CTEP AAFM Chartered Trust & Estate Planner® (CTEP®) Certification Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CTEP Chartered Trust & Estate Planner® (CTEP®) Certification Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

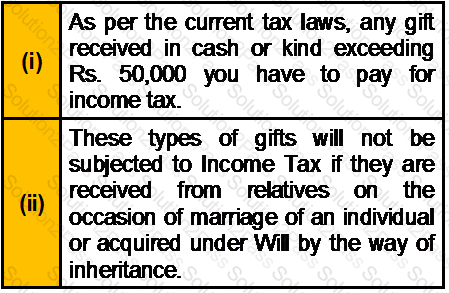

Which of the following statement(s) is/are correct?

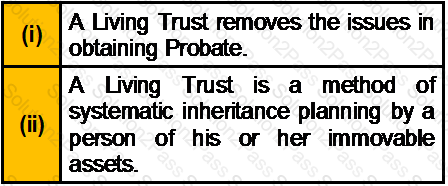

Which of the following statement(s) about Living Trust is/are correct?

Which of the following statement(s) about Exemption Trust is/are correct?

Which of the following statement(s) about “Special Needs Trust” is/are correct?

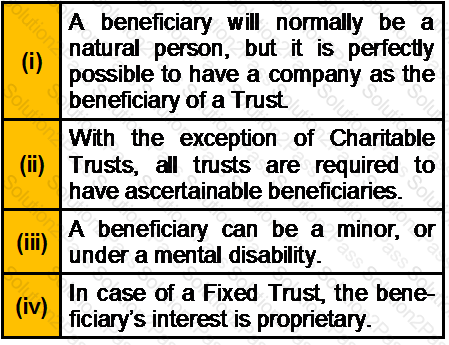

Which of the following statement(s) about beneficiary is/are correct?

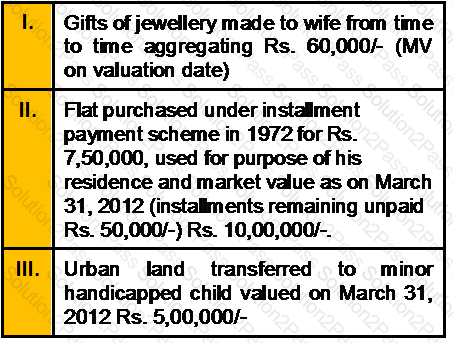

X furnishes the following particulars for the compilation of his wealth-tax return for assessment year 2012-13.

Calculate the amount on which Wealth Tax is Payable.

For claiming exemption u/s 54G, the assessed shall acquire the new asset within:

Employees Provident Fund is applicable to firms employing over _______________ employees

Any income chargeable under the head “Salaries” is exempt from tax under Section 10(6)(viii), if it is received by any non resident individual as remuneration for services rendered in connection with his employment in a foreign ship where his total stay in India does not exceed a period days in that previous year.

With respect to Workmen’s Compensation Act, if distinction is made on the ground of duration of incapacity it may extend to

Mr. Sahil has two daughter and is in receipt of education allowance of Rs 200 per month for each of them. What would be the taxable allowance in the hands of Mr. Sahil for the full FY.

In context of Hindu Adoptions and Maintenance Act,1956 if a person has more than one wife living at the time of adoption

As per Muslim Law, if the husband is missing for _________ the wife may file a petition for the dissolution of her marriage. __________ of Dissolution of Muslim Marriages Act provides that that where a wife files petition for divorce under this ground, she is required to give the names and addresses of all persons who would have been the legal heirs of the husband on his death.

In_________ type of arrangement, the mortgagor binds himself to repay the mortgage money on a certain date.

Expenditure incurred in carrying out illegal business is—

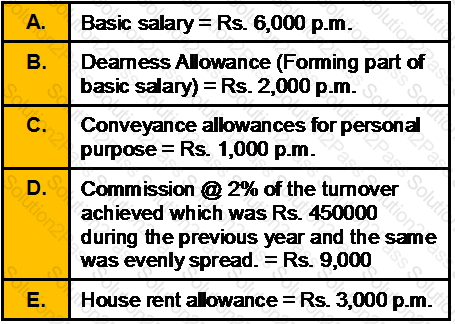

Sudesh Haldia is employed at Delhi as Store Manager in one of the Retail Companies. The particulars of his salary for the previous year 2006-07 are as under:

The actual rent paid by him is Rs. 2,000 p.m. for an accommodation at Noida till 31-12-2006.From 1-1-2007 the rent was increased to Rs. 4000 p.m. Compute the taxable HRA?

Tax slab for male / HUF(for AY 2007-08)

Rs. 0 to 100000 — No Income Tax

Rs. 1,00,001 to 1,50,000 — 10%

Rs. 150001 to 2,50,000 — 20%

Rs. 2,50,001 and above — 30%

Note: A surcharge of 10% on income tax amount is payable if total income is exceeding Rs. 10,00,000 and a 2% education cess is payable on the income tax amount and surcharge.

______________ means a contract in which advance payment is made for good to be delivered later on. ____________ is a special kind of partnership where one partner gives money to the other for investing it in a commercial enterprise.

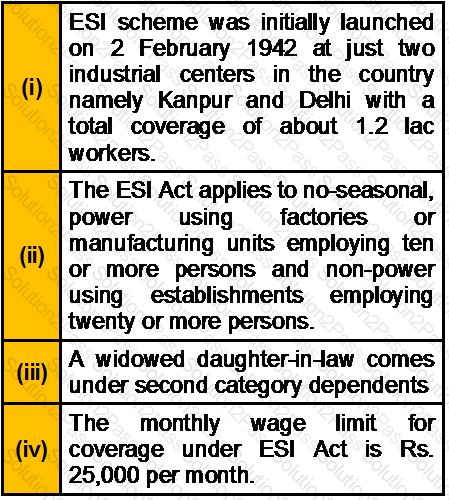

Which of the following statement(s) about Employee State Insurance Act is/are correct?

Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable

Pushkar completed the construction of a house property on 14.8.2008 with borrowed capital of Rs.8,00,000 @ 12%. The loan was taken on 1.4.2006 and is still outstanding. The house was used for his own residence during the entire FY 2012-13. Deduction U/S 24(B) for interest on borrowed capital for PY shall be