1z0-1054-25 Oracle Financials Cloud: General Ledger 2025 Implementation Professional Free Practice Exam Questions (2025 Updated)

Prepare effectively for your Oracle 1z0-1054-25 Oracle Financials Cloud: General Ledger 2025 Implementation Professional certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Challenge 2

Manage Shorthand Aliases

Scenario

Your client intends to utilize the Shorthand Alias feature and would like to see how the aliases will appear when entering transactions.

Task 2

Create a shorthand alias for the US Chart of Accounts to record Revenue Domestic for Supremo Fitness, Line of Business 2, and US Operations Cost Center.

Note:

. Prefix your alias name with 07, where 07 is

your exam ID.

. There is no Product or Intercompany

impact.

You want to achievemulti-step cascading allocations. Which feature do you use?

You need to add new transactional attributes to the journal approval notification in an implementation project. Which two Business Intelligence catalog objects should you copy (or customize) and edit?

Task 3

Manage Chart of Accounts Mappings

Scenario

Your client needs to consolidate their UK Ledger to the Canadian parent ledger. Each Chart of Accounts

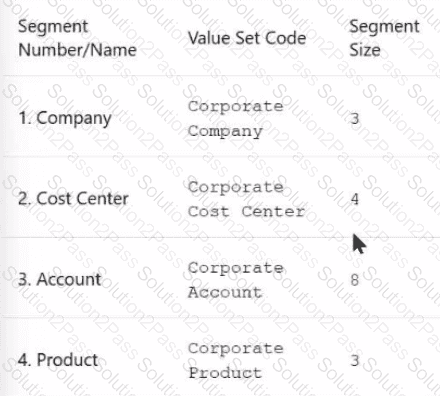

has the following segments:

Company-LoB-Account-Cost Center-Product-Intercompany

Know that the Company, LoB, Product, and Intercompany segments share the same value sets.

Create a Chart of Accounts mappings to map UK Chart of Accounts to CA Chart of Accounts that meets the following specifications:

Cost Center Mapping

. Balance Sheet (0 and 000) should be mapped to

Balance Sheet

. All other cost centers should be mapped to 610

Account Mapping

. Asset accounts (in the 1000 range) should be

mapped to account 11101

. Liability accounts (in the 2000 range) should be

mapped to account 22100

. Equity accounts (in the 3000 range) should be

mapped to account 34000

. Revenue accounts (in the 4000 range) should be

mapped to account 42000

. Expense accounts (from 5000 onwards) should be

mapped to account 51100

Note:

· Do not use conditions based on parents.

. Treat any account after the 5000 range as an expense.

· Ensure all maps are numeric only.

· When creating your mapping rules for each segment

please allow for existing and future segment values

You need to set up a calendar for the year Apr-XX to Mar-YY where YY is the following year, and you would like the periods to be named according to the year they fall in.

What format should you choose?

A company implementing Oracle General Ledger has a business requirement to report under two accounting conventions and is considering setting up a primary and secondary ledger. The two accounting standards are very close.

Which data conversion level should you recommend to ensure only manual journals will be entered in the secondary ledger?

Your current Oracle Fusion Cloud implementation project includes the configuration of multiple ledgers per country and the setting up of accounting automation to drive journal processing efficiencies. In a particular country (which has a primary, secondary, and multiple reporting currency ledgers), there is a requirement to exclude the country's journal processing from accounting automation.

If you enter a ledger set (including all ledgers for that country) on the Exclusion tab of Manage Accounting Automation, what is removed from accounting automation processing?

The intercompany accountants on the cloud project are trying to reconcile intercompany balances using the latest intercompany reconciliation report.

However, they have some concerns about the information presented in the report and want you to clarify the content in the standard reconciliation report.

What is included in the intercompany reconciliation report?

Your organization would like to use the journal sequencing functionality in General Ledger. You want to include all journal sources but would like a different sequence assigned to journals originating in the Joint Venture application.

What should you create to achieve this?

You are creating a Multitier Intercompany agreement and haven chosen to use a clearing organization in Financial Route.

How many clearing organizations can be involved in Financial Route?

The Journal Import process pulls information from the GL Interface table to create valid, postable journal entries in General Ledger.

Which two statements are true about the Journal Import process?

The current implementation project covers Financials (with Fixed Assets and Expenses) with operations planned in three countries (USA, Italy, and India).

Which three labels are required when designing the chart of account structure for this project? (Choose three.)

You are setting upClose Monitor, which comprises aledger set hierarchy definition.

Which two components of theenterprise structureshould the ledgers in the ledger set share?

There is a business requirement for a subsidiary company to report to the parent company on a monthly basis.

Given that:

The subsidiary is in another country from the parent.

There is no requirement to have daily balances.

The objective is to minimize the data stored in the reporting currency.

Which data conversion level should you recommend?

You are using account hierarchies for reporting and allocations.

Which two statements are true about these types of hierarchies? (Choose two.)

Which two statements are true regarding the Translation process? (Choose two.)

When working with Essbase, versions of the tree hierarchy as defined in the Fusion are not available in the Essbase balances cube. What should you do to correct this situation?

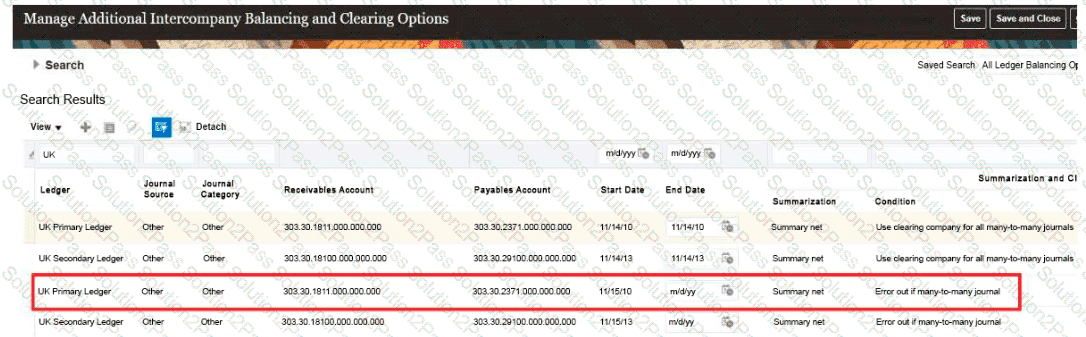

When will Intercompany processing balance a journal using the accounts identified here for the UK Ledger?

You are required to changetoday’s daily ratesfor convertingGBP to USD. What are three ways in which you can update existing daily rates?

Users with the General Accountant job role have reported that they are unable to access the UK Ledger. They require read/write access to the full ledger. The accounting configuration completed successfully.

What should you do to allow access to the ledger?