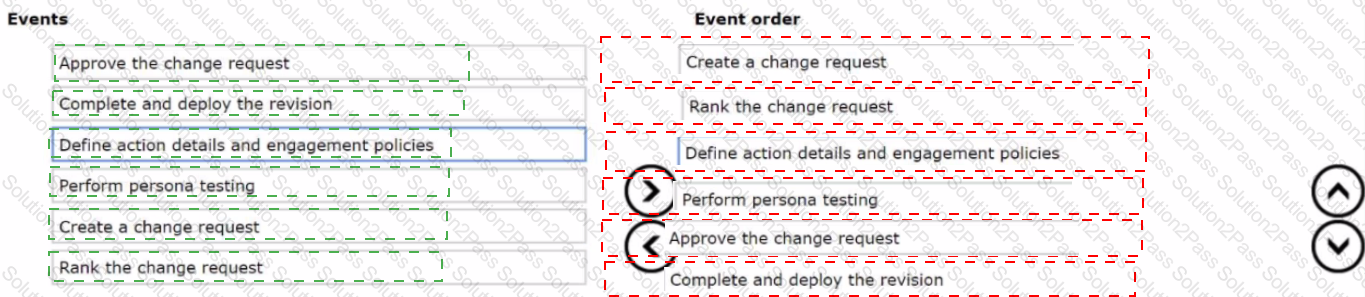

The bank wants to introduce a new offer in the Business Operations Environment. Place the steps in the correct order of implementation.

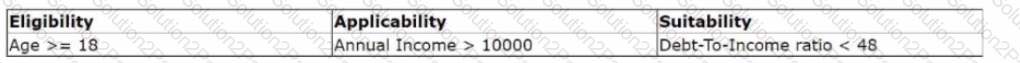

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)

U+ Bank is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS.

Which type of outbound interaction do you configure to implement this requirement?

MyCo, a telecom company, wants to introduce a new group of offers called Tablets for all customers. As a decisioning architect, which two valid actions do you create? (Choose Two)

U+ Bank wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

1yCo, a telecom company, wants to start promoting data plan offers through SMS to qualified customers. The marketing team needs to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

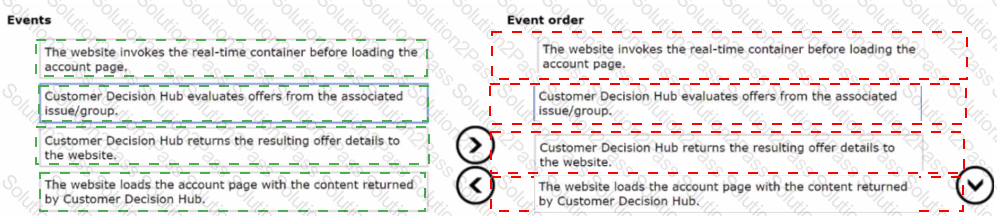

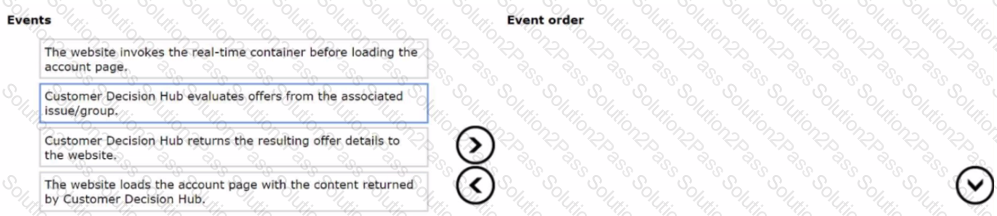

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer.

Place the events in the sequential order.

