GLO_CWM_LVL_1 AAFM Chartered Wealth Manager (CWM) Global Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM GLO_CWM_LVL_1 Chartered Wealth Manager (CWM) Global Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A return relative is

Under a post office recurring deposit account, loan up to ______ of the deposit may be taken after __________ year and before maturity.

The data gathering is done by which of the following instruments given below?

Markets in which funds are transferred from those who have excess funds available to those who have a shortage of available funds are called

Indicate whether the following statement is True or False.

Money launderers often use professional intermediaries to layer their illegal funds. These professional intermediaries include lawyers, company formation agents, accountants and other professionals working in non-financial institutions. A banker is not generally regarded as a professional intermediary because he works in a financial institution.

A mortgage where the mortgagor delivers possession and binds himself to deliver possession of the mortgaged property to the mortgagee is called?

Notice of loss should be given to the insurer within ________days of the event of loss.

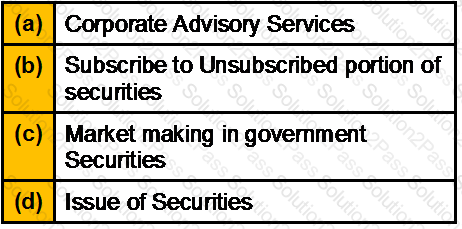

Which of the following is/are the role of Investment Bankers?

The standard deviation of the returns of a portfolio of securities will be _________ the weighted average of the standard deviation of returns of the individual component securities.

Deposit insurance covers _______.

Which of the following determines the exchange rate?

"When a customer deposits cheque with a bank for clearing, the customer becomes a _______."

_________ is a key determinant indicating availability of banking services for the entire economy.

Solvency ratio is usually __________ in the case of young couples as compared to senior citizens

X, a shopkeeper says to Y, who manages his business – “Sell nothing to Z unless he pays you ready money, for I have no opinion of his honesty”. Can Z claim against X for defamation?

Often burdened with loan and generally both of the spouses work to earn their living. Under which category this type of family falls?

A “Mass Affluent” segment client has investible assets worth of

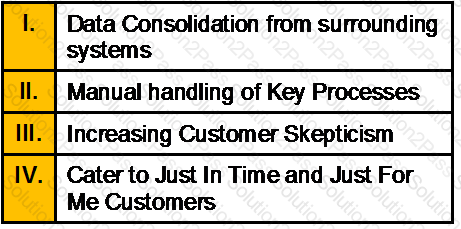

Which of the following is/are the challenges of Private Banking?

Deduction under section 80QQB is allowed to an author of a book of literary or artistic or scientific nature who is resident in India to the extent of:

“Contango” is

Joint account with a resident is permitted in case of

AUM stands for

In the context of Organizational Models of banks in Wealth Management, a model in which Private Banking acts as a peripheral add-on to the core investment banking business is termed as:

Which of the following statement is true?

_______ is an Over the Counter market

Long term interest rate is equal to .......

Which of the following is not a key issue in retirement planning?

All stock market indexes are most accurately characterized by which of the following statements about the degree to which they co-vary together?

The gap between Government’s total expenditure and its total receipts (excluding borrowing) is known as:

For calculating the benefit under Entertainment allowance, salary means,

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. Said rent is —

Investments that are difficult to convert to cash are said to have _________

Compulsory audit of account is required u/s 44AB of IT, if the total sales/ turnover exceed _______

Which one of the following is/are correct?

If, C=Rs.240 million, I = Rs.20 million, G = Rs.90 million, X = Rs.50 million M = Rs.80 million Calculate the value of GDP?

Mr. Shivam Sharma expects to receive Rs 25000 in net receipts each year for five year and to sell the property for Rs 350,000 at the end of the five-year period, if Mr. Sharma expects a 15% return, what would be the value of the property?

A ………………… mortgage is a mortgage which does not fully amortize over the term of the note thus leaving a balance due at ……………..

Find out the effective quarterly rate for 18% per annum compounded half yearly.

Which of the following is a reasonable assumption to make about the understanding of a client on the Wealth planning Process?

One should accept a project if NPV is