CWM_LEVEL_2 AAFM Chartered Wealth Manager (CWM) Certification Level II Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Section B (2 Mark)

As per Article 11 double Taxation Avoidance Agreement with US Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State.However, such interest may also be taxed in the Contracting State in which it arises, and according to the laws of that State, but if the beneficial owner of the interest is a resident of the other Contracting State, the tax so charged shall not exceed:

(a) ____per cent of the gross amount of the interest if such interest is paid on a loan granted by a bank carrying on a bona fide banking business or by a similar financial institution (including an insurance company); and

(b) _____ per cent of the gross amount of the interest in all other cases.

Section B (2 Mark)

The income exemption threshold in respect of income year ending 30 June 2009 is as follows for an individual with two dependents in Mauritus is:

Section B (2 Mark)

Broker dealer model is more prevalent in

Section C (4 Mark)

Zenith Finance is a big financial firm which owns several mutual funds. The funds are managed individually by portfolio managers but it has an investment committee that oversees all of the funds. This committee is responsible for evaluating the performance of the funds relative to the appropriate benchmark and relative to stated investment objectives of each individual fund. During a recent investment committee meeting, the poor performance of its Equity Funds were discussed. In particular, the inability of the portfolio managers to outperform their benchmarks was highlighted. The net conclusion of the committee was to review the performance of the manager responsible for each fund and dismiss those managers whose performance had lagged substantially behind the appropriate benchmark.

The fund with the worst relative performance is the Zenith Large Cap Fund which invests in large cap stocks. A review of the operations of the fund found the following:

• The turnover of the fund was almost double that of other similar style mutual funds

• The fund’s portfolio manager solicited input from her entire staff prior to making any decision to sell an existing holding

• The beta of the Zenith Large Cap Fund’s portfolio was 65% higher than the beta of other similar style mutual funds

• The portfolio manager refuses to increase the Capital Goods sector weighting because of past losses the fund incurred in the sector

• The portfolio manager sold all the fund’s Oil Marketing Companies stocks as the price per barrel of oil rose above $105. He expects oil prices to fall back to the $80 to $85 per barrel

• No stock is considered for purchase in the Large Cap Fund unless the portfolio manager has 10 years of financial information on that company.

A committee member made the following 2 comments:

Comment 1: “One reason for the poor performance of Large Cap Mutual Fund is that the portfolio lacks recognizable companies. I believe that good companies make good investments

Comment 2: “The portfolio manager of the Large Cap Fund refuses to acknowledge his mistakes. He seems to sell stocks that appreciate, but she holds stocks that have declined in value

The two behavioral biases exhibited respectively in the above 2 comments from the committee are:

Section A (1 Mark)

If a married couple (or civil partners) receive joint income, the amount of that income will normally be divided equally between them for tax purposes. True or False?

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $125000 in US dollars and he is a US citizen (single individual)

• $109000 in SGD and he is a citizen of Singapore

Section B (2 Mark)

Total income for assessment year 2007-08 of an individual including long-term capital gain of Rs. 60,000 is Rs. 1,40,000. The tax on total income shall be:

Section A (1 Mark)

Operational customer relationship management supports which of the following function?

Section B (2 Mark)

Under the Workmen Compensation Policy, when the employment injury results in death, the insurance company pays 40 % of the monthly wages of the deceased multiplied by the relevant factor or Rs. _________ whichever is more.

Section A (1 Mark)

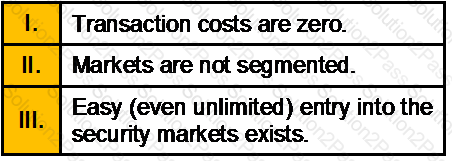

EMH frequently include, among others, assumptions such as:

Section C (4 Mark)

Singhvi group has recently announced that expected dividends for the next three years will be as follows:

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Section B (2 Mark)

An assessee was allowed deduction of unrealized rent to the extent of Rs. 40,000 in the past although the total unrealized rent was Rs. 60,000. He is able to recover from the tenant Rs.45,000 during the previous year on account of such unrealized rent. He shall be liable to tax to the extent of:

Section C (4 Mark)

Read the senario and answer to the question.

