8010 PRMIA Operational Risk Manager (ORM) Exam Free Practice Exam Questions (2026 Updated)

Prepare effectively for your PRMIA 8010 Operational Risk Manager (ORM) Exam certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Under the contingent claims approach to credit risk, risk increases when:

I. Volatility of the firm's assets increases

II. Risk free rate increases

III. Maturity of the debt increases

Which of the following best describes economic capital?

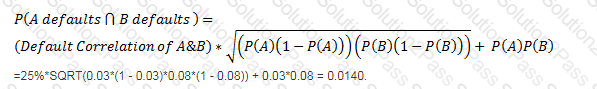

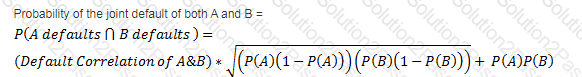

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon. If the default correlation is 25%, what is the one year expected loss on this portfolio?

Which of the following is the most accurate description of EPE (Expected Positive Exposure):

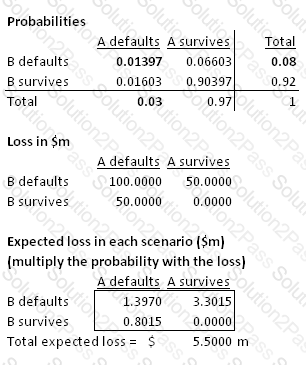

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon. If the probability of the two bonds defaulting simultaneously is 1.4%, what is the default correlation between the two?

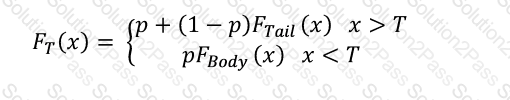

When fitting a distribution in excess of a threshold as part of the body-tail distribution method described by the equation below, how is the parameter 'p' calculated.

Here, F(x) is the severity distribution. F(Tail) and F(Body) are the parametric distributions selected for the tail and the body, and T is the threshold in excess of which the tail is considered to begin.

According to the Basel framework, reserves resulting from the upward revaluation of assets are considered a part of:

When compared to a low severity high frequency risk, the operational risk capital requirement for a medium severity medium frequency risk is likely to be:

For a corporate bond, which of the following statements is true:

I. The credit spread is equal to the default rate times the recovery rate

II. The spread widens when the ratings of the corporate experience an upgrade

III. Both recovery rates and probabilities of default are related to the business cycle and move in oppositedirections to each other

IV. Corporate bond spreads are affected by both the risk of default and the liquidity of the particular issue

Which of the following is not a credit event under ISDA definitions?

For a back office function processing 15,000 transactions a day with an error rate of 10 basis points, what is the annual expected loss frequency (assume 250 days in a year)

Which of the following are valid methods for selecting an appropriate model from the model space for severity estimation:

I. Cross-validation method

II. Bootstrap method

III. Complexity penalty method

IV. Maximum likelihood estimation method