CCRA-L2 AIWMI Certified Credit Research Analyst Level 2 Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AIWMI CCRA-L2 Certified Credit Research Analyst Level 2 certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Mark Construction Company (MCC) has bagged a contract for construction of a large dam and hydro power project on river Shivna in Madhya Pradesh (MP). The project is also of relevance from the irrigation perspective due to its location and as per the agreement MCC will have to undertake construction of web of canals, approach road to dam, power house and other ancillary units. MCC is promoted by Mr. Thomas Mark, who is a MP from the ruling party which recently formed government in MP. Historically, MCC has been engaged into construction of rural roads, small bridges and railway platforms on contract basis for the Government. MCC will have a separate special purpose vehicle (SPV) floated for this venture.

The hydro power project comes under the public private partnership scheme of the Government of MP, where in the private partner builds owns operates and transfers (BOOT) the hydro power plant. The detailed terms of the hydro power project agreement are as follows:

1. The construction of the dam, canals and hydro power plant shall be undertaken by the contractor. The

Government of MP will have to acquire land which will submerge on construction of dam and shall rehabilitate the owners of land.

2. MCC shall have right to operate the hydro power project from date of commencement of commercial operations (DCCO) for a period of 20 years and shall transfer the project to Government thereafter. Further,

SPV shall be tax exempt for a period of five years from DCCO i.e. FY17-FY21.

3. The power project is of 600 megawatts (MW) shall comprise 4 units of 150 MW each. The estimated cost of project is about INR3, 500 Million to be spent over a period of 4 year(s) the project is estimated to be commercially operational by April 1, 2016 with two units operational om same day and one unit each will be operational on April 1, 2017 and April 1, 2018.

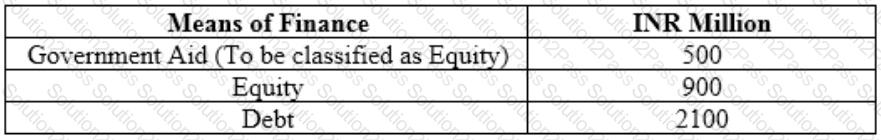

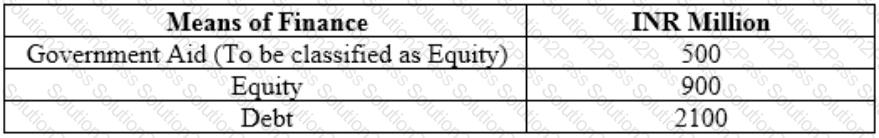

4. Means of finance:

Means of Finance INR Million

Government Aid (To be classified as Equity) 500Equity 900 Debt 2100

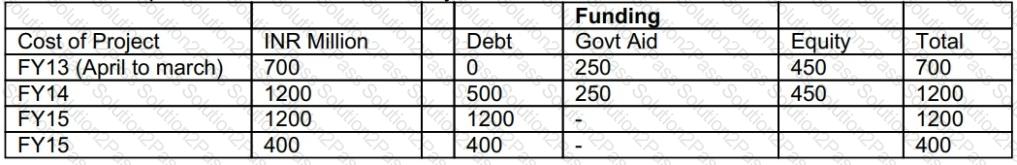

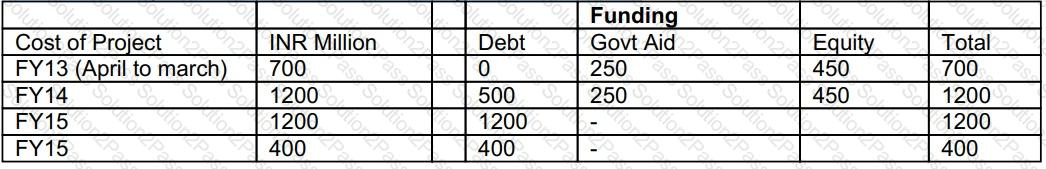

5. Amount if expenditure estimated in various years is as follows:

Debt shall bear a fixed rate of interest of 10% and all interest till DCCO shall be added to the principal. The expected principal along with capitalized interest is expected to be INR2, 400 Million (i.e.INR2100 Million debt plus INR300 Million capitalized interest). The repayment of the same shall be in 12 equated annual installments starting from FY17.

