GLO_CWM_LVL_1 AAFM Chartered Wealth Manager (CWM) Global Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM GLO_CWM_LVL_1 Chartered Wealth Manager (CWM) Global Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

DINK stands for _______

Which of the following is/are not the statutory objectives of Financial Service Authority(FSA) of UK?

Maximum no. of members in case of private company is

Under flexible exchange rates a small open economy should

G-Secs and corporate securities are variants of

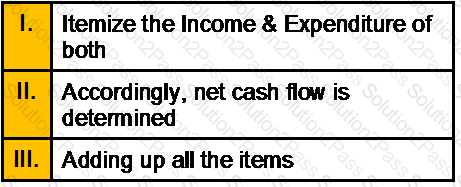

Determination of monthly income & expenditure of client & his spouse can be done with the following steps. Arrange them in a logical order?

In ULIP plans, the returns are dependent on in which the investments are done by the insurance company

The Indian Taxation System by nature is...........

A situation in which an owner of more than 50% of voting shares can elect the entire board of directors is known as

Wealth Erosion can happen due to _______

Which of the following is not a part of scheduled banking structure in India?

Risk can be

Where a coparcener with only his widow as legal heir dies, Can a partition be deemed as between the surviving coparcener and the widow on his death?

Who would get the first preference when the property of a deceased person is to be distributed

Open-ended funds have

Vishwajeet wishes to have a lump sum Retirement Fund of Rs. 25,00,000/- in 30 years time. Assuming that he can get 12% returns per annum, compounded annually, what amount he should save every year to reach his target?

Which of the following statement (s) is/are true about the rate risk?

Comprehensive Wealth Management addresses

Minimum number of independent directors on the board of asset Management Company is

Expenditure incurred by an employer on medical treatment and stay abroad of the employee shall not be taxed in the case of ___________.

How many members are required to form a society?

ln the Transfer of property Act, immovable property does not include

What do you mean by deceased to have died intestate?

Fixed exchange-rate systems maintained by a gold standard have difficulty achieving equilibrium if

An inverted yield curve implies that:

A copy of the rules & regulations of the society, certified to be correct copy by not less than_____________ of the members of the governing body shall be filled with the MOA

Which of the following is not true in respect of the conditions essential for taxing income under the head income from House Property?

Under the current international monetary system,

Open Market Operations is an important tool for central banks in ___________.

The risk measure used for calculating Treynor Index is:

Wealth Conservation is _____________

Liquid assets comprise

The income received by the approved superannuation fund on the investments made by the fund is

Income which accrue or arise outside India from a business controlled from India is taxable in case of:

In Islamic Banking, Anything permitted by Shariah is called:

The credit balance in Non resident (external) account is exempt from wealth tax provided depositor is a person

Speculative risk can result in