CTP AFP Certified Treasury Professional Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AFP CTP Certified Treasury Professional certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

An analyst at Davis Company uses the tax payment (TXP) banking convention for payment of state taxes. The analyst is preparing to pay $650,000 in taxes to the state where Davis Company is domiciled. What payment method will the analyst use to make the tax payment?

Senior management at ABC Company plans to make a large capital expenditure to bolster its infrastructure exactly one year from now. Their primary concern is to preserve the current capital position until the expected cash outlay. The majority of the cash at ABC Company is held in treasury notes, but management would like to also invest some of the money into corporate bonds and money market funds. Which investment objective BEST suits the needs of ABC Company?

Company XYZ offers a retirement plan wherein the value of the plan’s assets and liabilities is measured separately. The plan’s funding and valuation can have a significant impact on the financial condition of the company. Company ABC offers a retirement plan wherein the amount owed to the participants at retirement is based solely on the account balance at the time of withdrawal with participants often bearing the responsibility for managing the investments in their account. Which of the following BEST describes the above two retirement plans and which act governs them?

The Treasurer at Worldwide Industries is concerned that its retail lockbox provider, Bank A, is not PCI DSS-compliant. Bank A processes 500,000 checks per month for Worldwide Industries. Worldwide Industries uses a third-party provider, Pay Point, for their credit card payments and funds are wired daily to Worldwide’s depository account at Bank A. What should the Treasurer do?

The Treasurer at ABC Company currently uses an in-house company-processing lockbox center. The Treasurer has asked for an analysis to determine the major advantage of using a traditional check/mail-based lockbox system. ABC receives 287,000 payments per month and hired seven additional staff members to process the payments in-house. Additionally, $389,000 was invested in the equipment used to process the payments and NSF checks have decreased 7% since using the in-house center. The equipment’s current market value is equal to its book value. What major advantage should the analysis indicate?

A company converts the expense processing for its sales team from reimbursement by check to providing the team with travel and entertainment cards. Immediately, the company’s expenses for the sales force increase by 10%, with no concurrent increase in sales volumes. What aspect should the company have covered in their policies for card use to prevent the increased expenses?

Over the past 3 years XYZ Company has expanded into multiple countries and significantly grown its banking relationships. The company now incurs significant expenses related to payment transaction costs and maintaining multiple bank connections. What should the company use to combat these rising costs?

Company XYZ is a manufacturer of industrial equipment and has enjoyed a large percentage increase in profits from a small increase in revenues. Sales recently plummeted resulting in steep decline in profitability. Which of the following BEST describes the cost structure of the company?

A U.S. company decides to enter a new geographic market facing some dominant competitors, but projects sales growth of 40% in its first year due to its superior product line. The company decides to only offer electronic payment methods for settlement of its receivables. A year later, the company’s sales volume only increases by 10%, but their average days’ sales outstanding of 32 days is the best in the industry. What should the company have considered in its collection policy objectives?

The Treasurer of a company would like to establish an investment policy for the organization. One objective that should be included in the investment policy that would BEST allow the organization to limit its exposure to a particular market sector would be to:

While revising the investment policy, the CFO performs a sensitivity analysis for the company’s cash flow from investments, and identifies that increasing the maximum dollar value for bond purchases will improve returns by 10% on average, all other variables being equal. What issue will the CFO now need to address in the investment policy?

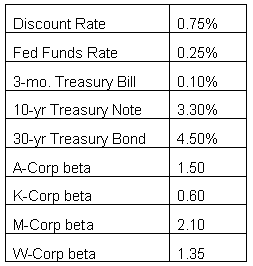

The historic rate of return in the U.S. stock market is 8%. An investment portfolio has a mix of equity investments consisting of 40% A-Corp stock, 30% K-Corp stock, 10% M-Corp stock and 20% W-Corp stock. The investment portfolio manager tends to buy and hold the equity investment position for 3 years on average. To calculate the required rate of return for this investment portfolio,

what rate from the table would be used as the risk-free rate?

Company ABC decides to outsource certain activities to an unrelated company and have that company assume the associated loss exposures. What loss control technique is Company ABC using?

Which of the following is considered an important factor when selecting a financial service provider?

Which of the following would MOST directly affect a company’s dividend policy?

Traditionally the primary source of operating risk in the area of external theft or malfeasance has been related to:

U.S.-based manufacturing Company XYZ is looking to deliver finished goods to ABC Company in a developing nation. The credit department wants to ensure collectability and has asked the treasury department for guidance. The desired solution may impact days sales’ outstanding but will have the lowest credit risk to Company XYZ. What will treasury recommend?

In cash forecasting, which of the following is a certain cash flow?

Multi-divisional or multi-subsidiary companies have opportunities to optimize their working capital position and overall liquidity by doing which of the following?

ABC Company, a U.S. company, has an overseas customer, XYZ Inc., who wants to purchase $3.1 million of equipment from ABC Co. XYZ Inc. wants to structure payment by paying 10% at time of order, 40% at time of shipment and the remaining 50% at time of receipt of the equipment. The last time XYZ Inc. purchased equipment from ABC Co. they never paid the final 50%, claiming the equipment did not work properly. Which of the following can ABC Co. use for this transaction to guarantee payment?

Which of the following is true about disbursement ZBAs?

A small group of investors is purchasing a company using a large amount of debt. This group is intending to sell off pieces of the acquired company to other firms that it believes can take advantage of potential synergies. What is this type of a transaction more specifically known as?

Contingency plans often focus on the business supply chain, ensuring that customer service is maintained. The financial supply chain, which is equally critical to the plan, should address:

Determining that payments are made to vendors and suppliers based on credit terms is the responsibility of:

Which of the following techniques would MOST accurately predict a company's daily cash position?

Which of the following is a type of borrowing between a company and a lender in which the paperwork connected with it is used to simplify the lending process?

A large multinational company with multiple autonomous operational entities is MOST LIKELY to operate.

A company wants to implement more control over its cash management system. Which aspect of the system is the most susceptible to external fraud?

If ¥120.14 = U.S.$1.00 and € .7564 = U.S.$1.00, how many ¥ = €1.00?

An olive oil producer in Macedonia is arranging for shipment of its product to an international distributor. To support this activity, the company arranges for export financing because:

What is a KEY reason that both a lessee and a lessor would enter into a lease financing agreement?

ABC Company offers trade terms of 2/10 NET 30. For several reasons, ABC has decided to eliminate the requirement for a letter of credit from one of its customers. If ABC puts the customer on open book credit, what is the MOST LIKELY outcome?

Which of the following is NOT a component of the operating cycle?

Company ABC has recently started to experience a significant reduction in funds availability. Which of the following is MOST LIKELY to reduce funds availability?

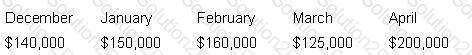

Company J is looking to perform an A/R cash analysis based on the following sales information:

60% of sales are collected within two months after sale. After three months, $135,000 of January's sales were collected. What was the dollar amount of January's sales collected in April?

Evaluating the liquidity needs of an organization is a function of:

A cash manager is responsible for a small subsidiary that has significant funds but only writes one check per month. Which of the following types of accounts would the cash manager use for this subsidiary?

At the time of the initial debt contract, the only way debt holders can protect their interests effectively is to establish certain provisions or covenants designed to:

A company is considering issuing debt in a market environment in which there is a larger than normal spread between high- and low-risk investments. Among several factors, what are the concerns regarding investor behavior that the treasurer will MOST need to consider?

What is the MOST appropriate definition of working capital?