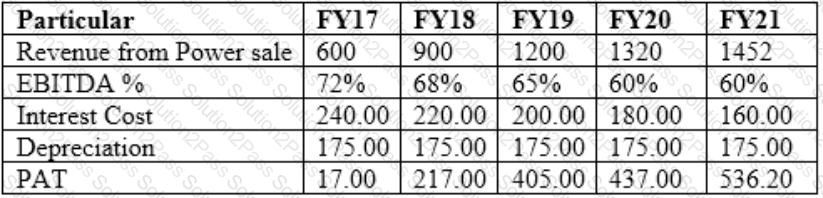

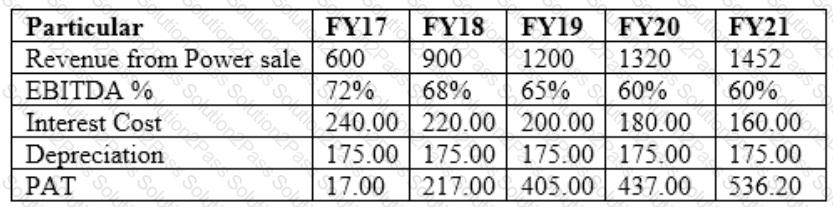

Brief projections for the period of FY17 to FY21 are given below:

Developments as on March 31, 2015

The project manager for the SPV made following comments at a press conferee on March 31, 2015:

As you all are aware, we were running bang on schedule till we last met on December 21, 2014. From today we are just left with one more year to complete the project in time. However, the flash floods which struck our dam site on this March 15, 2015 have created havoc in the region. I shall not point out the loss of lives in the region as you all are well aware of those. Our project has also been badly hit due to the same and we have been assessing the damage over the last one week. After analyzing damage, we have made changes in project schedule. Now we will be making only one unit of 150 MW operational on April 1, 2016 and 1 unit each will be added in each of subsequent year(s).

Development as on September 30, 2015

Post the flash floods, lot of environmentalists started raising issues of changes in environment due to construction of large number of dams. A few Public Interest Litigations (PILs) have been filed in various courts.

Honorable High Court of MP on September 27, 2015, banned construction of any dams in the region and banned permissions for new dams till next hearing scheduled on November 30, 2015. MCC in its press release has indicated that they will apply to the higher court on the matter.

After the developments of March 31, 2015, assuming revenues are directly linked to the power production and the EBITDA margins remain intact for the year, as were projected, compute the revised interest coverage ratio dfor FY17 and FY18?

Basket Default swaps could be

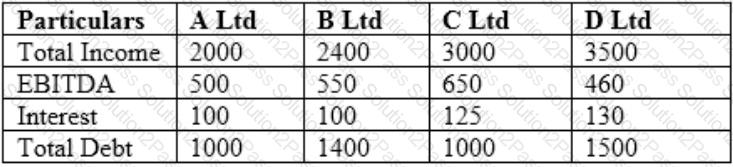

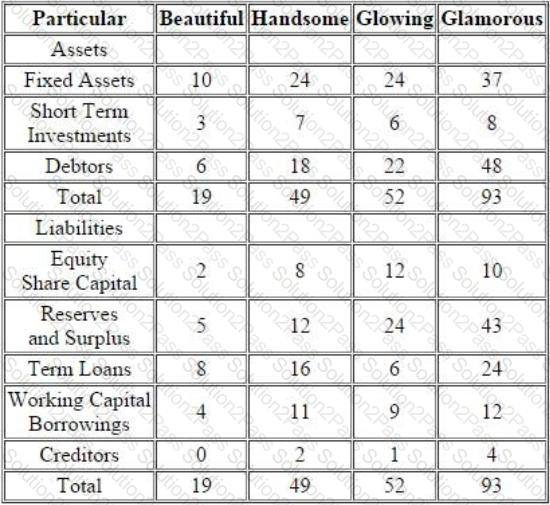

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Two credit analysts are discussing the DM-approach to credit risk modeling. They make the following statements:

Analyst A: A portfolio’s standard deviation of credit losses can be determined by considering the standard deviation of credit losses of individual exposures in the portfolio and summing them all up.

Analyst B: I do not fully agree with that. Apart from individual standard deviations, one also needs to consider the correlation of the exposure with the rest of the portfolio so as to account for diversification effects. Higher correlations among credit exposures will lead to higher standard deviation of the overall portfolio.

Satish Dhawan, a veteran fixed income trader is conducting interviews for the post of a junior fixed income trader. He interviewed four candidates Adam, Balkrishnan, Catherine and Deepak and following are the answers to his questions.

