IFC CSI Investment Funds in Canada (IFC) Exam Free Practice Exam Questions (2025 Updated)

Prepare effectively for your CSI IFC Investment Funds in Canada (IFC) Exam certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

What bias would be considered an emotional behavioural bias?

Based on your discussions with your client Sierra, you believe an asset allocation of 30% fixed income and 70% equities will help her achieve her long-term goals. What type of asset allocation strategy are you implementing?

Your employer has a contributory group RRSP under which he matches employee contributions, up to a maximum of 5% of salary.

Which of the following statements about a group registered retirement savings plan (RRSP) is CORRECT?

What variable needs to decrease on a company's statement of changes in equity for its retained earnings to increase?

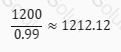

Frederic recently sold his units in a US dollar (USD) denominated mutual fund. He wants to convert the proceeds back to Canadian dollars (CAD). If he received proceeds of $1,200 USD from the sale and the exchange rate is $1 CAD for $0.99 USD, how much will Frederic receive in Canadian dollars?

Sonya, a mutual fund manager for Drake Financial, has had a stellar year in managing their Canadian equity portfolio and has outperformed the benchmark by over 200 basis points. She is now concerned that within the last couple of months of this calendar year, the Canadian equity market is due for a 10 to 15% pullback. Which investment strategy would be most appropriate for her to implement for the last couple of months of the year to offset the market correction?

What is a permissible selling practice for mutual fund representatives?

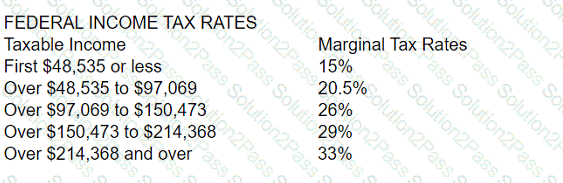

Kerry's total income this past year was $100,000 and she claimed a tax deduction of $2,000. When the tax return is filed, what would be the federal tax payable when applying the following federal tax rates?

(Round to the closest whole dollar for the final answer.)

In what circumstance would an investor receive a T3 or T5 reporting a capital gain from a mutual fund investment?

An investor who wants to deplete their funds within the next five years is considering various withdrawal plans. Assuming the investor is less concerned about predictable annual cash flows, what withdrawal plan type is most appropriate for the investor?

Jack and Jill hold a mutual fund account as tenants in common. What conditions would apply to their account?

Should either die, full ownership of the account would pass to the other

Each would be the owner of 50% of the account’s assets

Either could issue trading instructions on all account assets

Each would be required to provide KYC information

Which stock would be considered the most defensive?

Which of the following actions by the federal government or the Bank of Canada is an example of monetary policy?

What does suitability mean?

Ellen and her only son Jeff live on the family farm with her father George. Jeff is five years old and Ellen has decided that it is time to start saving for Jeff’s post-secondary education. She has called you to ask about registered education savings plans (RESPs).

Which of the following statements is TRUE?

The following data is available for an investment:

Purchase value

$125

End of the year value

$133

Quarterly dividend amount

$1

What is the annual return for this investment if held for one year?

The ZZZ Money Market Fund has a 7-day yield of 0.05%. What is the current yield for the fund? Round your answer to two decimal places.

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth

$340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle's name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

Which of the following is a conflict of interest that should be AVOIDED?

What role do investment dealers play in the Canadian and global financial markets?

A math problem with numbers

AI-generated content may be incorrect.

A math problem with numbers

AI-generated content may be incorrect.