FPC-Remote APA Fundamental Payroll Certification Free Practice Exam Questions (2025 Updated)

Prepare effectively for your APA FPC-Remote Fundamental Payroll Certification certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

All of the following plans are deferred compensation plans EXCEPT:

Which of the following circumstances would cause a breach of confidentiality?

Under the rules of constructive receipt, the employee is considered paid:

To identify an out-of-balance general ledger account, all of the following documents should be used EXCEPT:

The purpose of grossing-up an amount to an employee is to:

Payroll liability tax accounts should be reconciled at LEAST once a:

All of the following resources are available to help a Payroll Professional stay abreast of regulatory changes EXCEPT the:

To ensure net pay is correct and taxes are deposited timely, which items need to be reconciled?

An employee hired on July 1, 2021, terminates employment on September 30, 2022. What is the earliest date the employer may dispose of the Form I-9?

Which of the following general ledger accounts should normally maintain a credit balance?

Which of the following master file components is NOT part of the employment data?

Which of the following amounts is subject to federal income tax withholding?

Which of the following documents listed on Form I-9 can be used to establish both an employee's identity and employment eligibility?

As of December 31, 2024, what is the MAXIMUM amount, if any, a 49-year-old employee can contribute to a 401(k) plan?

The types of accounts used by businesses to classify transactions are:

An employee clocked in for work at 8:07 a.m. and out at 4:08 p.m. According to the DOL policy on rounding work hours, which of the following recorded hours are CORRECT?

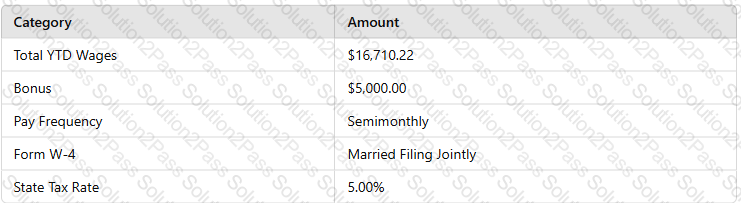

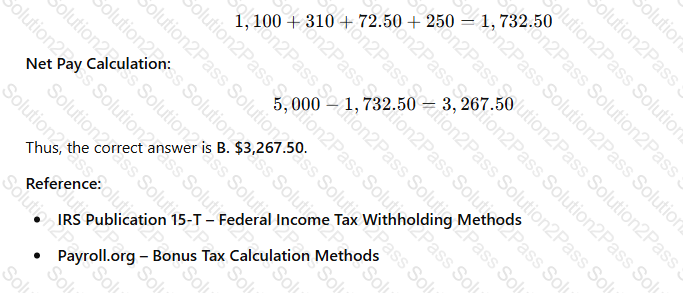

An exempt employee is being paid an annual discretionary bonus. The employee has submitted a 2020 W-4. Calculate the net pay based on the following information:

Under the FLSA, all of the following categories are defined as "white-collar" exemptions EXCEPT:

All of the following activities are examples of an internal control EXCEPT:

Payroll staff should be aware of all of the following potential warning signs of a data breach EXCEPT:

A white paper with black text

AI-generated content may be incorrect.

A white paper with black text

AI-generated content may be incorrect.