Question 1: Tell something about Option Adjusted Spread

Adam: OAS is applicable only to bond which do not have any options attached to it. It is for the plain bonds.

Balkishna: In bonds with embedded options, AS reflects not only the credit risk but also reflects prepayment risk over and above the benchmark.

Catherine: Sincespreads are calculated to know the level of credit risk in the bound, OAS is difference between in the Z spread and price of a call option for a callable bond.

Deepark: For callable bond OAS will be lower than Z Spread.

Question 2: This is a spread that must be added to the benchmark zero rate curve in a parallel shift so that the sum of the risky bond’s discounted cash flows equals its current market price. Which Spread I am talking about?

Adam: Z Spread

Balkrishna: Nominal Spread

Catherine: Option Adjusted Spread

Deepark: Asset Swap Spread

Question 3: What do you know about Interpolated spread and yield spread?

Adam: Yield spread is the difference between the YTM of a risky bond and the YTM of an on-the-run treasury benchmark bond whose maturity is closest, but not identical to that of risky bond. Interpolated spread is the spread between the YTM of risky bond and the YTM of same maturity treasury benchmark, which is interpolated from the two nearest on-the-run treasury securities.

Balkrishna: Interpolated spread is preferred to yield spread because the latter has the maturity mismatch, which leads to error if the yield curve is not flat and the benchmark security changes over time, leading to inconsistency.

Catherine: Interpolated spread takes account the shape of the benchmark yield curve and therefore better than yield spread.

Deepak: Both Interpolated Spread and Yield Spread rely on YTM which suffers from drawbacks and inconsistencies such as the assumption of flat yield curve and reinvestment at YTM itself.

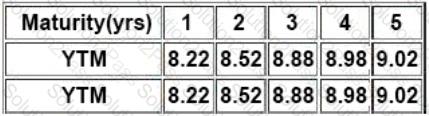

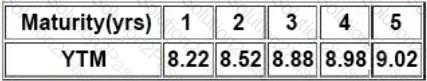

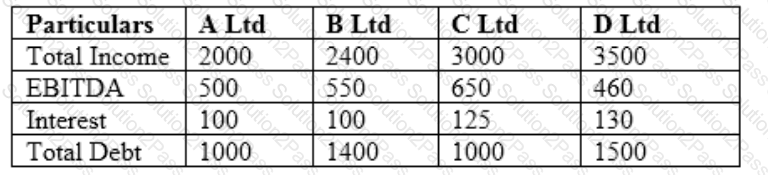

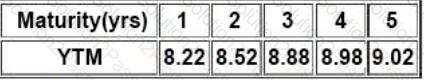

Then Satish gave following information related to the benchmark YTMs:

Who amongst the four candidates is correct regarding OAS?

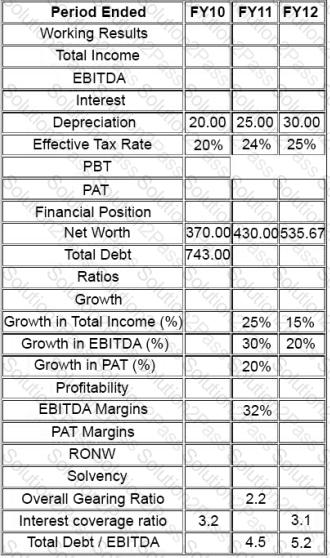

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh

Airlines Ltd, a company operating chartered aircrafts in India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

PAT margins are highest in which of the years?

Short term rates are determined by____________

Which of the following shall not be used as a source of information for the credit risk assessment?

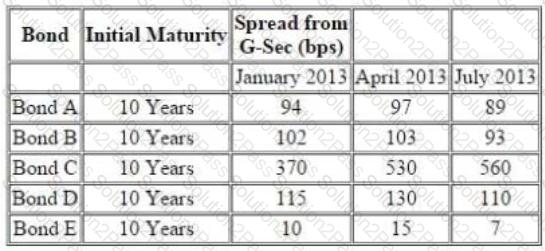

The following information pertains to bonds:

Further following information is available about a particular bond ‘Bond F’

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which ccorresponds to YTM of 9.22%. The following are the benchmark YTMs.

Assume that the general market rates have increased. An issuer, Revolution Ltd has plans to roll over its existing commercial paper and forth coming reset dates for its floating rate bonds are very near. Which of the following ratios for revolution will get impacted?

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Which of the following statements is incorrect?