Nimita had invested Rs. 3 lakh on 2nd May 2004 in an Equity MF when the NAV was Rs. 12.58 per unit she opted for divided payout option and received dividends paid by the scheme at 12% each on 18th Aug 2004, 20th Nov 2005, 15th Apr 2007 and on 16th Jun 2008, the dividend cum NAV per unit was Rs. 12.95, Rs. 13.05, Rs. 13.99, and Rs. 14.68 and the latest NAV of the fund is Rs. 16.68 per unit. Nimita wants to know the rate of return she got on this investment. The same is ________. (Please ignore charges and taxes if applicable)

Section B (2 Mark)

Which of the following activities is/are a part of “Building the CRM project foundation phase “in CRM implementation?

Section A (1 Mark)

Which of the following is a market anomaly?

Section B (2 Mark)

Encashment of leave during service tenure is

Section A (1 Mark)

Rapid accumulation stage suggests that the net worth is ________

Section B (2 Mark)

Ms. Shalini Bhargav plans to purchase a property having a projected annual income for three year is Rs 20,000 with 12 percent expected return and expect to sell it at the end of three years for Rs 2,70,000. Compute the present value of the property.

Section B (2 Mark)

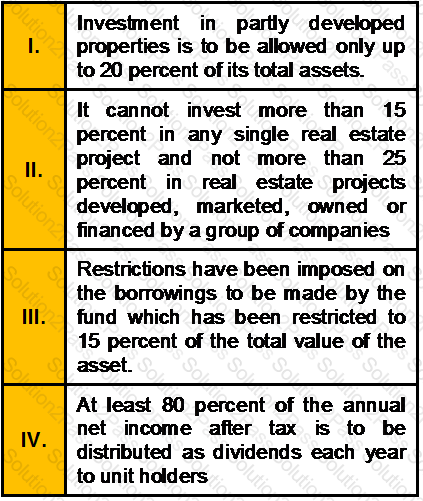

Which of the following is/are incorrect with respect to Draft guidelines of REITs in India?

Section B (2 Mark)

Mr. Murti is working in a reputed company and earning Rs. 4,00,000/- p.a. and is now 50 years old. He has invested Rs. 1,50,000/- in an annuity which will pay him after 5 years a certain amount p.m. at the beginning of every month for 10 years. Rate of interest is 8% p.a. Calculate how much he will receive at the beginning of every month after 5 years?

Section A (1 Mark)

If the intrinsic value of a stock is greater than market value, which of the following is a reasonable conclusion?

Section C (4 Mark)

Puspinder Singh Ahluwalia took a housing loan on 1st. of June 2009 (EMI in arrear) of Rs. 50 lacs at a ROI of 10.75% p.a. compounded monthly for 12 years. He wants to know the deduction in taxable income he can claim u/s 24 of the IT act for the FY 2011 -12

Section A (1 Mark)

Mr. Kashyap took a business premise on lease with the provision that he himself had to pay the insurance premium for fire and other perils on the premises and not the owner of the premises. This would be an instance of_______________ on the part of owner of the premises.

Section A (1 Mark)

The goal of the Dow theory is to

Section A (1 Mark)

First step in developing a Wealth Management Plan is

Section B (2 Mark)

Which of the following statements is correct?

Section A (1 Mark)

Which of the following is classified as passive income in US?

Section C (4 Mark)

Omax Inc. one of the largest developer of residential projects, reported earnings per share of Rs 8.0 in 2003, and paid dividends per share of Rs 4.8 in that year. The firm is expected to report earnings growth of 25% in 2004, after which the growth rate is expected to decline linearly over the following six years to 7% in 2009. The stock is expected to have a beta of 0.85 and current risk free rate is 6.25%.

Estimate the value of the firm using the H Model.

Section B (2 Mark)

In order to determine the residential status of an NRI returning to India for permanent settlement, for the year of return, besides the stay not exceeding 181 days an additional condition is applicable that of stay not totalling to____________ days or more in relevant year if his stay in earlier ___________ years totaled to 365 days or more.

