CTP AFP Certified Treasury Professional Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AFP CTP Certified Treasury Professional certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

What is the correct sequence of the following disbursement float events, from first to last step?

1. Check clears back to drawee bank account.

2. Check is encoded and enters the clearing system.

3. Depositor receives ledger credit.

4. Lockbox bank receives check.

On a statement of cash flow, which of the following items are considered sources of cash?

I. Increase in short-term investments

II. Net income

III. Increase in accounts payable

IV. Decrease in long-term debt

Which of the following is responsible for liquidating the assets of failed financial institutions?

Which of the following would be the most efficient method of reducing the number of cross-border payments between two units of a company?

Which of the following functions is LEAST likely to be part of a cash manager's responsibilities?

Which of the following can be considered key responsibilities of daily cash management?

I. Overseeing compensation for bank services

II. Management of short-term borrowing and investing

III. Projecting future cash shortages and surpluses

A major toy retailer operates 65 retail stores throughout the Midwest. Which of the following credit terms is MOST LIKELY to be offered to this company by its suppliers?

Which of the following factors is NOT used by a cash manager to estimate a target compensating balance?

Which of the following statements is true about a forward foreign exchange contract?

Buying a security with the intent of selling it prior to its maturity date to increase the return is an example of:

Which of the following is a negotiable time draft?

All of the following are differences between Fedwire and ACH EXCEPT:

A convenience store chain would typically use which of the following types of collection systems?

A prearranged ACH payment normally includes which of the following?

I. A fixed payment amount

II. A provision for immediate availability

III. A predetermined payment date

The PRIMARY objective of the AFP Account Analysis Standard is to help cash managers in which of the following areas?

The ACH system eliminates float because the:

Which of the following statements is true about lockbox network systems?

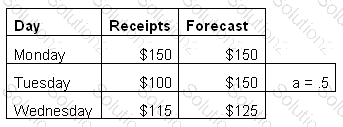

On the basis of the data above,

what is the forecast for Thursday's cash receipts, under the exponential smoothing method?

A banker's acceptance can be described as all of the following EXCEPT:

Compared to debt, which of the following statements is true about a company issuing equity?

All of the following statements are true about adjustable-rate preferred stocks EXCEPT:

Which of the following clears international checks?

The term "collection float" is defined as the delay between the time the payor:

All of the following statements are true about loan participations EXCEPT:

A lockbox system is characterized by which of the following?

The credit management function is responsible for:

Systemic risk can be caused by which of the following?

Which of the following can be used for monitoring accounts receivables?

I. Aging schedule

II. Credit terms

III. Days' sales outstanding

IV. Receivables balance pattern

A U.S. company that is expecting to receive a payment of C$1,000,000 purchased a put option of C$1,000,000 at a strike price of 1.75 C$/US$. Two days before the receipt of the payment, the spot rate is 1.85 C$/US$. To maximize its receipt of dollars, the company should do which of the following?

The time from the deposit of a check in a bank account until the funds can be used by the payee is known as:

A PRIMARY objective of the cash concentration function is to:

Which of the following statements is true about threshold concentration?

A company sells products to customers on credit, generating accounts receivable. The company uses the accrual accounting method. Once the company collects good funds from its customers, what is the impact on the financial statements of the company?

ABC Company is a national retail company and uses XYZ Bank for its collections and payroll services. XYZ has recently experienced financial problems; what is the greatest risk to ABC Company?

A company’s capital structure includes $800,000,000 in total capital, of which $200,000,000 comes from debt. The firm’s after-tax cost of debt is 6%, and its cost of equity is 12%. The marginal tax rate is currently 40%. What is the company’s weighted average cost of capital?

A Chicago meat processor is concerned about the volatility of pork belly prices. Which of the following derivative products would be used to fix these prices within a given range?

An instrument that gives the right to buy a stated number of shares of common stock at a specified price is known as:

A cash manager has determined that the break-even amount for justifying a wire transfer over an ACH for concentration of funds is $145,000. Using a wire instead of an ACH gives the company use of the funds two days earlier to make overnight investments. Based on a wire transfer cost of $10.00 and an ACH transaction cost of $0.70, what is the company’s overnight investment interest rate on a 365-day year basis?

The MOST common way that companies structure their treasury operations is as a:

An analyst for a landscaping company wants to adjust her cash-flow forecast to account for the seasonality of outflows. How can this be accomplished?