P3 CIMA Risk Management Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA P3 Risk Management certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

With regard to the internal audit department, which TWO of the following statements are correct?

An internal auditor has just completed an investigation into human resource (HR) procedures in the Springtown branch of IUY The Springtown branch is too small to have its own full-time HR staff All HR work is undertaken by the Branch Manager, assisted by the Branch Administrator

The internal auditor has discovered a number of problems with branch HR records. These are due to a misunderstanding of the regulations by the Branch Manager and the Branch Administrator, neither of whom has any specific HR training The Branch Manager has asked that the problems be omitted from the internal audit report because they were due to a lack of training and will be rectified immediately

Which TWO of the following actions should the internal auditor take with regard to the audit report on the Springtown Branch?

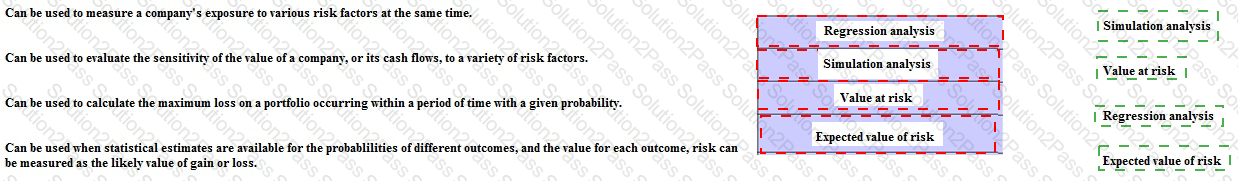

Match the descriptions shown in the boxes below with the method of quantifying risk exposure it best describes.

A large department store has just discovered that the staff in the store coffee shop have been defrauding the company for the past three years. The six employees who work in the coffee shop have been keeping a proportion of the cash takings, concealing the theft by not recording all sales up in the till They shared the proceeds of this fraud between them The fraud was only uncovered when one of the employees left and his replacement reported the theft to management rather than becoming involved in the crime

Which of the following best describes the role of the store's internal controls in the context of this fraud?

DFG's home currency is the D$.

DFG is heavily exposed to the exchange rate between the D$ and the L$, country L's currency. DFG's treasurer has noted the following:

• Inflation has been running at 5% in DFG's home country and 8% in country L

• Interest rates are 7% in DFG's home country and 11% in country L

• The spot rate is D$1.0000 = L$2.1000 and the three month forward rate is D$1.0 = L$2.1196

Which of the following statements is consistent with these figures?

YGH has recently completed a post completion audit on a five year contract that has only recently come to a conclusion. The main finding was that the project delivered most of the expected benefits, but that it cost significantly more to implement than had been anticipated at the project appraisal stage. YGH would not have proceeded if the true cost had been known at that stage.

The project was the responsibility of the production department, which is presently managed by G.

When the project was proposed, the production department was managed by H. H is now YGH's Director of Operations.

How should the finding from this post completion audit be interpreted?

TRF is conducting a post completion audit on an investment in a pollution control machine that has reached the end of its five year useful life.

TRF could have been heavily fined if the machine had failed to keep pace with the output of emissions, measured in units. TRF's cost of capital is 10%. When the machine was purchased, there was a choice of three machines on the market:

TRF purchased the Big machine, but annual requirements only exceeded 600,000 once, in year 3, when 720,000 units of emissions were emitted.

Calculate the amount that the post completion audit shows TRF overpaid for the ownership costs associated with this machine.

Give your answer to the nearest whole $ (in $'000s).

A consultancy firm has many overseas clients The firm's staff are responsible for booking travel and accommodation through an independent travel agent who invoices the firm. There are strict rules governing bookings Staff at all levels must book economy class airfares unless the scheduled flight time is greater than eight hours, in which case they can book a business class seat Hotel accommodation should cost less than $300 per night

One of the firm’s directors is visiting the consultancy team responsible for a large overseas project The director flew business class, even though the flight took only five hours The director is booked into an executive suite at an expensive hotel at a cost of $900 per night

Which TWO of the following statements concerning the director's behavior are correct?

