CSC1 CSI Canadian Securities Course Exam 1 Free Practice Exam Questions (2025 Updated)

Prepare effectively for your CSI CSC1 Canadian Securities Course Exam 1 certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Which investment dealer category do discount brokers belong to?

Which regulatory body is responsible for thesurveillanceof trading and market-related activities of participants on Canadian equity marketplaces?

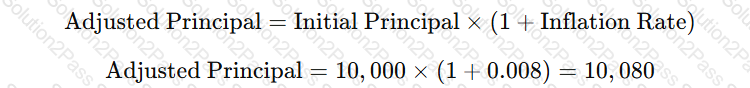

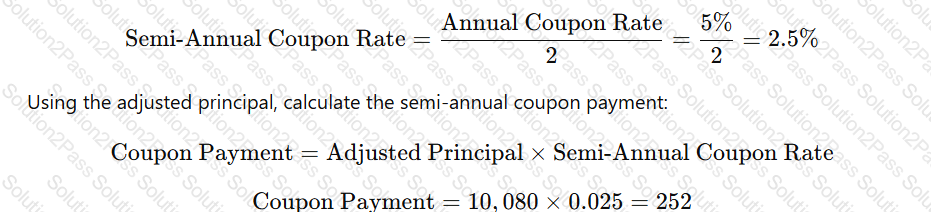

Brice purchased a $10.000 real return bond. The bond has a 10-year term to maturity and an annual coupon of 5% paid semi-annually. If the Consumer Price index increases by 0.8% over the next six months, what is the amount of Brice's first coupon payment?

Which preferredshare pays a fixed dividend rate based on the yield to maturity on the five-year benchmark Government at Canada bond?

How do high interest rates affect the economy?

What order would an investor use to protecta short position?

TDF Dealer's liability desk purchases 5,000 shares of a stock with a market order at $15 bid, $15.20 ask. The desk later sells the shares with a market order at $15.25 bid, $15.40 ask. What is TDP Dealer's gain on the trades?

What is a common use of bond Indexes in the securities industry?

What is the main benefit for the investors when a company announces a stock spit?

Which statutory right allowsa purchaser to caned their order if a prospectus has a misrepresentation?

A white paper with black text

Description automatically generated

A white paper with black text

Description automatically generated