CTP AFP Certified Treasury Professional Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AFP CTP Certified Treasury Professional certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A multidivisional domestic company with centralized treasury decision-making can potentially utilize intra-company lending to:

In order to reduce the premiums paid to insurance companies, a company should consider retaining or self insuring for:

A multinational corporation has a successful subsidiary in a country that taxes cross-border dividend payments at 72%. Collections on accounts receivable average 90% per month, and the average rate on local government bond investments is 2.5%. What would be the BEST method for the company to repatriate local profits?

What type of tax does a multinational auto manufacturer commonly pay in foreign countries at each stage of a vehicle’s production?

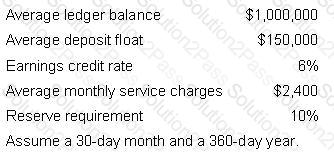

In this situation, the net earnings credit amount for the month would show:

Which of the following institutions would be regulated by the Office of the Comptroller of the Currency (OCC)?

In the event of bankruptcy and the subsequent liquidation of issuer's debt, in what order, from first to last, will the following be repaid?

1. Senior secured debt

2. Senior subordinated debt

3. Junior secured debt

4. Junior debentures

Financial ratios may provide an inaccurate forecast of a company's performance because they are:

A company's investment guidelines typically restrict all of the following EXCEPT:

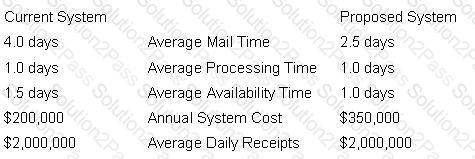

A company is considering expanding to a three-site lockbox system from its current two-site system and has collected the following data:

The average collection float in the current system is:

Which report is MOST LIKELY to be a current-day information report?

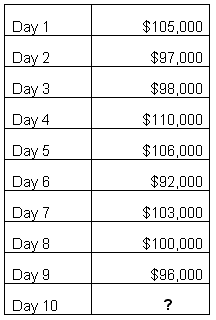

The treasury analyst for XYZ Corporation, a small retailer, is trying to forecast daily cash receipts being swept from the store depository accounts. The analyst has been given the data in the table regarding receipts from the last few days. The analyst chooses to use a seven-day simple moving average forecast methodology.

What is the amount that XYZ Corp. would expect to receive on Day 10 (rounded to the nearest whole $)?

On a daily basis, the cash manager is responsible for all of the following EXCEPT:

If a company uses accrual accounting, deferred taxes are reported on which financial statement?

A sinking fund is primarily used for which of the following purposes?

Upon entering into an interest rate swap with a notional principal of $10,000,000, what is the initial amount of money the counterparties must exchange at the beginning of the swap?

All of the following factors influence a company's decision to use electronic commerce EXCEPT:

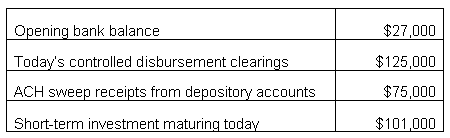

The Cash Manager of XYZ Corporation is trying to determine today’s closing cash position in order to make an investment or borrowing decision. The Cash Manager anticipates wiring $55,000 in tax payments and $63,000 in supplier payments today. Additionally, the Cash Manager is aware that a $15,000 wire was received today into the company’s concentration account from a customer and that XYZ Corp. will have to fund a bond interest payment of $200,000 in three days.

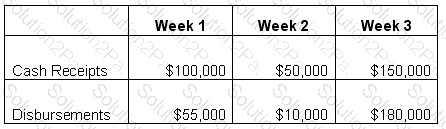

Using this information, as well as the data in the table, what is the closing cash position for XYZ Corporation?

A company has a $300,000 credit line of which $200,000 was the average amount outstanding for the year. The terms of the loan include a 1/2 of 1% commitment fee on the unused portion, an interest rate of 10%, and a compensating balance requirement of 2% of the total credit line. The company's compensating balances are funded from credit-line borrowings.

If the company negotiates to eliminate the compensating balance requirement and the average borrowings remain at $200,000, the annual interest rate would be:

What step can a cash manager take to validate a cash flow forecast?

