F2 CIMA F2 Advanced Financial Reporting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F2 F2 Advanced Financial Reporting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of static revenues and margins, in August 20X6 KL opened a fourth store at a busy airport terminal which is proving to be successful.

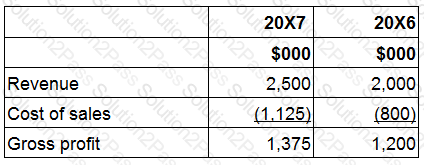

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of KL?

LM are just about to pay a dividend of 20 cents a share. Historically, dividends have grown at a rate of 5% each year.

The current share price is $3.05.

The cost of equity using the dividend valuation model is:

Which of the following should be eliminated when using the equity method to account for associates in a parent's financial statements?

Select ALL that apply.

GH granted 100 share options to each of its 1,000 employees on 1 January 20X8. The fair value of each option was $7 on 1 January 20X8 and had risen to $8 at 31 December 20X8.

Which of the following statements represents the treatment that GH adopted to account for the related expense of these share options in its financial statements for the year ended 31 December 20X8, in accordance with IFRS 2 Share-based Payments?

ST has in issue unquoted 7% debentures which were issued at par and are redeemable in 1 year's time. These debentures cannot be traded. The yield to maturity on these debentures has been calculated at 5%.

Which of the following would explain why the yield to maturity is lower than the coupon?

GH is a listed entity which holds equity shares in one subsidiary and one associate.

Information extracted from the most recent financial statements is as follows:

What is the interest cover for the year?

HJ is currently in dispute with an employee, who is claiming $400,000 in a legal case against them.

HJ's legal advisors have stated that it is probable that they will lose the case and will have to pay the amount claimed.

Also, HJ are claiming $250,000 from a supplier of defective goods and the legal advisors have stated that it is probable that HJ will be successful in this claim.

What is the correct accounting treatment for these two items in HJ's financial statements?

When accounting for a finance lease under IAS 17 Leases, which TWO of the following are recognised in the statement of profit or loss?

ST has in issue unquoted 7% debentures which were issued at par and are redeemable in 1 year's time. These debentures cannot be traded. The yield to maturity on these debentures has been calculated at 5%.

Which of the following would explain why the yield to maturity is lower than the coupon?

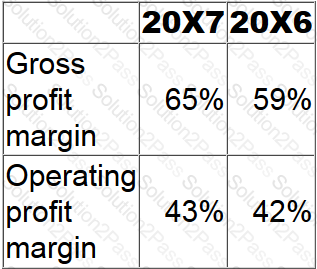

Ratios calculated from the financial statements of ST Group for the years ended 31 August 20X7 and 20X6 are as follows:

Which of the following would have contributed to the movements in these ratios?

Which of the following is NOT an example of an unconsolidated structured entity as defined in IFRS12 Disclosure of Interests in Other Entities?

LM is a car dealer that is supplied inventory by car manufacturer SQ. Trading between LM and SQ is subject to a contractual agreement. This agreement states the following:

• Legal title of the cars remains with SQ until they are sold by LM to a third party.

• Upon notification of sale to a third party by LM, SQ raises an invoice at the price agreed at the original date of delivery to LM.

• LM has the right to return any car at any time without incurring a penalty.

• LM is responsible for insuring all of the cars on its property.

When considering how these cars should be accounted for, which THREE of the following statements are true?

Which of the following statements are incorrect regarding identifiable assets? Select ALL that apply.

Which of the following best describes the goal of WACC as a measure?

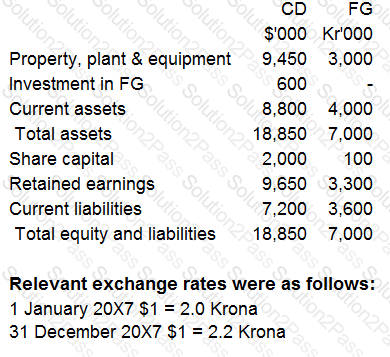

CD acquired 100% of the equity share capital of FG for cash consideration of Kr1,200,000 on 1 January 20X7.

Retained earnings of FG at the date of acquisition was Kr800,000. CD operates from Country A and its functional and presentation currency is $. FG is located and trades throughout Country B and its functional currency is the Krona (Kr).

CD has no other subsidiaries. Goodwill had not suffered any impairment to date.

Summarised data from the statements of financial position for both entities at 31 December 20X7 is presented below:

Calculate the exchange difference arising on the retranslation of goodwill on the acquisition in the consolidated statement of financial position of CD at 31 December 20X7.

Give your answer to the nearest $000.

XY's investments enable it to exercise control over AB and have significant influence over FG and JK.

The Managing Director of XY is a non-executive director of LM. XY does not hold any investment in LM.

XY is preparing its consolidated financial statements for the year ended 30 September 20X9.

Which of the following transactions during the year will be disclosed in these financial statements in accordance with IAS 24 Related Party Disclosures?

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

What is meant by the term "a placing of ordinary shares"?

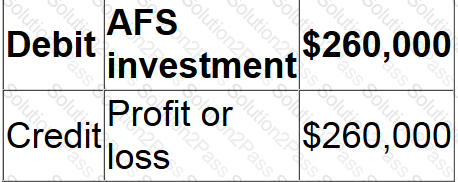

KL acquired 2 million $1 equity shares in MN on 18 July 20X0 for $1.65 a share and classified this investment as available for sale (AFS) in accordance with IAS 39 Financial instruments: Recognition and Measurement.

KL paid a 0.5% transaction fee to its broker on this transaction. MN's shares were trading at $1.78 on 31 December 20X0.

Which of the following journals records the subsequent measurement of this investment at 31 December 20X0?

CD commenced a construction contract on 1 April 20X9. The contract value was agreed at $100,000. CD had incurred $40,000 costs to date and estimated costs to completion were $50,000. At the year ended 31 December 20X9 this contract was estimated to be 60% complete. CD adopted the provisions of IAS 11 Construction Contracts when preparing its financial statements for the year to 31 December 20X9.

What value should be included in CD's profit for the year ended 31 December 20X9 in respect of this contract?

Give your answer to the nearest whole number.

$ ?