CTEP AAFM Chartered Trust & Estate Planner® (CTEP®) Certification Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CTEP Chartered Trust & Estate Planner® (CTEP®) Certification Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

More than_______ in wealth classifies the person as “Ultra HNI”

__________ is an influential person who knows you favorably and agrees to introduce or recommend you to others.

As per Employee Provident Fund, a member can withdraw________ of the amount of provident fund at credit after attaining the age of 54 years or within one year before actual retirement or superannuation whichever is later.

What is a ‘CestuquieTrust’?

You are an Estate Planner. Mr. Arun Mittal, a HNI client asks you to explain him the number of ways to dispose of his wealth. You explain to him about the three ways of disposing wealth. He further asks you to give ranking to the methods-from most preferred to least preferred. You tell Mr. Arun that the correct order is _________________.

There are _________________ Non-Formal Sources of Law.

The goals of Estate Planning can be broadly divided into_______ categories.

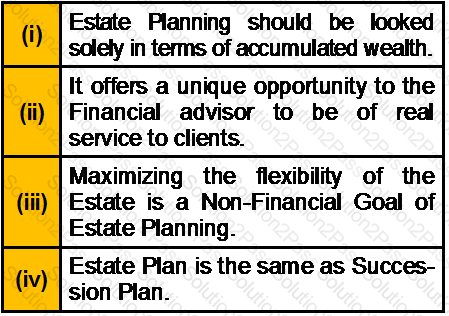

Which of the following statement(s) about Estate Planning is/are correct?

Estate planning has_____ phases.

A will can be made by anyone above _____ years of age in India.

Who needs an Estate Plan?

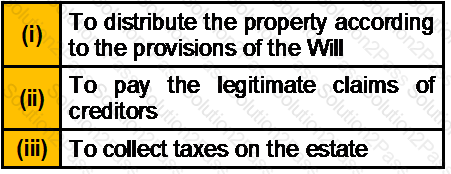

Which of the following is/are objective(s) of Probate process?

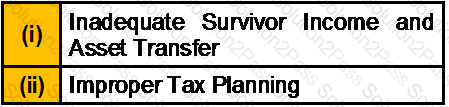

Failure to create an Estate Plan leads to __________

For which of the following stage of Business Cycle a succession plan is not prepared?

_________ is the most appropriate method for donors who prefer to make gifts at the end of their life and _________ is the most appropriate method for donors who prefer to give gifts during their lifetime.

Private Companies have a minimum paid up capital of _______________ or such higher capital as may be prescribed.

Estate tax is also called ________

Wills executed according to __________ of the _____________ are called Unprivileged Wills.

You are an estate planner. A couple has jointly owned company. They have three children out of which one is disabled. As an estate planner, which Estate planning would you suggest to the couple, so as to enable them to transfer wealth efficiently to their children.

While preparing a Will, the person who is making the Will must declare ________ that he is making the Will in his full senses and free from any kind of pressure. Once the testator completes writing the Will, he must the sign the Will very carefully in presence of at least __________independent witnesses.