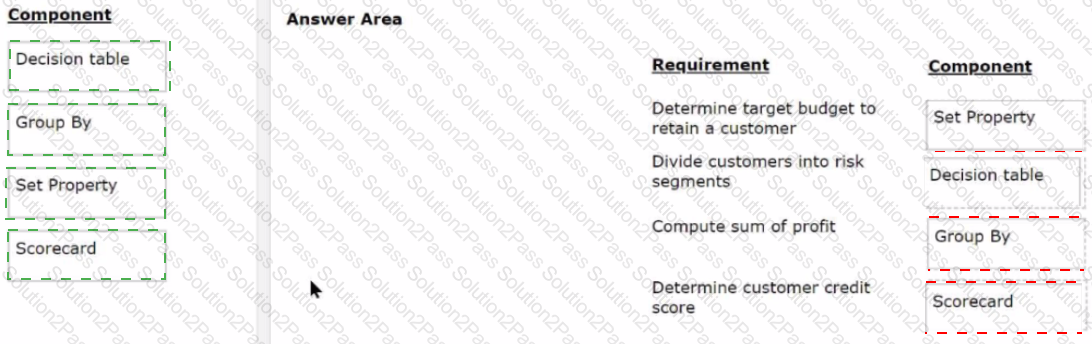

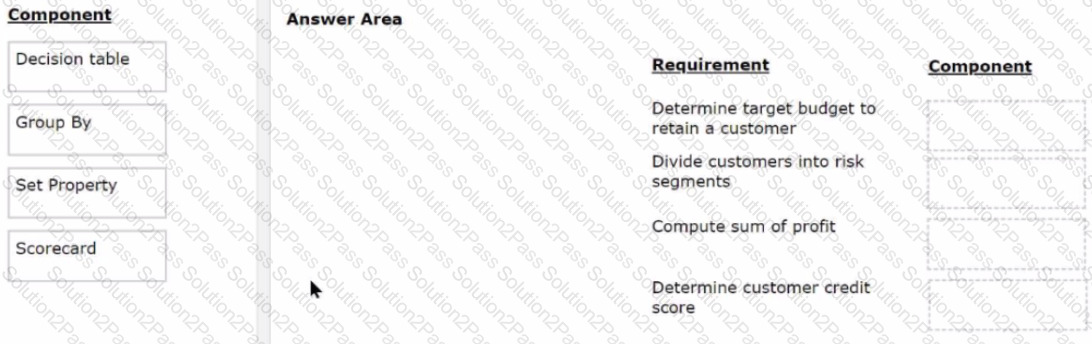

You are a deaccessioning architect on a next-best-action project and are responsible for designing and implementing decision strategies. Select each component on the left and drag it to the correct requirement on the right.

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website. What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

U+ Bank, a retail bank, uses the business operations environment to perform its business changes. The bank completes these changes by using revision management features of Pega Customer Decision Hub™ and 1:1 Operations Manager.

Customers see credit card offers based on various engagement policies on the U+ Bank website. The bank wants to update the underlying decision strategy of

an engagement policy condition.

According to best practices, which statement correctly describes the implementation of the change to fulfill this business requirement?

