F2 CIMA F2 Advanced Financial Reporting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F2 F2 Advanced Financial Reporting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A convertible bond with a nominal value of $100 can be redeemed at par in 5 years' time or be converted into 1 new equity share for every $5 of bond held.

The current equity share price is $3.50 and it is anticipated that this will grow at a rate of 7% per year.

What is the value of the conversion option of the bond in 5 years' time?

Give your answer to two decimal places.

$ ?

EF has redeemable 10% bonds which are currently trading at $94.00 for each $100 of nominal value. The bonds can be redeemed at par in five years' time. The corporate income tax rate is 22%.

The present value of the cash flows associated with $100 nominal value of these bonds at a discount rate of 7% is $9.28.

Calculate the post tax cost of debt.

Give your answer as a percentage to one decimal place.

%

AB sold the majority of its operating equipment to LM for cash on 30 December 20X9 and then immediately leased it back under an operating lease.

AB used the cash proceeds from the sale to reduce its long term borrowings significantly. No early repayment charge was levied by the lender.

Which of the following statements is true in respect of AB's ratios calculated at 31 December 20X9?

XY puchased 2% of the equity shares of FG on 1 October 20X3.

XY paid $25,000 for the shares as well as a transaction cost of 2.5% of the purchase price.

The shares are being held for short term trading and XY intend to sell them in December 20X3.

At the year end of 31 October 20X3, the shares in FG could be sold for $28,000.

What is the journal entry to record the subsequent measurement for this investment at 31 October 20X3?

AB acquired a financial investment on 1 January 20X9, incurring $5,000 related agency fees. AB initially classified the investment as held for trading, in accordance with IAS 32 Financial Instruments: Presentation.

Which of the following statements reflects the accounting treatment that AB adopted in respect of this investment when it prepared its financial statements to 31 December 20X9?

FG has a weighted average cost of capital of 12% based on its existing:

• level of gearing of 30% (measured as debt/(debt + equity)); and

• business operations.

This would be used as an appropriate discount factor to assess which of the following significant projects?

The dividend yield of ST has fallen in the year to 31 May 20X5, compared to the previous year.

The share price on 31 May 20X4 was $4.50 and on 31 May 20X5 was $4.00. There were no issues of share capital during the year.

Which of the following should explain the reduction in the dividend yield for the year to 31 May 20X5 compared to the previous year?

When producing the consolidated statement of profit or loss and other comprehensive income, which TWO of the following will be disclosed as attributable to the equity holders of the parent company and the non-controlling interests?

On 30 November 20X9 OPQ acquires a financial asset that is classified as Available for Sale.

Which of the following describes the value of the financial asset on the date of acquisition?

ST acquired 80% of the equity shares of AB on 1 January 20X7. AB acquired 60% of the equity shares of UV on 1 January 20X8. Profit for the year ended 31 December 20X9 for AB is $160,000 and for UV is $100,000.

Calculate the non-controlling interest figure to be included within ST's consolidated statement of profit or loss for the year ended 31 December 20X9.

Give your answer to the nearest whole number in $000s.

$ ?

JJ's current share price is $1.80, with a dividend of $0.20 a share just about to be paid.

Dividends have increased at an average annual growth rate of 4.5% and this is expected to continue into the future.

What is JJ's cost of equity?

When establishing a group structure, which of the following factors need to be considered: Select ALL that apply.

RST sells computer equipment and prepares its financial statements to 31 December.

On 30 September 20X5 RST sold computer software along with a two year maintenance package to a customer. The customer is given the right to return the goods within six months and claim a full refund if they are not satisfied with the computer software. The risk of return is considered to be insignificant for RST.

How should the revenue from this transaction and the right of return be recognised in the financial statements for the year ended 31 December 20X5?

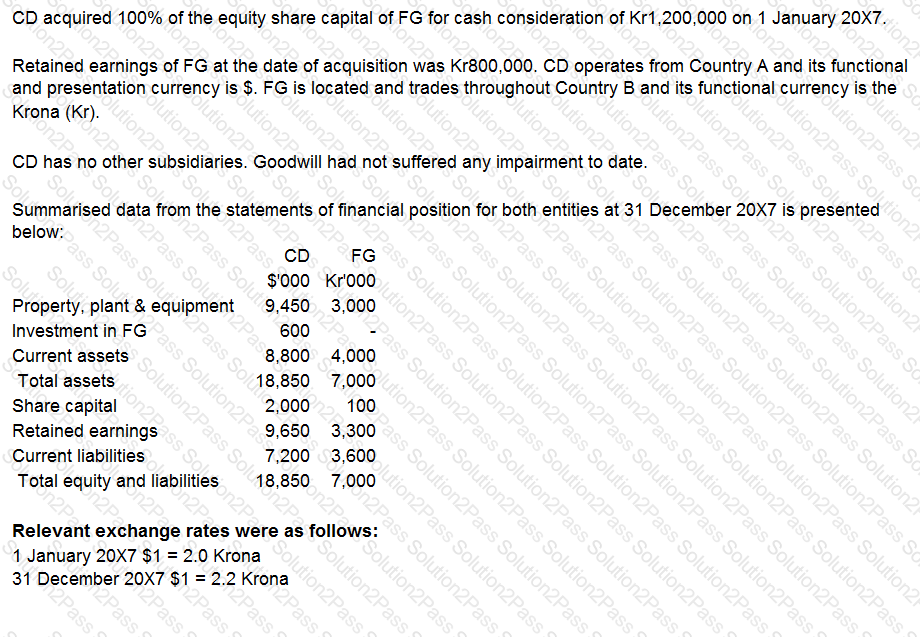

Calculate the exchange difference arising on the retranslation of goodwill on the acquisition in the consolidated statement of financial position of CD at 31 December 20X7.

Give your answer to the nearest $000.

$ ? 000

EF acquired a copy machine under a three-year operating lease. EF will pay nothing in year one and then will pay $6,000 in years two and three. The estimated economic useful life of the machine is six years.

Which THREE of the following statements are true in respect of how EF will account for its use of the machine and the associated operating lease payments?

On 1 January 20X4 EF grants each of its 125 employees 500 share options on the condition that they remain in employment for 3 years. During the year to 31 December 20X4 10 employees left and It is expected that a further 25 will leave before the end of the vesting period.

The fair value of each share option is $30 on 1 January 20X4 and $45 on 31 December 20X4.

What is the journal entry in respect of these share options in EF's financial statements for the year ended 31 December 20X4?

Which of the following statements are INCORRECT with regards to impairment of financial instruments; Select ALL that apply.

LM is preparing its consolidated financial statements for the year ended 30 April 20X5. During the year LM acquired 30% of the equity shares of AB giving it significant influence over AB.

LM conducted ratio analysis comparing the financial performance of the group for 30 April 20X4 and 20X5.

Which of the following ratios would not be comparable as a result of the acquisition of AB?

Which THREE of the following statements are true in relation to financial assets designated as fair value through profit or loss under IAS 39 Financial Instruments: Recognition and Measurement?

HJ is currently in dispute with an employee, who is claiming $400,000 in a legal case against them.

HJ's legal advisors have stated that it is probable that they will lose the case and will have to pay the amount claimed.

Also, HJ are claiming $250,000 from a supplier of defective goods and the legal advisors have stated that it is probable that HJ will be successful in this claim.

What is the correct accounting treatment for these two items in HJ's financial statements?