The _______ cycle is the length of time between the company’s outflow on raw materials and the manufacturing expenses and the inflow of cash from the sale of goods.

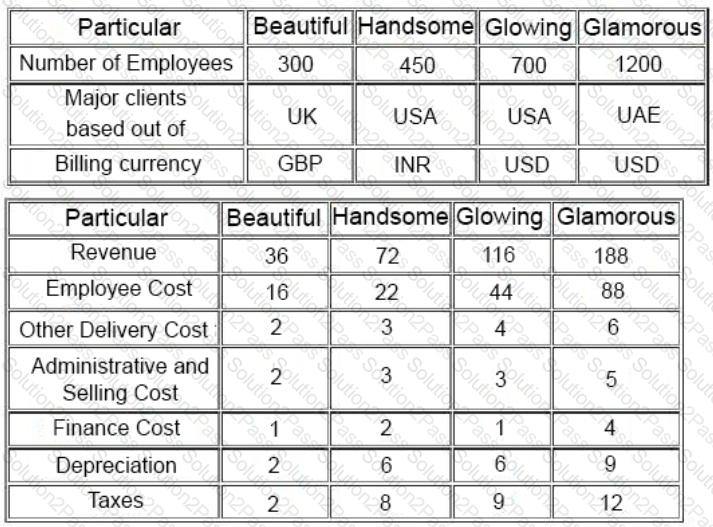

“Following four entities operate in the Indian IT and BPO space. They all are into same segment of providing off-shore analytical services. They all operate on the labour cost-arbitrage in India and the countries of their clients. Following information pertains for the year ended March 31, 2013.

The year FY13, was typically a good year for Indian IT companies. For FY14, the economic analysts have

given following predictions about the IT Industry:

A) It is expected that INR will appreciate sharply against other USD.

B) Given high inflation and attrition in IT Industry in India, the wages of IT sector employees will increase more

sharply than Inflation and general wage rise in country.C) US Congress will be passing a bill which restricts the outsourcing to third world countries like India.

While analyzing the four entities, you come across following findings related to Glowing:

Glowing is promoted by Mr.M R Bhutta, who has earlier promoted two other business ventures, He started

with ABC Entertainment Ltd in 1996 and was promoter and MD of the company. ABC was a listed entity and

its share price had sharp movements at the time of stock market scam in late 1990s. In 1999, Mr. Bhutta sold his entire stake and resigned from the post of MD. The stock price declined by about 90% in coming days and has never recovered. Later on in 2003, Mr. Bhutta again promoted a new business, Klear Publications Ltd (KCL) an in the business of magazine publication. The entity had come out with a successful IPO and raised money from public. Thereafter it ran into troubles and reported losses. In 2009, Mr. Bhutta went on to exit this business as well by selling stake to other promoter(s). There have been reports in both instances with allegations that promoters have siphoned off money from listed entities to other group entities, however, nothing has been proved in any court.”

Based on your findings in the case of Glowing, how will you handle the same as a credit rating analyst:

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Giving equal weightage to all three ratios, determine which of the above entities should be rated highest on a relative scale.

Satish Dhawan, a veteran fixed income trader is conducting interviews for the post of a junior fixed income trader. He interviewed four candidates Adam, Balkrishnan, Catherine and Deepak and following are the answers to his questions.

Question 1: Tell something about Option Adjusted Spread

Adam: OAS is applicable only to bond which do not have any options attached to it. It is for the plain bonds.

Balkishna: In bonds with embedded options, AS reflects not only the credit risk but also reflects prepayment risk over and above the benchmark.Catherine: Sincespreads are calculated to know the level of credit risk in the bound, OAS is difference between in the Z spread and price of a call option for a callable bond.

Deepark: For callable bond OAS will be lower than Z Spread.

Question 2: This is a spread that must be added to the benchmark zero rate curve in a parallel shift so that the sum of the risky bond’s discounted cash flows equals its current market price. Which Spread I am talking about?

Adam: Z Spread

Balkrishna: Nominal Spread

Catherine: Option Adjusted Spread

Deepark: Asset Swap Spread

Question 3: What do you know about Interpolated spread and yield spread?

Adam: Yield spread is the difference between the YTM of a risky bond and the YTM of an on-the-run treasury benchmark bond whose maturity is closest, but not identical to that of risky bond. Interpolated spread is the spread between the YTM of risky bond and the YTM of same maturity treasury benchmark, which is interpolated from the two nearest on-the-run treasury securities.

