CWM_LEVEL_2 AAFM Chartered Wealth Manager (CWM) Certification Level II Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Section C (4 Mark)

Mr. Chopra runs a Garment Factory, he is very concerned about his retirement and wants you to help him out in planning for it. His Current annual expenses are Rs. 12,00,000 which would be rising at an annual rate of 8% pre- retirement and 2% post retirement. His current age is 50 years and he wants to work till the age of 65. The expected life expectancy in his family is 75 years. Calculate the monthly contribution he must make till his retirement if the pre- retirement returns are 12% p.a. compounded monthly and post-retirement returns are 8% p.a compounded annually.

Section A (1 Mark)

_____________ is the transfer of the balance of an existing home loan that you availed at a higher rate of interest (ROI) to either the same HFC or another HFC at the current ROI a lower rate of interest.

Section B (2 Mark)

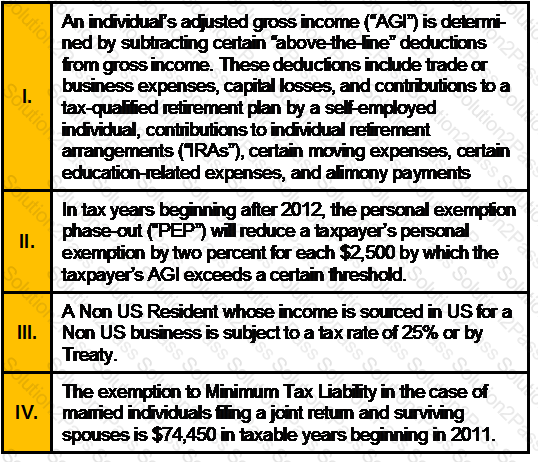

Which of the following statements with respect to US Taxation Structure is/are correct?

Section B (2 Mark)

Eric, who has lived in the Netherlands for the whole of his life, arrives in the UK on 1 June 2011 and remains in the UK until 31 December 2011, when he returns permanently to the Netherlands. His UK residence status for 2011-12 is:

Section A (1 Mark)

Customer services are defined as:

Section A (1 Mark)

A good customer relationship management program will allow a business to:

Section C (4 Mark)

Suppose Sunil visits his favorite coffee shop and encounters his good friend Rohit. Rohit raves about his stockbroker, whose firm employs an analyst who appears to have made many recent successful stock picks. The conversation goes something like this:

SUNIL: Hi, Rohit, how are you?

ROHIT: Hi, Sunil. I’m doing great! I’ve been doing superbly in the market recently.

SUNIL: Really? What’s your secret?

ROHIT: Well, my broker has passed along some great picks made by an analyst at her firm.

SUNIL: Wow, how many of these tips have you gotten?

ROHIT: My broker gave me three great stock picks over the past month or so. Each stock is up now, by over 10 percent.

SUNIL: That’s a great record. My broker seems to give me one bad pick for every good one. It sounds like I need to talk to your broker; she has a much better record!

Which of the following biases have been exhibited by Gaurav?

Section A (1 Mark)

____________represents people’s propensity to claim an irrational degree of credit for their successes.

Section B (2 Mark)

What is the monthly payment size of a 23-year mortgage for Rs165 600 and an interest rate of 5.25% compounded semi-annually?

Section A (1 Mark)

Every employer is obliged to ensure that his employees get a safe and secure workplace. In relation to the risks arising in the workplace which affects the employees, cover is provided through

Section A (1 Mark)

Which of the following is an assumption of the CMT?

Section A (1 Mark)

Vineet invests Rs. 5000/- per month at the beginning of the month for 10 years in Recurring Deposit account that pays 8.5% p.a interest compounded quarterly. What will be the accumulated amount in his account.

Section B (2 Mark)

Amount of liability of payment of gratuity is calculated at the rate of

Section A (1 Mark)

Any property inherited by a female Hindu from her husband or from her father in law, in the absence of any son or daughter of the deceased shall go to…..

Section B (2 Mark)

The Dow theory illustrates that the three forces that simultaneously affect stock prices are ____________.

Section A (1 Mark)

An American call option can be exercised

Section B (2 Mark)

If the commodity’s futures price declines

Section A (1 Mark)

Which of the following is/are correct?

Section A (1 Mark)

Commodity exchanges enable producers and consumer to hedge their _______ given the uncertainty of the future.

Section A (1 Mark)

The basic competitive factors facing industries include all of the following except:

Section A (1 Mark)

Mansi has deposited Rs. 7,00,000/- in a bank today @ ROI of 10 % per annum compounded monthly. She wants to know that if she withdraws this money in monthly installments at the END of the month for 7 years, then how much will be the each installment amount?

Section C (4 Mark)

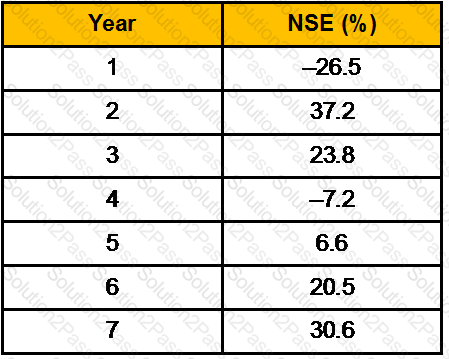

You are given the following set of data:

Historical Rate of Return

Determine the arithmetic average rates of return and standard deviation of returns of the NSE over the period given.

