GLO_CWM_LVL_1 AAFM Chartered Wealth Manager (CWM) Global Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM GLO_CWM_LVL_1 Chartered Wealth Manager (CWM) Global Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Mukul purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-. Please calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

A typical personal accident policy would normally have provisions to pay

Which one of the following statements is/are correct?

An investment having market value of Rs. 100 lakhs in the beginning of 2007, a Rs. 200 lakhs value at the end of 2007, and a Rs. 100 lakhs value at the at the end of 2008. Calculate the arithmetic return and time-weighted return?

If a Rs. 100 par value preferred stock pays an annual dividend of Rs. 5 and comparable yields are 10 percent, the price of this preferred stock will be

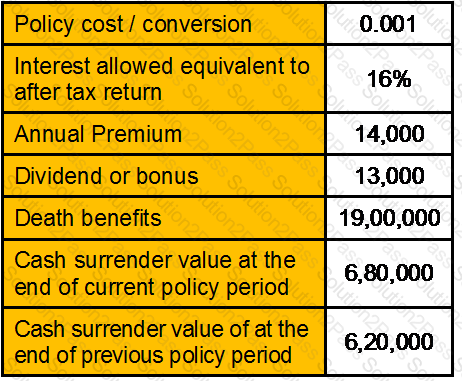

Derive policy cost per thousand with following data:

Broadly, world over the minimum investable assets for MULTI FAMILY OFFICE SEGMENT is :

"When a customer opts for a safe deposit locker, the bank becomes a _______."

The relevant banking ombudsman for filing a complain regarding credit card with central processing is the one under whose jurisdiction __________________?

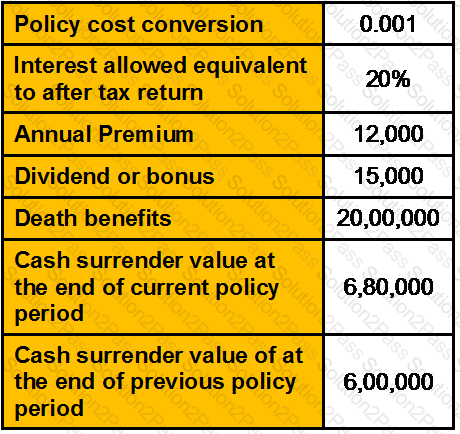

Derive policy cost per thousand with following data:

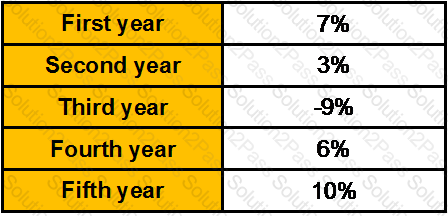

Returns on a security held for 5 years by Praveen are:

Find the standard deviation of the security.

Ranbir deposits Rs. 80000 as a lump sum amount in a immediate annuity. He will receive annuity on a monthly basis for next one year. Determine the monthly amount he is entitled to receive. The rate of interest is 15%

Which of the following are the necessary contents of a will?

If a preferred stock pays an annual Rs. 4.50 dividend, what should be the price of the stock if comparable yields are 10 percent? What would be the loss if yields rose to 12 percent?

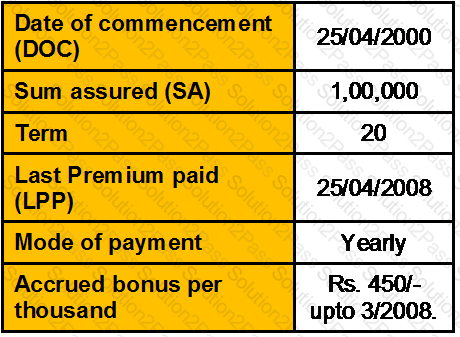

From the following information:

The Surrender value is 43% of the paid up value and loan is available at 85% of surrender value.

Calculate paid up value, surrender value, and loan value

A maximum of _____% of the issue would be allotted to one single QIB

Sujoy has purchased shares of Rs.12500 of common stock in Hindustan Unilever . He has recently sold investment to the tune of Rs.15000 & received Rs 2500 as cash dividends during the holding period of 4 years. He paid a total of Rs 250 in commissions. What is CAGR on the investment?

