8006 PRMIA Exam I: Finance Theory Financial Instruments Financial Markets - 2015 Edition Free Practice Exam Questions (2026 Updated)

Prepare effectively for your PRMIA 8006 Exam I: Finance Theory Financial Instruments Financial Markets - 2015 Edition certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Futures initial margin requirements are

If the delta of a call option is 0.3, what is the delta of the corresponding put option?

A bank holding a basket of credit sensitive securities transfers these to a special purpose vehicle (SPV), which sells notes based on these securities to third party investors. Which of the following terms best describes this arrangement?

Which of the following will have the effect of increasing the duration of a bond, all else remaining equal:

I. Increase in bond coupon

II. Increase in bond yield

III. Decrease in coupon frequency

IV. Increase in bond maturity

Security A has a beta of 1.2 while security B has a beta of 1.5. If the risk free rate is 3%, and the expected total return from security A is 8%, what is the excess return expected from security B?

Calculate the net payment due on a fixed-for-floating interest rate swap where the fixed rate is 5% and the floating rate is LIBOR + 100 basis points. Assume reset dates are every six months, LIBOR at the beginning of the reset period is 4.5% and at the end of the period is 3.5%. Notional is $1m.

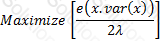

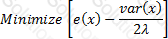

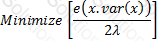

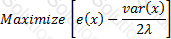

The objective function satisfying the mean-variance criterion for a gamble with an expected payoff of x, variance var(x) and coefficient of risk tolerance is λ is:

A)

B)

C)

D)

Which of the following is true about the early exercise of an American call option:

Euro-dollar deposits refer to

Which of the following statements is false:

A US treasury bill with 90 days to maturity and a face value of $100 is priced at $98. What is the annual bond-equivalent yield on this treasury bill?

A hedge fund offers a fund with an expected volatility of 12% and expected returns of 12%. The risk free rate is 4%. An institutional investor wants the hedge fund manager to invest 60% of their total allocation to the fund, and the rest in the risk free asset. What expected return and volatility can the institutional investor expect?

Which of the following statements is INCORRECT according to CAPM:

If the current stock price is $100, the risk-free rate of interest is 10% per year, and the value of a put option expiring in 1 year on this stock at a strike price of $110 is $5. What is the value of the call option with the same strike?

Consider a portfolio with a large number of uncorrelated assets, each carrying an equal weight in the portfolio. Which of the following statements accurately describes the volatility of the portfolio?

A refiner may use which of the following instruments to simultaneously protect against a fall in the prices of its products and a rise in the prices of its inputs:

A large utility wishes to issue a fixed rate bond to finance its plant and equipment purchases. However, it finds it difficult to find investors to do so. But there is investor interest in a floating rate note of the same maturity. Because its revenues and net income tend to vary only predictably year to year, the utility desires a fixed rate liability. Which of the following will allow the utility to achieve its objectives?

If the spot price for a commodity is lower than the forward price, the market is said to be in:

Using covered interest parity, calculate the 3 month CAD/USD forward rate if the spot CAD/USD rate is 1.1239 and the three month interest rates on CAD and USD are 0.75% and 0.4% annually respectively.

The volatility of commodity futures prices is affected by