CTEP AAFM Chartered Trust & Estate Planner® (CTEP®) Certification Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CTEP Chartered Trust & Estate Planner® (CTEP®) Certification Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

The maximum limit of net wealth not chargeable to tax under provisions of the Wealth Tax Act,________ is Rs.___________ at present.

According to ________________ of the Indian Trusts Act, a Trust may be created for any lawful purpose.

One of the essential condition for obtaining exemption of the income of a charitable trust is that at least_____________ of the income should be applied for charitable purposes in India with certain exceptions and exemptions.

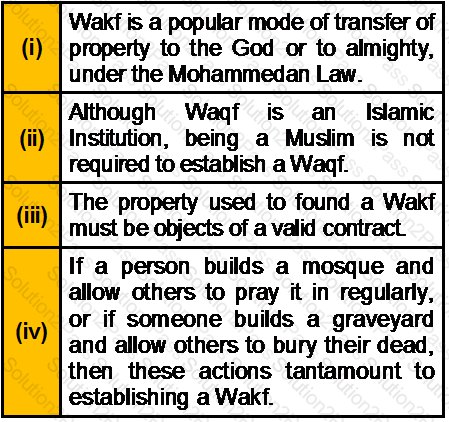

Which of the following statement(s) about Wakf is/are correct?

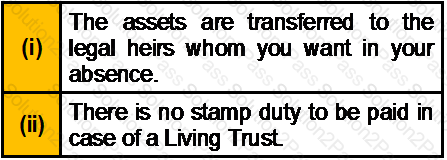

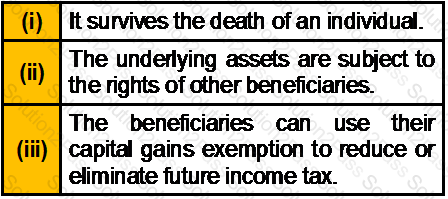

Which of the following is/are advantage(s)of Living Trust?

In __________, a protective trust is a type of trust that was devised for use in estate planning.

Which of the following structure of Unborn Trust is not valid?

As per Section 164(1) a trust for the benefit of an unborn person is liable to income tax at maximum rate of Income Tax, currently_________.

Under _______________ of the Transfer of Property Act, a transfer of property can legally be made for the benefit of an unborn person.

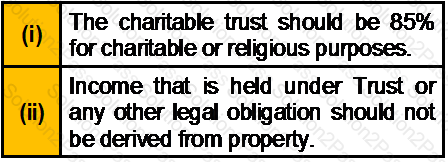

Which of the following is an essential condition for obtaining exemption of the income of a Charitable Trust?

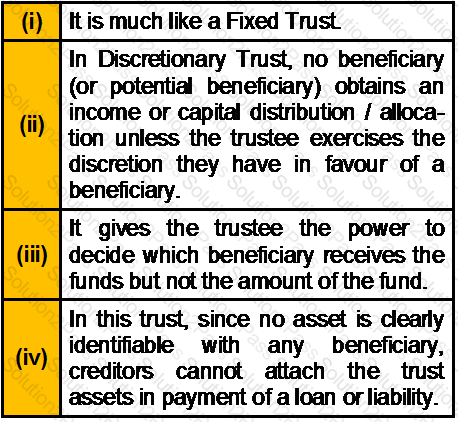

Which of the following statement(s) about Discretionary Trust is/are correct?

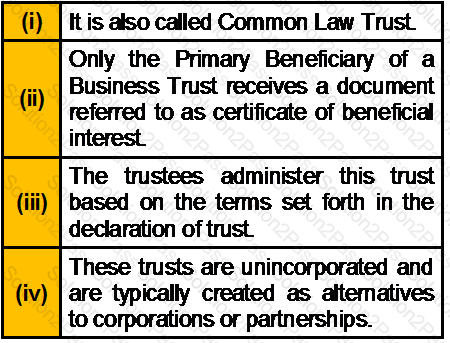

Which of the following statement(s) about Business Trust is/are correct?

Which of the following cannot be transferred with the help of Trust?

As per Section 3 of the Indian Trusts Act, a person who declares the confidence is called ____________ of the Trust.

A trust is a relationship between____________ parties.

Which of the following is/are ancillary benefit(s) of Discretionary Family Trust?

A person can create _________________ living trust/trusts while he is alive and the assets can be transferred to it/them as desired by the person.

A Public charitable or religious institution can be formed either as a Trust or as a Society or as a Company registered under _____________ of the Companies Act.

In order to form a Society, at least ___________ persons are required.

Which of the following Trust is employed by the law as an “Equitable Remedy”?