CTEP AAFM Chartered Trust & Estate Planner® (CTEP®) Certification Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CTEP Chartered Trust & Estate Planner® (CTEP®) Certification Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

You are an Estate Planner. Your Client asks you that if he wants to give business to his children which method is not appropriate. He further asks you which method can help him control the size of this gift through his will. Your reply would be___________

In case one wants to sell his/her business interest __________ and __________ are not appropriate.

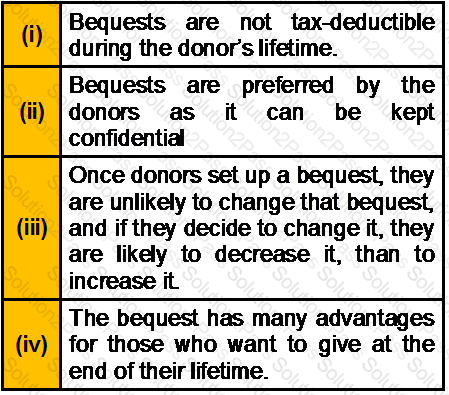

Which of the following statement(s) about Bequest is/are correct?

___________ is a brief description of what you do and what you serve.

___________ is the submission of a disputed matter to an impartial person.

You have just started your Estate Planning firm. Your friend who is into Estate Planning since 5 years explains you that an Ideal Estate Planning Prospect is one who is aged ___ or over and are _______________.

What does ‘T’ in ‘SWOT’ stands for?

In UK, for year 2013-2014 the Income limit for Personal Allowance is _____________ and the Personal Allowance for people born after 5 April 1948 is ___________.

As per US Tax Laws 2013 in case of Single Individuals, if the taxable income is above $400,001 the tax is $116,163.75 plus __________ of the excess of over $400,000.

Which of the following statement(s) about UTMA is/are correct?

Which of the following trusts is considered invalid by the courts?

As per ______________ of the Indian Trust Act, the subject matter of a trust must be properly transferable to the beneficiary.

Competency to contract has been defined under ____________ of the Indian Contract Act,___________

________________ is an informal type of Trust that is created during the lifetime of the grantor by depositing money into an account at a bank or other Financial Institution in the grantor’s name as the Trustee for another person.

Under ______________, deduction (special exemptions) in respect of donations to certain funds, charitable institutions etc. is granted. In order to be eligible under this section, the charitable trust/institutions need to obtain a valid certificate by making an application to them on ____________.

Which of the following is/are essential(s) of a valid Charitable or Religious Trust?

A Discretionary Family Trust is one of the most common small business structures in _____________. It can operate upto ____________ in the same.

Wealth Tax is charged at _________ the amount by which the net amount exceeds Rs. ____________________

Which of the following is/are advantage(s) of Living Trust?

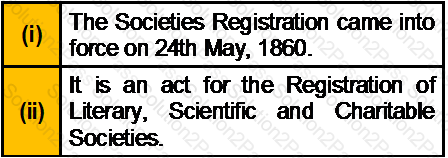

Which of the following statement(s) about Socities Registration Act is/are correct?