Section A (1 Mark)

Anurag has invested Rs. 10 lakh. in a pension fund that pays an interest rate of 12% p.a. compounded quarterly. If Anurag wants to withdraw money after 25 years every month for next 20 years what amount can he withdraw.

Section C (4 Mark)

Calculate expected rate of return on the following portfolio.

Weight of X and Y in the portfolio is 50% and 50% respectively.

Section B (2 Mark)

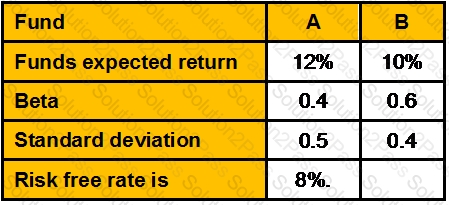

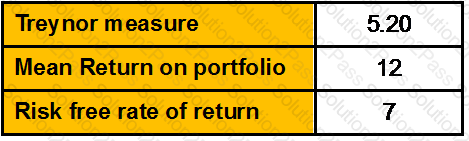

The following parameters are available for two mutual funds:

Calculate Treynor’s performance index for Fund A & Fund B respectively

Section A (1 Mark)

The information in your credit report is primarily used by the credit bureau to compute your

Section B (2 Mark)

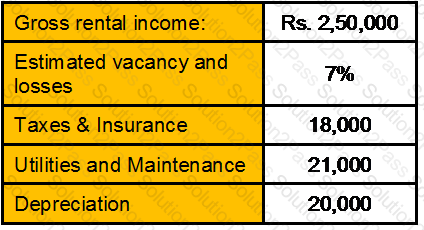

Calculate the NOI for an office building with the following information:

Section A (1 Mark)

With regard to hedge funds, ‘2 and 20’ is best explained as:

Section C (4 Mark)

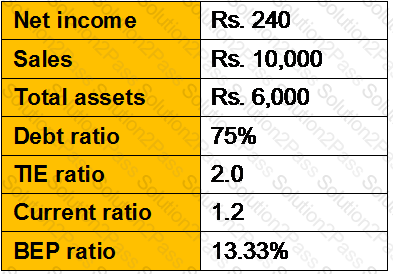

Tapley Dental Supply Company has the following data:

If Tapley could streamline operations, cut operating costs, and raise net income to Rs300, without affecting sales or the balance sheet (the additional profits will be paid out as dividends), by how much would its ROE increase?

Section A (1 Mark)

A bank is considering making a loan to Neelam Pandey. The bank is looking at her credit report from Equifax and also examining the reason Neelam has put on the loan application for needing the loan? What aspect of evaluating a consumer loan application is the bank looking at?

Section B (2 Mark)

The current market price of a share of MOD stock is Rs15. If a put option on this stock has a strike price of Rs20, the put

Section C (4 Mark)

Read the senario and answer to the question.

Mrs. Deepika’s brother is impressed with Manav Fashion Ltd. an online clothing firm that focuses on the 18–22 age bracket. Their prices are much lower than their competitors, and the quality is high. Reading about the firm on its web site and in various financial newspapers, her brother has learned that the company plans to expand its clothing lines. The prevailing price of its share is 70 per share. Manav Fashion Ltd. has had recent annual earnings of Rs. 5 per share. Only three other companies have very similar business to Manav Fashion Ltd. and have stock that is traded and there PE ratios are as follows:

Her brother asked Mrs. Deepika to guide him in investing the Manav Fashion Ltd. Getting the query from her brother Mrs. Deepika asks your advice on this matter. As a Chartered Wealth Manager what will be your advice?

Section C (4 Mark)

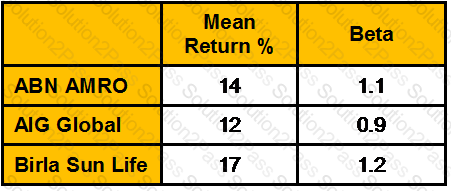

Consider the following information for three mutual funds

Risk free return is 6%. Calculate Treynor measure.

Section A (1 Mark)

______________ is a manifestation of mental accounting that can cause people to take on more risk as their wealth increases.

