P3 CIMA Risk Management Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA P3 Risk Management certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

HJK is a publishing company that employs several hundred staff A member of the company's IT Security Department contacted 30 members of HJK's staff selected at random, and told each one that his or her computer appeared to be infected with a virus The staff members were asked to provide their login details and corporate passwords so that IT Security could remove the virus remotely A total of six members of staff provided this information.

Which TWO of the following statements are correct?

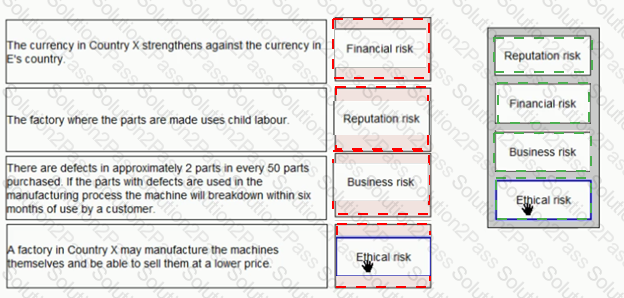

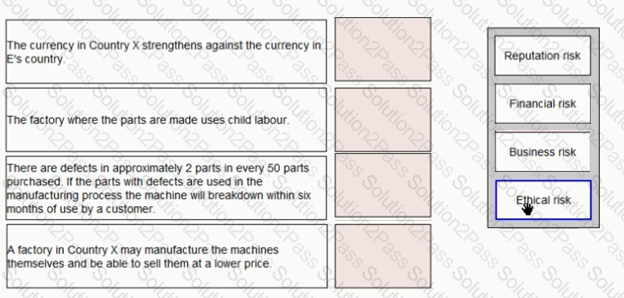

E purchases parts for one of the machines it manufactures from Country X Place the risk classification next to the risk it relates to:

Company W produces mobile phone components and has recently tendered for a substantial contract. The results of the tendering process will not become available until three months from now. If the company is successful it will require 2,000 units of a commodity which is currently traded in an open commodity market for $740 per unit. However, there has been speculation that this commodity could increase substantially in price over the next three months and so the company is considering purchasing the commodity now and storing it for three months.

The funds to buy the commodity would be borrowed at an annual interest rate of 7% and the storage cost of the product would be $5.40 per unit per month. The storage costs would be paid at the end of the three month storage period.

Which of the following represents the gain or loss (to the nearest thousand dollars) that will accrue to Company W assuming that the price of the commodity rises to $800 in three months' time?

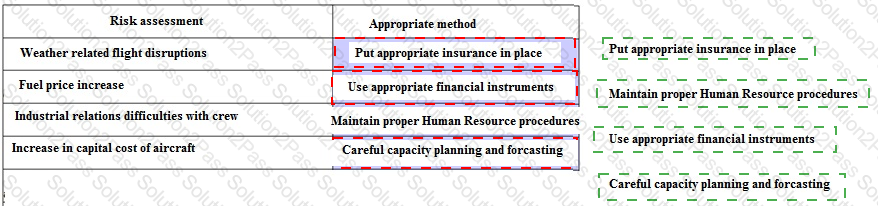

As part of risk assessment exercise for a low-cost airline you are requested to match the risks listed below with the most approriate method of minimising or dealing with each risk.

A has an opportunity to invest $90,000 in a project that is expected to generate annual cash inflows of $60,000 for each of the next three years. The project's beta coefficient implies a discount rate of 12% for this project, based on a risk-free rate of return of 3%.

A is prepared to forego the expected cash flows from this project in return for a guaranteed payment of $50,000 at the end of year 1, $42,000 at the end of year 2 and $30,000 at the end of year 3.

What is the certainty equivalent value of this opportunity to A?

B, a construction company, has a policy of carrying out a post completion audit on every construction project undertaken where the value exceeds $1 million.

What is the role of the post completion audit?

Division A of X plc produced the following results in the last financial year.

Net profit $200,000 Gross capital employed $1,000,000

For evaluation purposes all divisional assets are valued at original cost.

The division is considering a project that has a positive NPV, will increase annual net profit by $15,000, but will require average inventory levels to increase by $50,000 and non-current assets to increase by $50,000.