Laura is an accounts clerk. She is supposed to sign each invoice as evidence that she has conducted checks against supporting documents. Sometimes Laura signs invoices without making these checks.

Terry is a member of the internal audit team. Terry has been told to conduct compliance tests on whether Laura is checking the invoices properly.

Which of the following would give Terry a false sense of assurance that Laura's checks have been operating?

A company is keen to avoid becoming a victim to malware. Which TWO of the following techniques would be valid responses to this threat?

DBB is a mining company. The company's business requires manners to work underground in hazardous conditions DBB takes every possible precaution to protect the safety and wellbeing of its miners, but that does not prevent the occurrence of four or five serious injuries every year. That number is small in relation to the many thousands of owners employed by DBB.

DBB's Board is preparing a risk map Most directors believe that injuries to miners should be classified as high Likelihood and high impact, which Is a category of risk that should be avoided according to the TARA framework One of the directors has suggested that the risk should be classified as low likelihood and high impact because that would move the risk into the quadrant associated with transference or sharing and so could be draft with by, say, insurance

Which TWO of the following are correct?

You are a member of the Chartered Institute of Management Accountants (CIMA) and you have recently taken up the position of Sales Manager with a company that is facing financial difficulties. The company's terms include a commitment to maintain specified profitability, liquidity and solvency measures; failure to do so would render bank loans immediately repayable. The draft financial statements show that the company has not succeeded in complying with all of these requirements.

The financial results are very dependent on various estimates such as receivables impairments. The Chief Executive Officer (CEO) has suggested that these be recalculated so as to bring the financial results within the requirements of the bank. He has asked you to sign pre-dated internal documentation which would imply that, as Sales Manager, you initiated these changes in the belief that they would enhance the accuracy of the Financial Statements.

Which TWO of the following courses of action available to you would be ethically acceptable according to the CIMA Code of Ethics?

J is a manager in charge of a section in GDD's Buying department. J has eight staff who report to her. Including M, who has worked for GDD for seven months.

One afternoon, while J was absent on sick leave, M was asked to place an urgent order for plastic pellets that are vital for GDD's production process. The usual supplier could not supply the pellets on time to avoid a shortage and so M telephoned a new supplier and placed an order. When the supplier invoiced for the delivery, GDD's Accounts Payable Department rejected the invoice because the supplier did not have a valid account.

On investigation, it was revealed that M did not have the authority to place an order with a new supplier. Only J can authorise new accounts. M claimed that he had been unaware of the need to seek approval because he had never found it necessary to place an order with a new supplier before

Which TWO of the following statements ate correct?

Which TWO of the following might create a good control environment?

SDF has a variable rate loan of $100 million on which it is paying interest of LIBOR + 2%.

SDF entered into a swap with CV bank to convert this to a fixed rate 7% loan. CV bank charges an annual commission of 0.3% for making this arrangement.

Calculate the net payment from SDF to CV bank at the end of the first year if LIBOR was 3% throughout the year.

Give your answer in $ million, to one decimal place.

Which of the following will increase the value of a call option?

Why is it potentially useful for an organisation to maintain a risk register?

They key objective of maximizing shareholders wealth would indicates that a capital investment project with a large positive BPV should be accepted.

Which THREE of the following statements are correct?

S Doc is an out-of-hours service provided by a country's government. The service allows members of the public to call and speak to a nurse who can advise on medical situations which are not obviously emergencies. Depending on the situation the caller can be referred to the full emergency services, or be advised to go to Accident and Emergency at the nearest hospital. Alternatively, a callout from a general practitioner (GP) can be organised; the caller can be advised of where GP services are available; advice can be given over the phone; or a decision can be taken that no further action is required at least until normal services resume on the next working day.

There has been a suggestion that the nurses who take these calls could be replaced by suitably trained operatives who have available to them a specially designed expert system.

Which of the following are advantages of using an expert system instead of nurses?

A project has an NPV of £1,200,000. The present value of material costs which are included in the NPV calculation are £8,000,000.

What is the sensitivity of the project to changes in material costs?

Give your answer to the nearest whole percentage.