"Fees" in Country Y, which would be considered bribes in the United States, are ingrained in the commercial culture. A U.S. company doing business in Country Y:

A manufacturing company is working to improve its cash conversion cycle. Factory production has increased over the last year to increase inventory levels. They have an inventory turnover of 3.1 and asset turnover of 5.0. The company has a days’ payable of 30 and a days’ receivable of 60. It has started enforcing its net 30 terms and placed customers with balances outstanding more than 45 days on credit hold. As a result, the company collected receivables quicker but it suffered a 10% loss in sales. What can the company do to reduce its cash conversion cycle?

A company has a beginning cash balance of $50,000. Its weekly cash flow forecast shows the following information for the next three weeks.

Which of the following statements is true?

Which two of the following are necessary to calculate average collected balances?

I. Deposit float

II. Reserve requirements

III. Ledger balance

IV. Earnings credit rate

XYZ Corporation is presently a short-term borrower and uses a revolving line of credit with an interest rate of 7%. The Treasurer would like to reduce interest expense and increase liquidity without renegotiating the line of credit. Which of the following projects should the Treasurer support in order to achieve this objective as quickly as possible?

In a large company, the person who normally oversees both the treasury and the accounting functions is the:

Which of the following global cash concentration methods would be MOST appropriate for a company with operations in the United States, Germany, Mexico, and Japan?

Which of the following would MOST LIKELY cause a decrease in a company's deposited checks availability?

Merchant XYZ has total credit card sales of $20,000 for one day with an average ticket of $200. The merchant’s interchange reimbursement fees are 2% and transactions fees are $0.05. This merchant receives net settlement. Which of the following is the value of the deposit for that day?

A company transfers funds from its remote accounts by ACH with a one-day settlement and is notified of a same-day credit of $100,000 in one of its accounts. A wire transfer costs $27.75 incrementally. Assuming a 360-day year, which of the following is the minimum rate of interest that must be earned on these funds to justify the cost of a wire transfer?

Which of the following will directly increase a company's cost in a fee-only bank relationship?

The relationship between debt and equity in a company's capital structure is called:

A small import/export company, XYZ Company, has recently set up an account with a German firm. The contract between the companies states that XYZ is to be paid as soon as all documents are in order showing that the transaction terms have been met. Which of the following forms of payment drafts would be MOST appropriate for XYZ?

A U.S. bank regularly transmits international payments to European based XYZ Bank. The payments flow through an intermediary bank. Recently regulators audited the intermediary bank and discovered the bank may be unknowingly facilitating illegal activities. What payment method was MOST LIKELY used?

Examples of fixed assets include which of the following?

I. Inventory

II. Treasury bills

III. Forklift

IV. Goodwill

All of the following are account reconciliation services EXCEPT:

Which statement is true about private placements compared to public offerings?

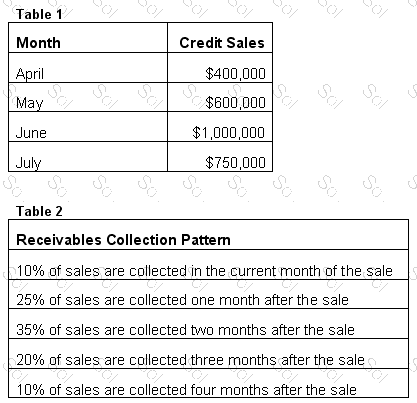

The company's monthly credit sales are in Table 1 and its receivables collection pattern is in Table 2. If this company wishes to achieve a second quarter (April-June) DSO of 60 days, what would its ending accounts receivable balance need to be?

Assume a 90-day quarter.

Trade terms are renegotiated under e-commerce in order to:

Merchant MNO’s sales for the day total $20,000. Fifty percent are credit cards, split between Card Red and Card Blue respectively, at 65% and 35% of the card volume. The average ticket is $50. Fees paid are 2% for Card Red and 2.5% for Card Blue and a fee of $0.05 per transaction. What are the fees that MNO will pay to the issuing banks?