F1 CIMA Financial Reporting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F1 Financial Reporting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

LM received notification on 10 November 20X4 from one of its customers stating they had ceased trading as they had gone into liquidation. The balance outstanding at 31 October 20X4 was $150,000.

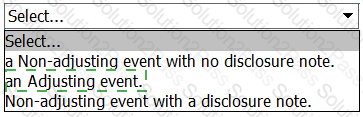

In accordance with IAS 10 Events after the Reporting Date this event will be treated as:

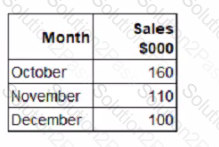

XYZ has the following data relating to the forecast sale of goods for the quarter to 31 December 20X2:

XYZ expects trade receivables to be settled as follows:

• 20% in the month of sale, by offering a settlement discount of 5%;

• 30% in the month following sale, and

• the remainder, after allowing for irrecoverable debts, in the subsequent month

$10,000 of the sales made in October 20X2 are expected to be irrecoverable

What is the forecast amount to be received by XYZ from trade receivables in December 20X2?

Select THREE actions that should be taken by a business offering credit to its customers to ensure that amounts owing are collected as quickly as possible.

An entity opens a new factory and receives a government grant of $25,000 towards the cost of new plant and equipment. This new plant and equipment originally costs $100,000.

The entity uses the net cost method allowed by IAS 20 Accounting for Government Grants and Disclosure of Government Assistance to record government grants of this nature. All plant and equipment is depreciated at 20% a year on a straight line basis.

Calculate the amount of depreciation to be included for this plant and equipment in the statement of profit of loss for the factory's first year of operation.

Give your answer to the nearest whole $.

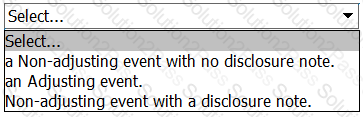

Which TWO of the following are features of a bank overdraft?

For the year ending 31 March 20X2, MN made an accounting profit of $120,000. Profit included $8,500 of political donations which are disallowable for tax purposes and $8,000 of income exempt from taxation.

MN has $15,000 of plant and machinery which was acquired on 1 April 20X0 and purchased a new machine costing $25,000 on 1 April 20X1. This new machine is entitled to first year allowances of 100% instead of the usual tax depreciation of 20% reducing balance. All plant and machinery is depreciated in the accounts at 10% on cost.

MN also has a building that cost $120,000 on 1 April 20X0 and is depreciated in the accounts at 4% on a straight line basis. Tax depreciation is calculated at 3% on a straight line basis.

Calculate the taxable profit.

Give your answer to the nearest $.

Company Y is using some of the money from a share issue to purchase a new office building. The company is also using some of the money to purchase inventories. Which method of financing is this?

Which of the following is an effect of using equity accounting to include an entity in the consolidated statement of financial position of a group?

In most developed countries employers deduct the tax from employees' pay each month and then pay the tax to the tax authorities on behalf of the employee on a monthly basis.

Which THREE of the following are advantages of this system to the employee?

Which of the following is NOT a responsibility of the International Accounting Standards Board?

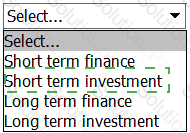

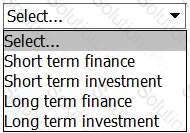

What is the correct classification of a 90-day government bond?

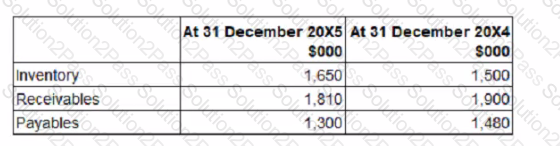

The following information has been extracted from GHI's statement of financial position:

Which of the following is the total cash flow for working capital changes to be recorded in GHI's statement of cash flows for the year ended 31 December 20X5?

Country X levies corporate income tax at a rate of 25% and charges income tax on all profits irrespective of whether they are distributed by way of dividend. Country Y levies corporate income tax at a rate of 20%.

A, who is resident in Country X, pays a divided to B, who is resident in Country Y. B is required to pay corporate income tax on the dividend received from A, but a deduction can be made for the tax suffered on this dividend restricted to a rate of 20%.

Which method of relief for foreign tax does this describe?

From the list below identify the item that appears in the statement of financial position.

If an entity makes a capital loss in a period, which of the following is the most likely way that will be allowed for relieving that capital loss?

The following information relates to a single asset:

*Original cost of $186,000

*Estimated residual value of $6,000

*Expected useful life of 10 years

*Accumulated depreciation at 31 December 20X5 of $66,960

*Annual depreciation rate of 20% on a reducing balance basis

Calculate the amount of depreciation that should be charged to profit or loss for the year ended 31 December 20X6.

Give your answer to the nearest whole number.

Country J is a newly formed independent country and it's accounting professionals are considering adopting international financial reporting standards (IFRS).

Which of the following is a disadvantage to Country J of adopting IFRS as their local generally accepted accounting practice (GAAP)?

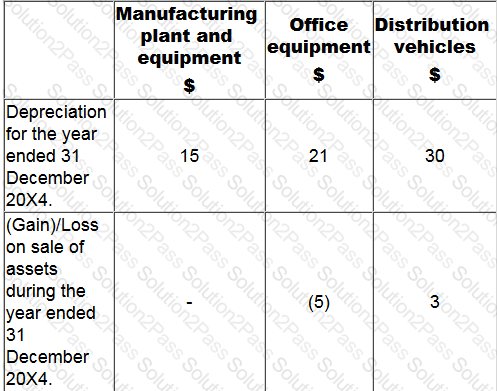

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

Calculate gross profit for the year ended 31 December 20X4.

Give your answer as a whole $.

A non-executive director of a company is somebody who:

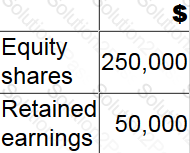

XY acquired 75% of the equity shares of CD on 1 January 20X2 for $230,000.

On 1 January 20X2 CD had the following balances:

XY uses the proportionate share of net assets method to value non controlling interest at acquisition.

Calculate the goodwill arising on the acquisition of CD.

Give your answer to nearest whole number.