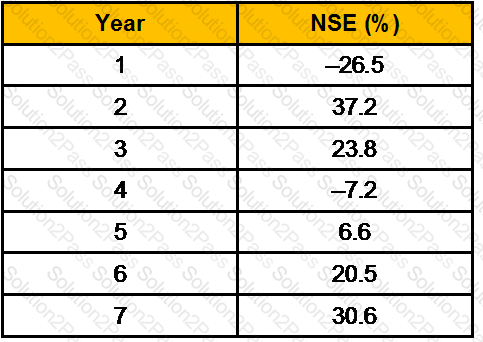

You are given the following set of data:

Historical Rate of Return

Determine the arithmetic average rates of return and standard deviation of returns of the NSE over the period given.

The main purpose of the guaranteed insurability rider benefit is to give the policyholder the right to

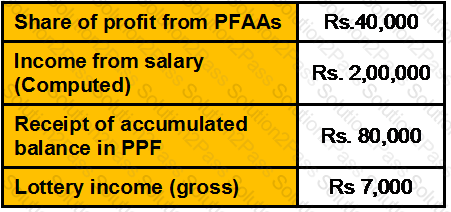

How much loan can be given from PPF account in the year 2006-07?

In straight line method

As a CWM® you recommended Mr. Raj Malhotra to put his money in Asset A offering 15% annual return with a standard deviation of 10%, and balance funds in asset B offering a 9% annual return with a standard deviation of 8%. Assume the coefficient of correlation between the returns on assets A and B is 0.50. Calculate the expected return after 1 year and standard deviation of Mr. Raj Malhotra’s portfolio

Mr. Gupta has got his stock insured against fire for Rs5,00,000/- ,during the year he lost the stock in his ware house for Rs. 4,00,000/-. The surveyor from insurance company gave his report that at the time of fire the stock in the ware house had value 6,00,000/-

Calculate what amount Mr. Gupta will receive from the insurance company.

"A borrower who has been given notice of enforcement of security interest, replies with his objections.

What is expected of the secured creditor?

Concept of final pay is a feature of

The risk free return of Security A is 8%. In addition to it, you expect that the return on market would be 14%. The expected return of Security A with beta of 0.70 is ________.

Rishi wants to purchase a car 5 years from now. His investments are presently worth Rs. 48,000/-. He puts them into an account today at a ROI of 10% per annum and he would be contributing Rs. 5,000/- from end of this month, every month for 5 years. What would be his accumulated savings in this account after end of 5 years?

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

The holding period return on a stock was 30%. Its ending price was Rs.26 and its cash dividend was Rs.1.50. Its beginning price must have been __________.

"A borrower who has been given notice of enforcement of security interest, replies with his objections. What is expected of the secured creditor? "

Ashok is 30 years old and plans to retire after another 25 years, is His annual expenditure is Rs. 2,00,000/-, and wants to maintain the same living standard as of now. Expected inflation rate is 5%. Calculate what will be the Ashok’s annual expenditure requirement at the beginning of first year of his retirement?

Choose the amount of final tax liability of R for the assessment year 2007-08:

CAMELS framework was first used in _______.

The share of a certain stock paid a dividend of Rs.10.00 last year. The dividend is expected to grow at a constant rate of 15 percent in the future. The required rate of return on this stock is considered to be 18 percent. How much should this stock sell for now? Assuming that the expected growth rate and required rate of return remain the same, at what price should the stock sell 4 years hence?

The returns on Stock A and Stock B have a correlation coefficient of –1. When the price of Stock A appreciates by 12%, how will Stock B’s price perform?

Calculate premium payable for term insurance policy of Rs. 10 lacs, for a group of 278 people of 39 years of age. The Mortality Table shows that in this age group 2,681 people die every year in a group of 12,50,000.

Pranoy is entitled to a basic salary of Rs. 5,000 p.m. and dearness allowance of Rs. 1,000 per month, 40% of which forms the part of the retirement benefits. He is also entitled to HRA of Rs. 2,000 p.m. He actually pays Rs. 2,000 p.m. as rent for a house in Delhi. Compute the taxable HRA.

EDLI is applicable to all establishments which

A doctor has taken a professional indemnity Policy on 01/06/2003 and has been continuously renewing it. In August, 2006 he operated on an infant child. But that operation failed. The parent of child filed a law suit against doctor in Sept, 2006. Which of the following statement is true in respect of the claim?

What is the exemption criteria U/S 10(10) (ii) of the IT Act, 1961 for any gratuity received by a seasonal employee?