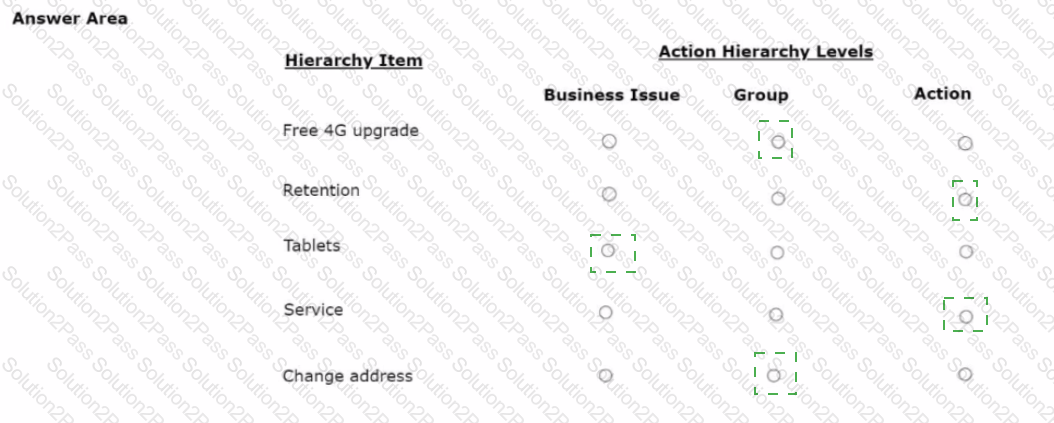

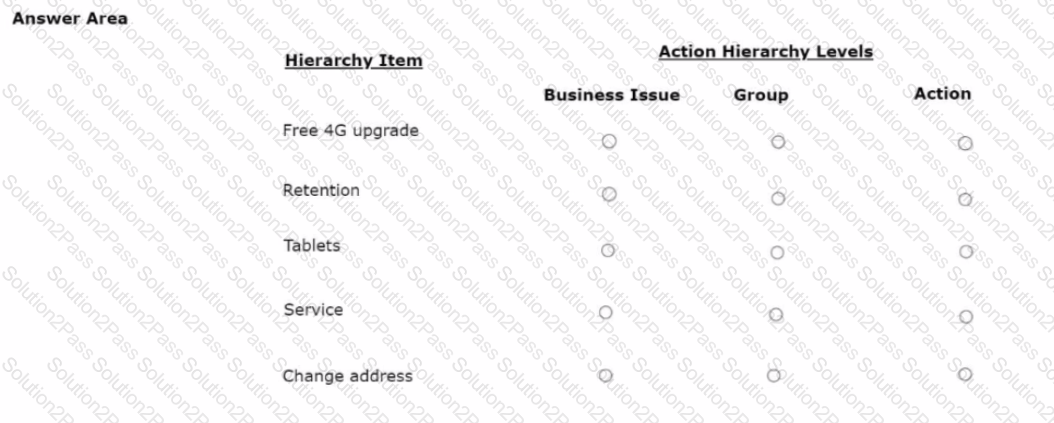

As a decisioning architect, you are setting up the action hierarchy for MyCo. Select the correct action hierarchy level for each of the hierarchy items identified.

