8010 PRMIA Operational Risk Manager (ORM) Exam Free Practice Exam Questions (2026 Updated)

Prepare effectively for your PRMIA 8010 Operational Risk Manager (ORM) Exam certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

The probability of default of a security over a 1 year period is 3%. What is the probability that it would have defaulted within 6 months?

Which of the following statements are true:

I. Pre-settlement risk is the risk that one of the parties to a contract might default prior to the maturity date or expiry of the contract.

II. Pre-settlement risk can be partly mitigated by providing for early settlement in the agreements between the counterparties.

III. The current exposure from an OTC derivatives contract is equivalent to its current replacement value.

IV. Loan equivalent exposures are calculated even for exposures that are not loans as a practical matter for calculating credit risk exposure.

Which of the following is NOT true in respect of bilateral close out netting:

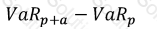

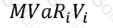

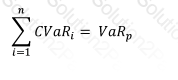

Which of the formulae below describes incremental VaR where a new position 'm' is added to the portfolio? (where p is theportfolio, and V_i is the value of the i-th asset in the portfolio. All other notation and symbols have their usual meaning.)

A)

B)

C)

D)

If the cumulative default probabilities of default for years 1 and 2 for a portfolio of credit risky assets is 5% and 15% respectively, what is the marginal probability of default in year 2 alone?

According to the Basel II framework, subordinated term debt that was originally issued 4 years ago with amaturity of 6 years is considered a part of:

For a loan portfolio, expected losses are charged against:

Which of the following are valid approaches for extreme value analysis given a dataset:

I. The Block Maxima approach

II. Least squares approach

III. Maximum likelihood approach

IV. Peak-over-thresholds approach

Altman's Z-score does not consider which of the following ratios:

Which of the following represents a riskier exposure for a bank: A LIBOR based loan, or an Overnight Indexed Swap? Which of the two rates is expected to be higher?

Assume the same counterparty and the same notional.

Which of the following measures can be used to reduce settlement risks:

When combining separate bottom up estimates of market, credit and operational risk measures, a most conservative economic capital estimate results from which of the following assumptions:

A bank holds a portfolio ofcorporate bonds. Corporate bond spreads widen, resulting in a loss of value for the portfolio. This loss arises due to:

A bullet bond and an amortizing loan are issued at the same time with the same maturity and with the same principal. Which of these would have a greater credit exposure halfway through their life?

Aderivative contract has a negative current replacement value. Which of the following statements is true about its loan equivalent value for credit risk calculations over a 2-year horizon?

All else remaining the same, an increase in the joint probability of default between two obligors causes the default correlation between the two to:

When modeling operational risk using separate distributions for loss frequency and loss severity, whichof the following is true?

A bank prices retail credit loans based on median default rates. Over the long run, it can expect:

Which of the following techniques is used to generate multivariate normal random numbers that are correlated?

Which of the following was not a policy response introduced by Basel 2.5 in response to the global financial crisis: