CTEP AAFM Chartered Trust & Estate Planner® (CTEP®) Certification Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CTEP Chartered Trust & Estate Planner® (CTEP®) Certification Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

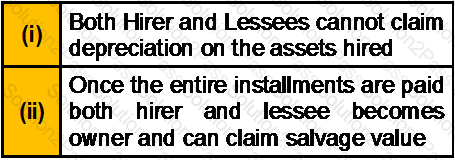

Which of the following statement(s) is/are correct?

Under ___________ of Income Tax Act,1961, partial partitions will not be recognized for tax purposes.

A non-resident in Singapore will be treated as a tax resident for a particular Year of Assessment if you are foreigner who stayed/worked in Singapore for _________or more in previous year (excludes director of a company)

Under English law, an individual acquires at birth the domicile of the person on whom he or she is legally dependent, which the individual retains until reaching the age of _____________.

Capital gains are subject to tax at ______________ for Trustees or Personal Representatives.

In case where the Filling Status is single, phase-out begin range is ____________ (as in 2013).

There are ________________ essential elements of a Lease.

Goods and Services Tax (GST) was introduced in Singapore in ____________

Tax rate on foreign sourced income in Singapore is ____ to _______ subject to conditions.

If the NPV of buy alternative is Positive and the NPV of incremental lease effect is negative then the correct decision is to___________.

In US, in the case of an individual the tax is ______________ of the lesser of net investment income or the excess of modified adjusted gross income over the threshold amount.

Which of the following statement(s) is/are correct?

Singapore corporate tax rate is capped at ___________

Which of the following statement(s) is/are correct?

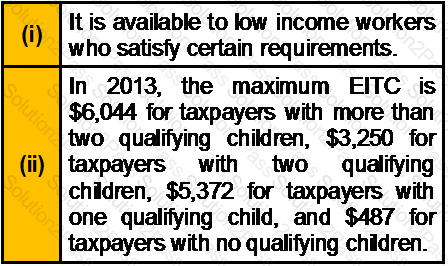

Which of the following statements about Earned Income Tax Credit (ETIC) is are correct?

A High Net Worth Individual (HNI) should hold at least _______ in liquid financial assets.

You are an Estate Planner. A client asks you to explain him the process of Probate. You explain him that Probate is one of the ways to pass ownership of estate property to a decedent’s survivors. The client further asks you to outline the various steps of Probate. As an estate planner, you would outline the steps of probate as follows (please specify the correct order)

A trust involves_______ parties. ___________ is the person who establishes the trust.

As per the ESI Act, the monthly wage limit for coverage is _____________ per month.

The maximum gratuity payable as per Payment of Gratuity Act is __________.