MB-310 Microsoft Dynamics 365 Finance Free Practice Exam Questions (2026 Updated)

Prepare effectively for your Microsoft MB-310 Microsoft Dynamics 365 Finance certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

You need to configure the posting groups for Humongous insurance s subsidiary. Which ledger posting group field should you use?

You need in BUI that captured employee mobile receipts automatic ally match the transactions to resolve the User1 issue.

Which feature should you enable?

You need to address the posting of sales orders to a closed period.

What should you do?

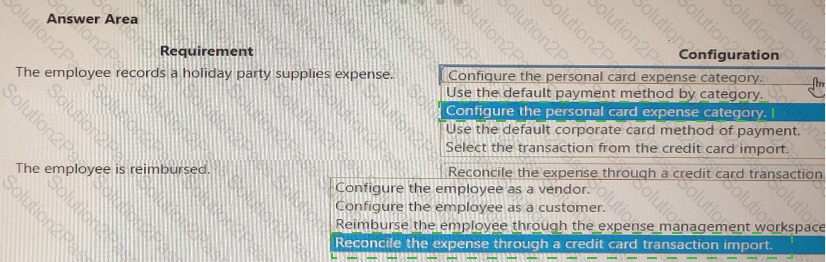

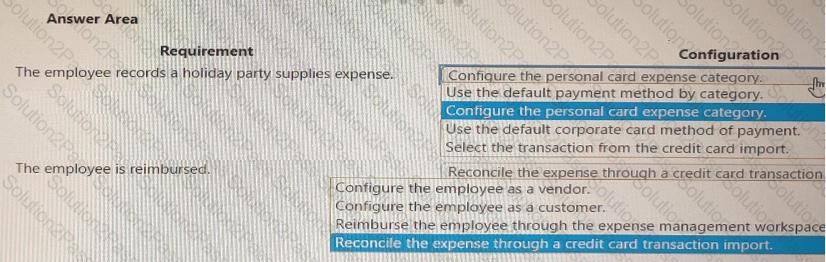

You need to configure the expense module for reimbursement.

How should you configure the expense module? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

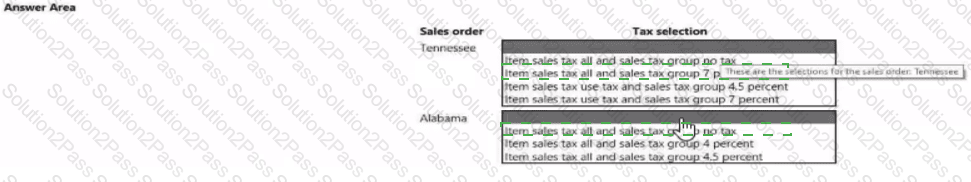

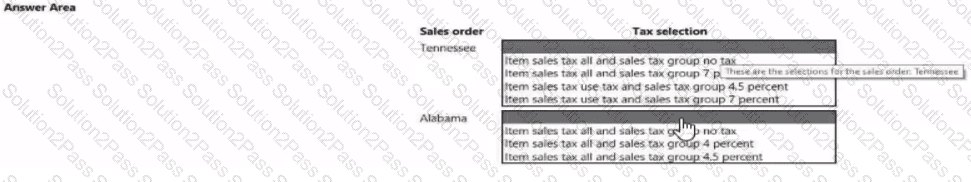

You need to validate the sales tax postings for Tennessee and Alabama.

Which tax selections meet the requirement? To answer. select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

You need to identify the posting issue with sales order 1234.

What should you do?

You need to configure revenue recognition to meet the requirements.

Which configuration should you use? To answer, drag the appropriate configurations to the correct requirements. Each configuration may be used once, more than not at all. You may need to drag the split bar between panes or scroll to view content

NOTE: Each correct selection is worth one point

You need to configure the system to meet the fiscal year requirements. What should you do?

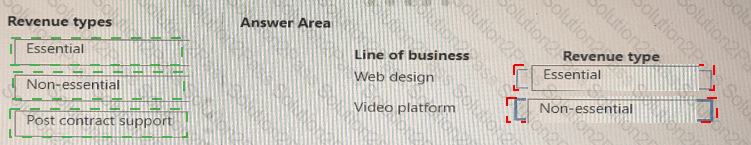

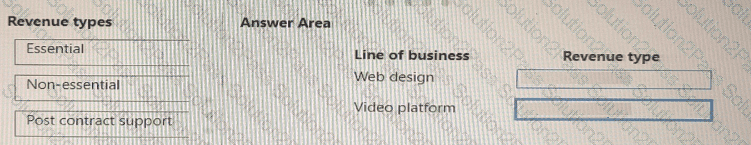

You need to configure recognition.

Which revenue type is associated with the line of business? To answer, drag the appropriate revenue types to the correct lines of business. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

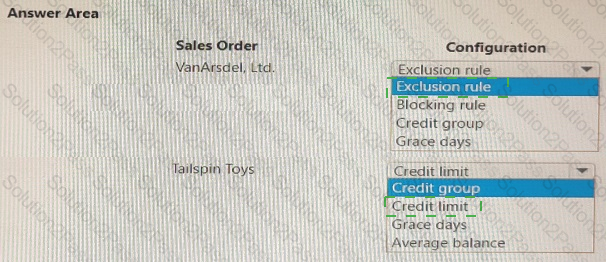

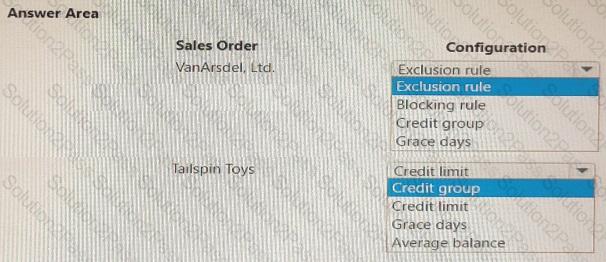

You need to identify why the sales orders where sent to customers.

