F1 CIMA Financial Reporting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F1 Financial Reporting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

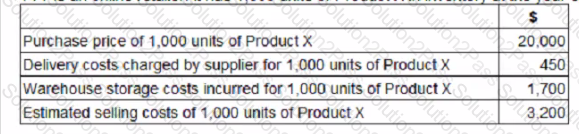

T T T is an online retailer. It has 1,000 units of Product X in inventory at the year end. The following information relates to Product X:

c

c

What is the amount that should be included in the cost of TTT's inventory of Product X?

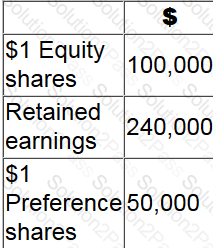

WX is considering an investment in ST.

At 31 December 20X2 ST had the following balances in its statement of financial position:

Which of the following would cause ST to become an associate investment of WX?

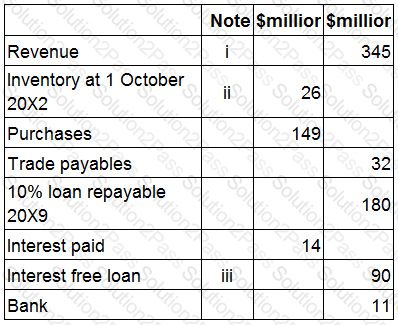

The following information is extracted from the trial balance of YY at 30 September 20X3.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the figure that should be included within non-current liabilities in YY's statement of financial position at 30 September 20X3 in respect of both of the loans outstanding at the year end?

Give your answer to the nearest $ million.

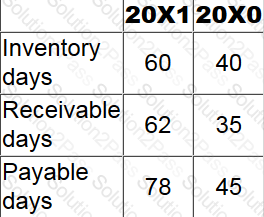

PZ has the following working capital ratios:

Which of the following could be the reason for the movements?

In which of the following concepts is profit an increase in the nominal value of capital over a period?

DE purchased an asset on 1 January 20X1 for $60,000 with a useful economic life of six years and a residual value of $3,000.

DE uses straight line depreciation for this asset.

On 31 December 20X3 the asset has a value in use of $ $28,000 and a fair value of $26,000.

Which of the following values should be used for the asset in DE's statement of financial position as at 31 December 20X3?

Entity T operates within several countries, but its country of residence is Country F. In 20X5, Entity T made $8.4 million in Country M. Country M has a flat rate corporation tax of 5.9%.

Country F and Country M operate a double taxation treaty which uses a foreign tax credit system. In Country F, there is a tax of 10% tax on all foreign income.

Taking into account the credit, what is the total tax liability that Entity T owes on its Country M income, in Country F?

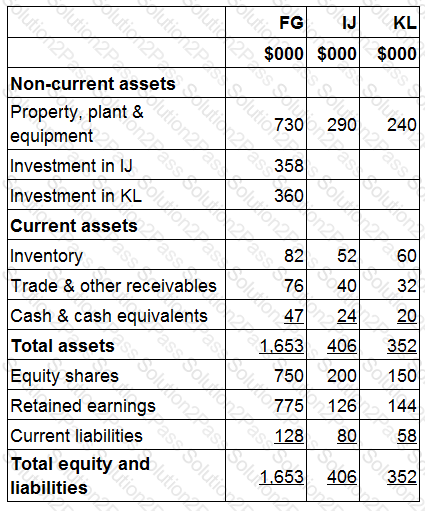

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the total goodwill to be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

In accordance with the Conceptual Framework for Financial Reporting, which TWO of the following qualitative characteristics of useful financial information should be considered when selecting a measurement basis?

The International Accounting Standards Board's "The Conceptual Framework for Financial Reporting" (known as The Conceptual Framework) states that "faithful representation" is a fundamental qualitative characteristic.

In accordance with the Conceptual Framework which of the following is NOT part of faithful representation?

Which of the following is the main purpose of corporate governance regulation?

To apply the fundamental principles of the Code of Ethics, existing and potential threats to the entity first need to be identified and evaluated.

Which THREE of the following are identified in the Code as threats?

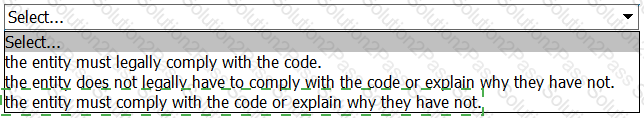

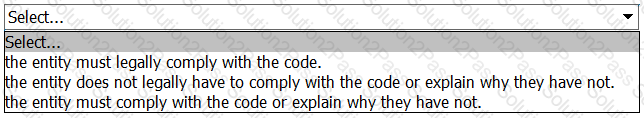

The United Kingdom (UK) uses a principle based approach to corporate governance which means:

LM is preparing its cash forecast for the next three months.

Which of the following items should be left out of its calculations?

An entity purchased an asset on 1 April 20X4 for $320,000, exclusive of import duties of $32,000.

The entity sold the asset on 31 March 20X9 for $480,000 incurring legal fees of $12,000.

The entity is resident in Country Y where chargeable capital gains are taxed at 20% and no indexation is allowed.

Calculate the amount of capital tax that the entity is due to pay.

Give your answer to the nearest whole $.

XYZ operates in Country P where the tax rules state entertaining costs and accounting depreciation are disallowable for tax purposes.

In year ending 31 March 20X4, XYZ made an accounting profit of $240,000.

Profit included $14,500 of entertaining costs and $5,000 of income exempt from taxation.

XYZ has plant and machinery with accounting depreciation amounting to $26,300 and tax depreciation amounting to $35,200.

Calculate the taxable profit for the year ended 31 March 20X4.

Country X charges corporate income tax at the rate of 20% on all income irrespective of whether it is paid out as a dividend. Country Y charges corporate income tax at the rate of 25% on all income.

An entity, AA, which is resident in Country X pays a dividend of $100,000 to another entity, BB, which is resident in Country Y.

Countries X and Y have a double taxation treaty which adopts the exemption method in respect of this type of transaction.

What is BB's liability to tax in Country Y in respect of the dividend income received?

The development of an international financial reporting standard generally goes through a number of stages.

Which of the following is NOT a stage of development?

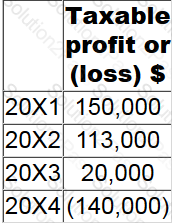

In 20X4, DEF closed its business having made a trading loss of $160,000. In DEF's country of residence, trading losses may be carried back three years on a LIFO basis.

The profits for the last four years of trading were:

What are the taxable profits or losses for years 20X1 and 20X2?

Which of the following is not a possible tax rate structure?