BUS105 Saylor Managerial Accounting (SAYA-0009) Exam Free Practice Exam Questions (2025 Updated)

Prepare effectively for your Saylor BUS105 Managerial Accounting (SAYA-0009) Exam certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Managers have several different methods from which to choose when evaluating long-term investments. Which method disregards the time value of money as a factor?

Strang Tax provides tax consulting services to its clients whom they charge on an hourly basis. They would like to use differential analysis to determine whether profits would change if they dropped certain clients. Which of the following items should be excluded from this analysis?

Ladron Candies is analyzing sales and production data for the holiday boxes they produced last year. The company expected to use 2 pounds of direct materials to produce one box of specialty candy at a cost of $3.00 per pound. Invoices show the company purchased 1,650,000 pounds of direct materials at $2.90 per pound and used 1,580,000 pounds in production. They sold 800,000 boxes of candy to retailers. What is the materials quantity variance?

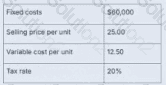

Using this data, what is the number of units that must be sold in order to achieve a desired after-tax profit of $100,000?

Ladron Candies is analyzing sales and production data for the holiday boxes they produced last year. The company expected to use 0.10 direct labor hours to produce one box of specialty candy, and the variable overhead rate was $2.00 per hour. According to payroll records, the company paid for a total of 104,000 hours of direct labor wages. The actual variable overhead costs totaled $200,000. They sold 800,000 boxes of candy to retailers. What is the variable overhead efficiency variance?

SJ Candles subscribes to a management theory known as management by exception. Which of the following best describes a situation where management by exception would be applied?

You are the financial accountant for Antioch Ski Resort. Managers have been promised end-of-year bonuses if profits for the year increase by 10%. At the end of the year, you determine that profits increased by only 8%, and the managers ask you to "fudge the numbers a bit" so they can still receive their bonuses. What should you do?

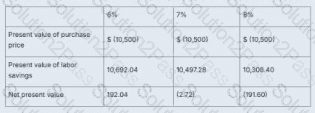

The manager of Ladron Candies is deciding whether or not to invest in new equipment with a purchase price of $10,500 and a required rate of return of 7%. Given this calculation of the present value of cash inflows and outflows for the next three years, what should he decide, based on the internal rate of return?

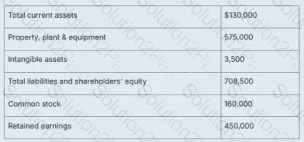

A potential lender is investigating Wyatt Corporation's leverage. This is select balance sheet data for Wyatt Corporation as of December 31. What is the company's debt to assets ratio?

A potential lender is investigating Wyatt Corporation's leverage. This is select balance sheet data for Wyatt Corporation as of December 31. What is the company's debt to assets ratio?

Bethel Bakery manufactures frosted sugar cookies. They maintain separate work-in-process accounts for their blending, cutting, baking, decorating, and packaging departments. Which costing method is Bethel Bakery most likely using?

Which of the following would be a measure of managerial accounting?

Coffee Beanz, Inc. currently maintains decentralized operations. The CEO is evaluating whether the company should centralize their operations. Which of the following situations would make centralized operations more beneficial than decentralized?

This is select financial statement data for Binks Corporation. What is the inventory turnover ratio for year 2?

Which of the following statements is a true statement about flexible budgets?

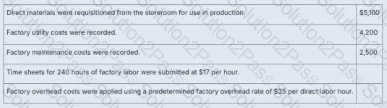

What is the balance in the manufacturing overhead account after these transactions were recorded, assuming the beginning balance was zero?

Now calculate the balance:

Manufacturing Overhead Balance = Actual Overhead – Applied Overhead

= $6,700 – $6,000 = $700 underapplied

Underapplied overhead → debit balance in Manufacturing Overhead account