Section A (1 Mark)

Rahul deposits Rs. 30,000/- per year, at the end of the year, into an account for 30 years. What amount would be accumulated in that account at the end of 30 years if ROI is 9 % per annum?

Section A (1 Mark)

The eligibility Criteria for Personal Loans Salaried Individuals for Maximum Age of Applicant at Loan Maturity in case of personal loan is:

Section B (2 Mark)

The Sachdeva family includes a financially well-informed couple, both aged thirty-two, and two children aged four and six. They are financially sound, but were not in the market during the bull market of the 2003 to 2007 as many of their neighbors were. The couple’s total income, Rs.12,00,000 which is not expected to grow significantly. They have saved Rs.15,00,000, which they hope will be the financial foundation from which they will send their children to college and retire comfortably. The Sachdeva’s suffer from:

Section B (2 Mark)

Calculate the beta on a portfolio from the following data:

Section B (2 Mark)

Compute YTM of a bond with par value of Rs.1000/-, carrying a coupon rate of 8% and maturing after 10 years. The bond is currently selling for Rs.850/-.

Section A (1 Mark)

Financial Gerontology tries to assess client needs based on __________

Section C (4 Mark)

In the year to 31 March 2012, a UK resident company receives overseas income of £9,000 (net) from which 10% tax has been deducted at source. The company's only other income is a UK trading profit of £80,000. There are no associated companies. What is the UK corporation tax liability for the year?

Section C (4 Mark)

Read the senario and answer to the question.

Harish incurred Rs. 10 Lakh on the construction of his house five years ago which has depreciated today to Rs. 7 Lakh. The cost of construction over the period has gone up by 70%.The depreciated value of household items is Rs. 2.5 Lakh and their present cost of replacement is Rs. 4 Lakh. Harish wants to buy a Householders’ insurance policy in such a way that the house is insured on reinstatement basis and household goods on the basis of written down value. How much total insurance coverage should he take from the insurance company?

Section B (2 Mark)

Which of the following statements is/ are correct?

Section A (1 Mark)

What is the Present Value of an annuity which pays Rs. 10,000/- for 3 years at the END of each year, assuming ROI @ 7% per annum compounded annually?

Section A (1 Mark)

A UHNW segment client has investible assets worth of

Section B (2 Mark)

Mr. Manish purchased a residential house for Rs.3 lakh on 1-4-1972. Its market value on 1-4-1981 was, however, Rs.12 lakh. He sells the house during the financial year 2011-12 for Rs.98 lakh. Calculate the taxable long term capital gain.[CII-12-13: 852,11-12: 785,10-11:711]

Section A (1 Mark)

A(n) _____________ is an assurance that investors will be repaid in the event of the default of the underlying loans in a securitization. These can be internal or external to the securitization process and lower the risk of the securities.

Section A (1 Mark)

Credit cards are the best example of a _____________ that offer consumers convenience and flexibility.

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $ 142700 in US dollars and he is a US citizen (married Individual Filing Joint returns and Surviving Spouses)

• $ 67250 in SGD and he is a citizen of Singapore

Section A (1 Mark)

Which of the following is a risk of using credit derivatives?

Section A (1 Mark)

If the proposer does not disclose fully all the material facts at the time of Proposal the principle violated

Section B (2 Mark)

Which of the following statements is / are correct?

Section B (2 Mark)

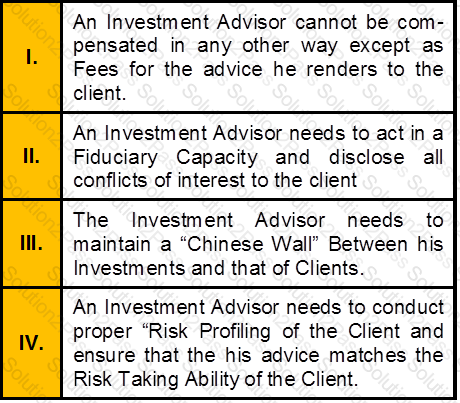

Which of the following statement is correct w.r.t to the obligations of an Investment Advisor Registered under SEBI Investment Advisor Regulations 2013.