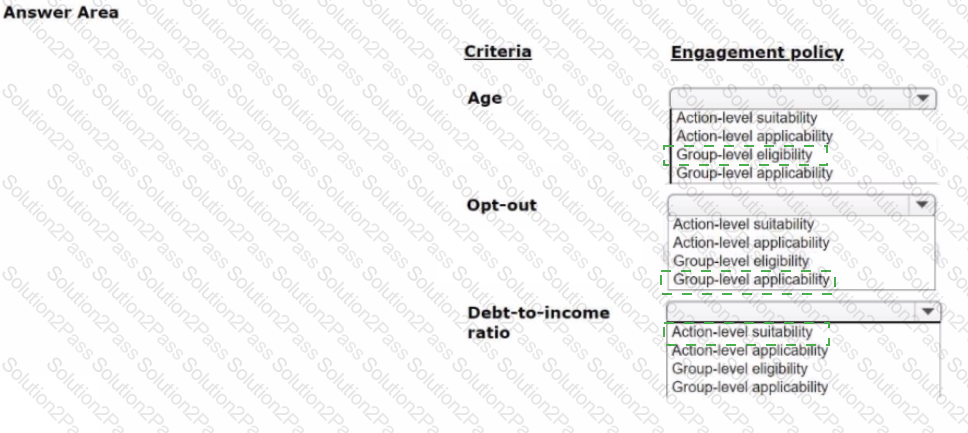

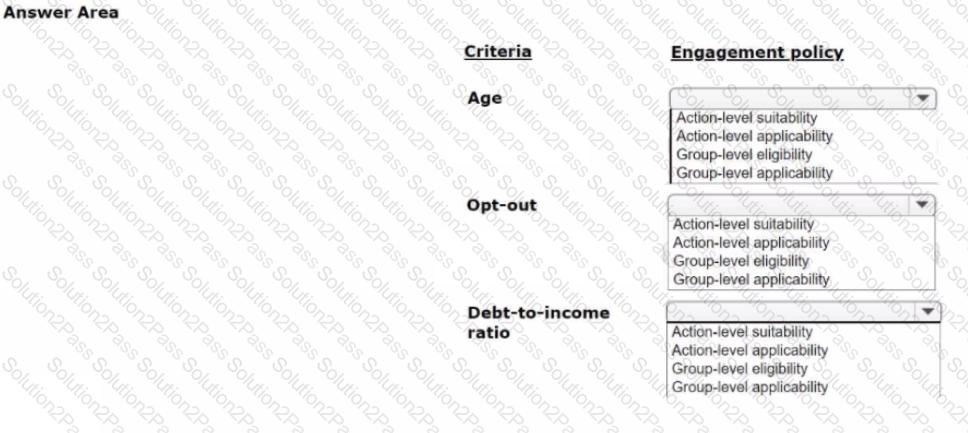

U+ Bank decides to introduce a credit cards group by leveraging the Next-Best-Action capability of Pega Customer Decision Hub™. The bank wants to present the credit card offers through inbound and outbound channels based on the following criteria:

1. Customers must be above the age of 18 to qualify for credit card offers.

2. The site offers credit cards only if customers do not explicitly opt-out of any direct marketing for credit cards.

3. The Platinum Card, one of the credit card offers, is suitable for customers with debt-to-income ratio < 45.

As a decisioning architect, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

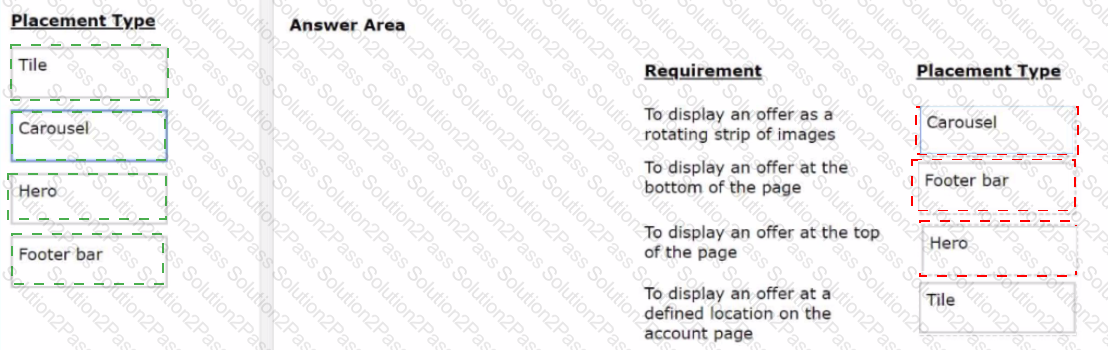

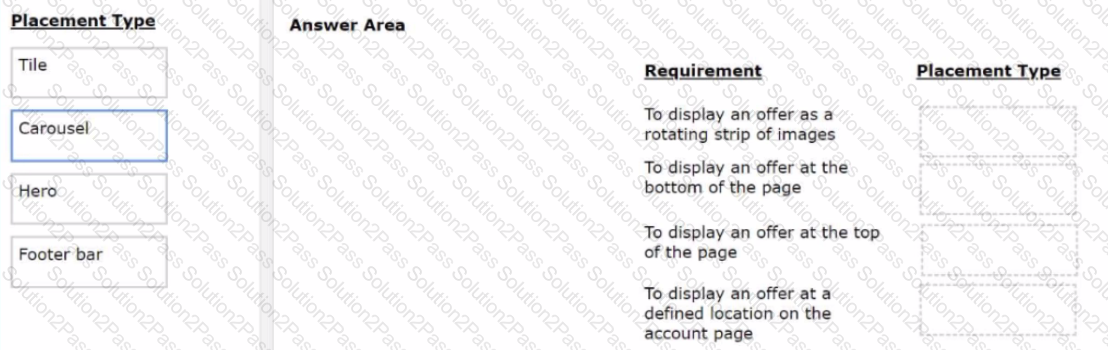

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

To access a property from an unconnected component, you use the

In a decision strategy, to use a customer property in an expression, you

A decisioning architect wants to use the customer properties income and age in a Filter component. Which decision component is required to enable access to these properties?

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?