Which configuration allowed the sales orders to be sent? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct select is worth one point.

You need to address the employees issue regarding expense report policy violations.

Which parameter should you use?

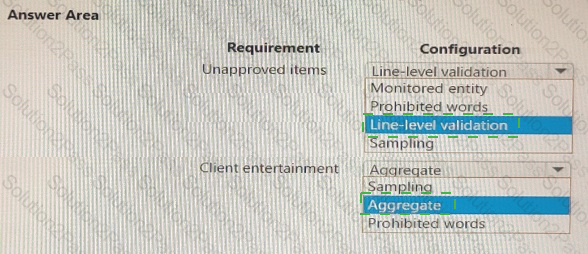

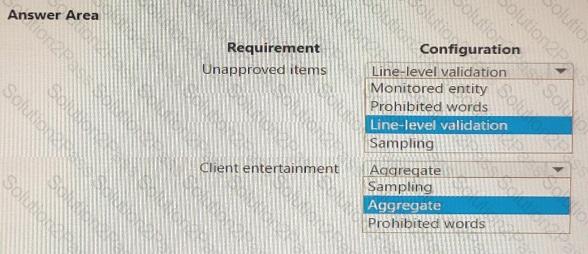

You need to prevent prohibited expenses from posting.

Which configurations should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

A company uses Microsoft [Dynamics 365 Finance.

You need to configure credit holds for sales orders.

Which three options can you use to set up blocking rules? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

A company uses Dynamics 365 Finance. The company sells extended warranty services that use a project fee journal.

You need to recognize unearned revenue for the extended warranty service over time.

Solution: Configure the project ledger posting for the fee category to post to the earned revenue account, set up a deferral template, configure the deferral default for project fees, and recognize the unearned revenue from the deferral schedule.

Does the solution meet the goal?

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance. The customer creates a purchase order for purchase $20,000 of office furniture.

You need to configure the system to ensure that the funds are reserved when the purchase order is confirmed.

Solution: Configure item posting groups for purchase requisitions.

Does the solution meet the goal?

A client wants general journal to be used only to post ledger-type transactions.

You need to set up journal configuration to achieve the requirement.

Solution: Set up the journal control on the general to the account type of ledger.

Does the solution meet the goal?

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions.

The client has the following requirements:

Only expense accounts require dimensions posted with the transactions.

Users must not have the option to select dimensions for a balance sheet account.

You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry.

Solution: Configure two account structures: one for expense accounts and include applicable dimensions, and one for balance sheet and exclude financial dimensions.

Does the solution meet the goal?

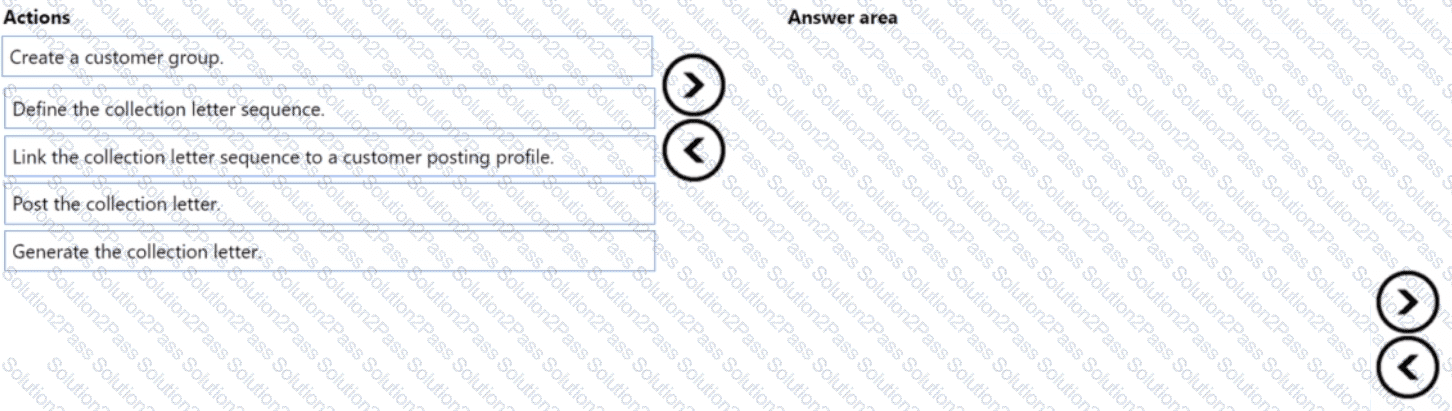

You manage customer credit and collections in a Dynamics 365 Finance implementation.

At the beginning of each month, you must send collection letters to customers whose payments are overdue.

You need to configure the collection letter functionality.

Which four actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

Which configuration makes it possible for User4 to make a purchase?

You need to configure system functionality for pickle type reporting.

What should you use?