P3 CIMA Risk Management Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA P3 Risk Management certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

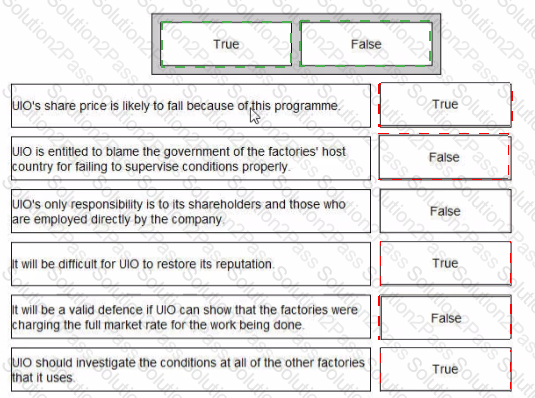

UIO designs clothes and pays third parties to manufacture them A recent television programme showed that two of the factories used by UIO were employing illegal immigrants whose status was used by the factory's owners to force them to work for low wages and in unpleasant and dangerous conditions. These factories were located in a developed country with strong labour laws

Classify each of the following statements as true or false:

CVB is a major chain of pharmaceutical retailers that is quoted on its home stock exchange.

CVB's Chief Executive Officer (CEO) persuaded a former school friend to join CVB's Board as Non-executive Chair It is not widely known that the two have been lifelong friends. The Chair tends to defer to the CEO on all matters arising at Board meetings

Which of the following statements are correct?

Select ALL that apply.

Which of the following represents the greatest risk associated with introducing a system of post-completion audit for investment projects?

The managers of a company are agents for the shareholders tasked with increasing shareholders' wealth. Which of the following will usually increase shareholders' wealth?

Which of the following statements are true of residual risk?

The senior manager in the accounts department is going on annual leave for three weeks and Jo, a supervisor is being put in charge of the department for that time.

Which TWO of the following statements are correct?

YUI owns 18 factories, which are spread around the country. Each factory employs 500-700 production staff and has its own administrative and accounts departments.

It has recently been discovered that the manager in charge of YUI's Hightown factory has been overstating his personal expenses claims for the past five years. The total amount stolen in this manner has been estimated at $10,000.

Why would it have been relatively difficult to have prevented this fraud?

P sells mobile phones and accessories The directors of P are concerned that there is a high risk of fraud being carried out by employees in the retail stores. There is a high turnover of employees in the shops as the sales targets are difficult to meet

Which TWO of the following controls would reduce this risk?

Smalltown had a problem with people parking cars on the town's mam shopping streets instead of in the nearby car parks The parked cars created congestion and made it difficult for delivery vehicles to unload Smalltown's local government had employed traffic wardens to enforce parking regulations by issuing parking fines to motorists who parked for more than the permitted 30 minutes.

The local government took further action to deal with this problem It banned parking on the busiest streets, it introduced parking charges in the remaining streets and it made it free to park m the town's car parks for up to two hours Fewer people now park cars on the streets because of the charges, but those who do generate significant revenues for the local government Fewer traffic wardens are required and so wage costs have reduced

The local goverment auditors have decided to carry out a value for money audit of the parking system

Which of the following is a measure of effectiveness?

AB is a manufacturing company which relies heavily on its computerised systems for customer management

Which of the following is the most important factor which will enable AB to continue to operate after an incident which destroys its central computer*?

Which of the following statements concerning the role of a non-executive director (NED) is correct?

Which THREE of the following form part of the role of Internal Audit?

Company directors who exercise executive share options generally resell the shares immediately, rather than holding them. Which of the following best explains this behavior?

A project requires a capital investment of £2.7million. The project will save £450,000 each year after taxation. Assume the savings are in perpetuity. The business risk of the venture requires a 15% discount rate. The company has to borrow £1million to finance the project at a rate of 9% and the net tax shield is 30%, the project supports debt which generates an interest tax shield of 0.30 x 0.09 x £1million, which is £27,000 per year in perpetuity.

Calculate the project's adjusted present value.

Which of the following statements best explains why a corporate treasury department should be established as a cost centre rather than a profit centre?

The Head of IT Security has been asked to conduct a detailed forensic analysis of a suspected data breach that ted to customer credit card details being intercepted.

Which TWO of the following would be suitable objectives for such a forensic analysis?

JHU has recently completed an eight year project. The project was evaluated at a discount rate of 10% and was accepted because the net present value was $18 million.

In year 3 of the project there was a significant unexpected repair arising because of the implementation stage of the project was rushed and some checks on equipment were skipped to save time. The cost of this was $8 million.

In year 8 of the project the costs of dismantling the project were $11 million more than anticipated because of unexpected changes to the law concerning disposal of industrial scrap.

How should these findings be reflected in the post completion audit?

Which of the following are true of an effective risk management culture?

You have been assigned the role of lead internal auditor. Your task is to carry out the annual assessment of the production line maintenance department.

When planning for this audit, which of the following must be completed?

James owns a small company which sometimes suffers from credit risk.

Which of the following measures should he put in place to help reduce this risk?