Balkrishna: Interpolated spread is preferred to yield spread because the latter has the maturity mismatch, which leads to error if the yield curve is not flat and the benchmark security changes over time, leading to inconsistency.

Catherine: Interpolated spread takes account the shape of the benchmark yield curve and therefore better than yield spread.

Deepak: Both Interpolated Spread and Yield Spread rely on YTM which suffers from drawbacks and inconsistencies such as the assumption of flat yield curve and reinvestment at YTM itself.

Then Satish gave following information related to the benchmark YTMs:

An investor decides to invest in the bond futures and has an outlook that the term structure curve would steepen. What should be his trading strategy?

Based on the Moody’s KMV model which of the following is not correct?

Which of the following may lead to the deterioration in credit profile of a bank?

Statement 1. Bank’s Capital adequacy falling below regulatory requirement. Statement 2. Rise in Slippage ratio

Mark Construction Company (MCC) has bagged a contract for construction of a large dam and hydro power project on river Shiva in Madhya Pradesh (MP). The project is also of relevance from the irrigation perspective due to its location and as per the agreement MCC will have to undertake construction of web of canals, approach road to dam, power house and other ancillary units. MCC is promoted by Mr. Thomas Mark, who is a MP from the ruling party which recently formed government in MP. Historically, MCC has been engaged into construction of rural roads, small bridges and railway platforms on contract basis for the Government. MCC will have a separate special purpose vehicle (SPV) floated for this venture.

The hydro power project comes under the public private partnership scheme of the Government of MP, where in the private partner builds owns operates and transfers (BOOT) the hydro power plant. The detailed terms of the hydro power project agreement are as follows:1. The construction of the dam, canals and hydro power plant shall be undertaken by the contractor. The

Government of MP will have to acquire land which will submerge on construction of dam and shall rehabilitate the owners of land.

2. MCC shall have right to operate the hydro power project from date of commencement of commercial operations (DCCO) for a period of 20 years and shall transfer the project to Government thereafter. Further,

SPV shall be tax exempt for a period of five years from DCCO i.e. FY17-FY21.

3. The power project is of 600 megawatts (MW) shall comprise 4 units of 150 MW each. The estimated cost of project is about INR3, 500 Million to be spent over a period of 4 year(s) the project is estimated to be commercially operational by April 1, 2016 with two units operational om same day and one unit each will be operational on April 1, 2017 and April 1, 2018.

4. Means of finance:

Means of Finance INR Million

Government Aid (To be classified as Equity) 500Equity 900 Debt 2100

5. Amount if expenditure estimated in various years is as follows:

Debt shall bear a fixed rate of interest of 10% and all interest till DCCO shall be added to the principal. The expected principal along with capitalized interest is expected to be INR2, 400 Million (i.e.INR2100 Million debt plus INR300 Million capitalized interest). The repayment of the same shall be in 12 equated annual installments starting from FY17.

Brief projections for the period of FY17 to FY21 are given below:

Developments as on March 31, 2015

The project manager for the SPV made following comments at a press conferee on March 31, 2015:

As you all are aware, we were running bang on schedule till we last met on December 21, 2014. From today we are just left with one more year to complete the project in time. However, the flash floods which struck our dam site on this March 15, 2015 have created havoc in the region. I shall not point out the loss of lives in the region as you all are well aware of those. Our project has also been badly hit due to the same and we have been assessing the damage over the last one week. After analyzing damage, we have made changes in project schedule. Now we will be making only one unit of 150 MW operational on April 1, 2016 and 1 unit each will be added in each of subsequent year(s).

Development as on September 30, 2015

Post the flash floods, lot of environmentalists started raising issues of changes in environment due to construction of large number of dams. A few Public Interest Litigations (PILs) have been filed in various courts.

Honorable High Court of MP on September 27, 2015, banned construction of any dams in the region and banned permissions for new dams till next hearing scheduled on November 30, 2015. MCC in its press release has indicated that they will apply to the higher court on the matter.

Based on the initial projections, do scenario analysis assuming only 75% capacity is utilized in FY17 and FY18 and thereby revenues will be proportionally reduced.

Compute DSCR under such scenario for FY17 and FY18, assuming other things remain constant?

Z spreads in Callable bonds include:

The longer the term to maturity of bond:

In a weakening economy, which of the following is least accurate?

Provisioning Coverage Ratio (PCR) is essentially the ratio of provisioning to ______ and indicates the extent

of funds a bank has kept aside to cover loan losses.