Section A (1 Mark)

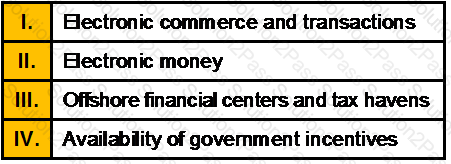

Fiscal termites are factors that threaten the integrity of tax systems, and most of which relate to the internationalization of tax. These are:

Section B (2 Mark)

A stock with a Beta of 0.7 currently priced at Rs 50 is expected to increase in price to Rs 55 by year end and pay Rs 1 as dividend. The expected market return is 15% and the risk free rate is 8%. The stock is:

Section B (2 Mark)

When returns to an investor’s portfolio increase, to what does he believe the change in performance is mainly due (if the investor exhibits self attribution bias)?

Section A (1 Mark)

In which case, the probability of customer increases to become a defector?

Section C (4 Mark)

Read the senario and answer to the question.

Ms. Deepika is interested in investments in foreign markets. Her brother is working in one of reputed American company in India and that is offering him some shares under ESOP scheme. This company is not listed in India. It is listed in New York Stock Exchange. Ms. Deepika is asking her manager how this transaction will took place for her brother?

Section A (1 Mark)

The cumulative number of futures contracts that are not offset at any point in time is called:

Section C (4 Mark)

Nifty is at 3200. Mr. XYZ expects very little movement in Nifty. He sells 2 ATM Nifty Call Options with a strike price of Rs. 3200 at a premium of Rs. 97.90 each, buys 1 ITM Nifty Call Option with a strike price of Rs. 3100 at a premium of Rs. 141.55 and buys 1 OTM Nifty Call Option with a strike price of Rs. 3300 at a premium of Rs. 64.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3200

• If Nifty closes at 4212

Section A (1 Mark)

Which one of the following equations correctly defines the dividend yield (Y) from a share of common stock?

Section A (1 Mark)

___________is concerned with the rational solution to the problem at hand. It defines an idea that actual decisions should strive to approximate.

Section A (1 Mark)

A well-diversified portfolio is defined as

Section C (4 Mark)

Roger deposits Rs. 10,00,000 in a bank account on 1st March 2005 and another Rs. 5,00,000 on 1st March 2011. He wants to withdraw all of this money with interest on 1st March 2015. If the account pays ROI of 11% p.a. compounded quarterly what amount can he withdraw from this account?

Section B (2 Mark)

Both __________ depend on electronic information that has been collected about customers, in place of human knowledge, to build and manage relationships.

Section B (2 Mark)

In the year to 31 March 2012, A Ltd (which is UK resident) made a UK trading profit of £100,000. The company's only other income consisted of rents received of £52,500 (net) from an investment property in Germany. These rents were received net of withholding tax of 25%. A Ltd has no associated companies.

The credit for double tax relief that will be given in the corporation tax computation for the year will be:

Section A (1 Mark)

Mr. Dhir is now 50 years old. He has invested Rs. 1,50,000/- in an annuity which will pay him after 10 years a certain amount p.a. at the beginning of every year for 10 years. Rate of interest is 7% p.a. Calculate how much he will receive at the beginning of every year after 10 years?

Section C (4 Mark)

Read the senario and answer to the question.

Sajan sold 350 shares of a company at Rs. 300 each on 1st March 2010. He purchased 50 shares on 1st May 1979 for Rs. 20 each. The fair market value was Rs. 40 each as on 1st April 1981. Again on 7 August 1998, he was allotted 50 bonus shares. The fair market value was Rs. 115 each as on 7th August 1998. He purchased additional 250 shares on 1st April 2009 for Rs. 150 each. Calculate the capital gains on shares sold.

(CII – 1981-82 : 100; 1998-99 : 351; 2008-2009 ; 582; 2009-10; 632)

Section A (1 Mark)

Which of the following are the advantages of a Credit Union:

Section C (4 Mark)

Read the senario and answer to the question.

Assume Reena retires at the age of 60 years and invests her salary at 8% p.a.What will be the future value of Reena’s salary at the time of her retirement if she saves her entire salary?

Section B (2 Mark)

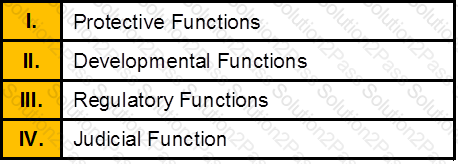

Securities and Exchange Board of India (SEBI) performs three major functions to meet its objectives these are:

Section B (2 Mark)

Risk to bondholders comes from

Section A (1 Mark)

_________________ is a method to evaluate a large volume of consumer loans quickly with minimum labor. This method is a statistical model which predicts whether the consumer will repay the loan or not.