X plc imposes a 16% capital charge on its divisions. Given these circumstances, will the evaluation criteria of return on investment (ROI) and residual income (RI) motivate division A managers to accept the project?

HGY is a major global corporation that has decided to implement the COSO Enterprise Risk Management Framework and integrate management practices throughout the organisation

Which THREE of the following would be appropriate for HGY?

HWG is a large company which grows and processes coffee The coffee is sold to supermarkets, branded with their names for sale as "own brand" products HWG brands and packages the coffee using the supermarkets' own designs

HWG's directors are considering a strategic proposal to develop a range of coffees to be sold under a brand that HWG will develop

Which TWO of the following should the directors consider as part of their strategic analysis?

Z plc has recently undertaken a SWOT analysis. The SWOT analysis identified two main threats to Z plc:

• The threat that the currency of Z plc's main overseas competitor weakens compared to Z plc's home currency.

• The threat that there will be a military coup which will overthrow the government in the country that Z plc purchases most of its raw materials from.

Which TWO of the following categories of risk correspond most closely to the above threats?

S Doc is an out-of-hours service provided by a country's government. The service allows members of the public to call and speak to a nurse who can advise on medical situations which are not obviously emergencies. Depending on the situation the caller can be referred to the full emergency services, or be advised to go to Accident and Emergency at the nearest hospital. Alternatively, a callout from a general practitioner (GP) can be organised; the caller can be advised of where GP services are available; advice can be given over the phone; or a decision can be taken that no further action is required at least until normal services resume on the next working day.

There has been a suggestion that the nurses who take these calls could be replaced by suitably trained operatives who have available to them a specially designed expert system.

Which of the following are advantages of using an expert system instead of nurses?

Which TWO of the following are benefits of carrying out a post-completion audit of capital projects?

The board of OKN is considering an investment opportunity that will require the company to borrow a large amount in month 10 of the current financial year and to invest it immediately in property, plant and equipment. This investment has a positive net present value that justifies the risk, but the directors are reluctant to invest in the project.

Why might the directors be reluctant?

A US company has to pay £500,000 for a new machine.

You have the following information on currencies.

EUR 1 = £1.2300

EUR 1 = USD 1.6200

What is the cost of the machine in USD?

Give your answer to the nearest $.

An electricity company owns and operates a nuclear power station located ten miles from a large city. A recent and very extensive engineering examination of the power station concludes with the estimate that the probability of a major nuclear disaster within the next 20 years is 0.2%.

Which of the following best explains the relevance of quantifying the risk in that way?

CH makes a popular type of chocolate bar The bars are made on a production line and are scanned for size and shape as they move along the line Wrong sized and misshapen bars are rejected as being poor quality. The scanner detects 90% of poor quality bars. If CH wants to reduce the risk of poor quality bars being sold to the public it can add a further check by a person scanning the production line as well. this check would detect 80% of poor quality bars

If the further check was implemented what percentage of poor quality bars would still get through the checking process?

You have just been appointed Financial Controller of Y, a marketing consultancy.

You are in a meeting with the Chief Executive Officer (CEO) of Y, and have been discussing the need for a major upgrade of all the information systems throughout Y, as they are all very old.

Knowing that major change should be managed effectively, you have suggested that Y should have a 'systems steering committee'.

Advise the CEO which of the following should be included in the terms of reference of the steering committee.

P has decided to invest in a new warehouse at a cost of $2,000,000. The discount rate of the project is 18% and the present value of the tax shield is £26,000.

What is the minimum acceptable Internal Rate of Return of the project?

NTN manufactures mobile phones. The company's directors have created a new formal long term strategy The strategy is based on differentiation. NTN's phones will be thinner and lighter than those of its competitors.

Which TWO of the following statements are correct?

The management of U is reviewing internal controls throughout the company. It has noted the following:-

1. In the trade receivables section, journal adjustments are made by the clerks, without any reference to their supervisor. Journal adjustments may relate to sales returns, discounts allowed, or transfers between accounts.

2. In the purchasing department, the purchasing manager selects and approves all suppliers, as they are the only person with sufficient experience to do so. They use a very limited number of suppliers because they can rely on these suppliers to provide goods of the quality required at a competitive price. They do not keep any documents in relation to negotiations with other potential suppliers or other quotes obtained.

In relation to the above, which of the following statements are valid?