Section B (2 Mark)

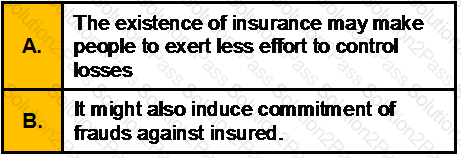

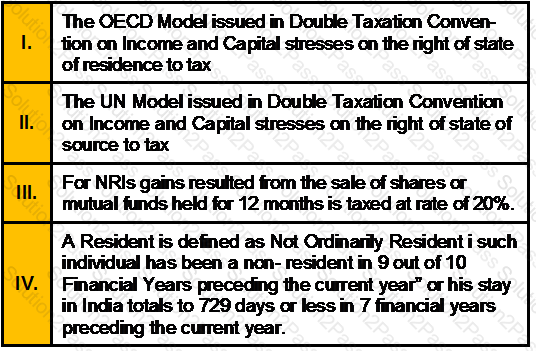

Which of the following statements is/are true?

Section C (4 Mark)

KB, a household product manufacturer, reported earnings per share of Rs3.20 in 1993, and paid dividends per share of Rs1.70 in that year. The firm reported depreciation of Rs315 million in 1993, and capital expenditures of Rs475 million. (There were 160 million shares outstanding, trading at Rs51 per share.) This ratio of capital expenditures to depreciation is expected to be maintained in the long term. The working capital needs are negligible. KB had debt outstanding of Rs1.6 billion, and intends to maintain its current financing mix (of debt and equity) to finance future investment needs. The firm is in steady state and earnings are expected to grow 7% a year. The stock had a beta of 1.05. (The Risk Free Rate is 6.25%.)

Estimate the value per share, using the FCFE Model.

Section B (2 Mark)

An investor is bearish about Tata Motors and sells ten one-month ABC Ltd. Futures contracts at Rs.6,06,000. On the last Thursday of the month, Tata Motors closes at Rs.600. He makes a _________. (assume one lot = 100)

Section A (1 Mark)

Which of the following characteristics are unique to real estate that differ from other asset classes?

Section A (1 Mark)

A type of lease where there is no payment schedule and penalty for a set period of lines.

Section A (1 Mark)

In US How many states do not have a personal income tax?

Section A (1 Mark)

Which of the following is a special human trait that we need to sharpen and use very often in CRM?

Section A (1 Mark)

The most common type of interest rate swap is

Section A (1 Mark)

A retirement planner must have detailed information about the client’s current and future assets and liabilities. Which of the following is of least importance in developing a retirement plan?

Section A (1 Mark)

Manish started investing in a savings scheme by depositing Rs. 30,000/-. He plans to increase his contribution every year by Rs. 2,000/-. If rate of interest offered in this scheme is 8 % per annum calculate the amount Manish will get on maturity of this scheme after 15 years?

Section A (1 Mark)

A type of CRM Dominant characteristic which applies technology across organizational boundaries with a view to optimizing company, partner and customer value is known as_______________.

Section C (4 Mark)

Read the senario and answer to the question.

In order to provide for Medical Education Expenses of Navneet he will be transferring whole of Equity share portfolio to Debt MF. And for Yogita’s PG degree he is ready to use his Equity MF portfolio. Balance to be met by SIP in equity MF. Starting from today. You are required to guide Keshav whether he will be able to meet Navneet’s Education Expand what is the surplus or deficit in Debt MF (today value). And what should be the SIP amount for Yogita’s Education goal?

Section B (2 Mark)

If after the partition of an HUF 2 members became partners in 3 firms on behalf of their respective HUFs and they also become partners in a fourth firm. The funds were obtained by means of loans from the other 3 firms. The share incomes of the members from the fourth firm were assessable as their individual income only.

Section B (2 Mark)

Babu Lal sold his residential house on 28-06-2010 and made a long term capital gain of Rs. 372229. He purchased a new house on 22-10-2010 for Rs. 360000 which is again sold for Rs.620000 on 16-6-2011. He purchased another house on 20-12-2011 for Rs.786000. Calculate the exemption available u/s 54 for the assessment year 2012-13. [CII-12-13: 852,11-12: 785,10-11:711]

Section C (4 Mark)

Read the senario and answer to the question.

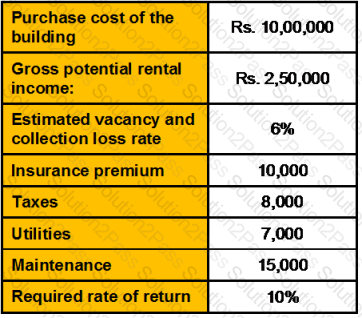

Raman is considering the purchase of a office building and, as part of his analysis, from the following given data calculate the appraised value of the property using the Income Approach?

Section A (1 Mark)

Wealth Enhancement is _____________

Section B (2 Mark)

Equity stock of X ltd. is currently selling at Rs. 35/- per share. The dividend expected next year is Rs. 2/- per share and the investor’s required return in this stock is 15 % per annum. If the constant Growth Model applies to X ltd. then calculate the Growth Rate.

Section A (1 Mark)

Individuals define risk as: