CTEP AAFM Chartered Trust & Estate Planner® (CTEP®) Certification Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CTEP Chartered Trust & Estate Planner® (CTEP®) Certification Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

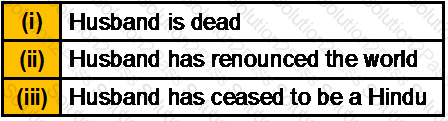

As per Hindu Adoptions and Maintenance Act,1956 a female Hindu can make adoption in which of the following cases

As per Gift Tax Act of 1958, a gift in excess of _________ received by anyone who is not your blood relative is taxable.

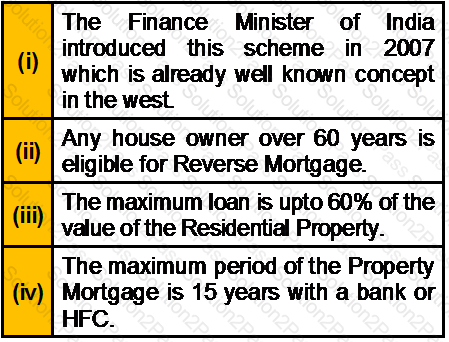

Which of the following statement(s) about Reverse Mortgage Scheme is/are correct?

In case of non-resident, who is carrying on shipping business, his Indian income shall be presumed to be:

Deduction under section 80QQB is allowed in respect of royalty income to:

The interest payable for a housing loan outside India is not allowed as a deduction U/S 24 (1) while computing the income from house property. The given statement is

Manish has two house properties. Both are self occupied. The annual value of:

Mr. Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20,000 by his employers out of which he spends Rs.18,000 for shifting his family and personal effects. Which of the following is true?

A salaried individual, aged 45 years, was awarded a car of market value Rs. 6,50,000 by his credit card company in a draw on 20th December 2012. There was no TDS by the company. He has total income from salary of Rs. 8,45,000 in the previous year 2012-13. He saved a total of Rs. 1,80,000 under different investment instruments eligible for exemption u/s 80C and Rs. 25,000 was paid by him on 5th January, 2013 towards his health insurance policy. Find his tax liability for AY2013-14.

Which of the following statement(s) about Benami Transaction is/are correct?

Exhibit:

______________ is the final stage in the process of 'Money Laundering' at the International Level.

Which of the following statement(s) about Islamic Banking is/are correct?

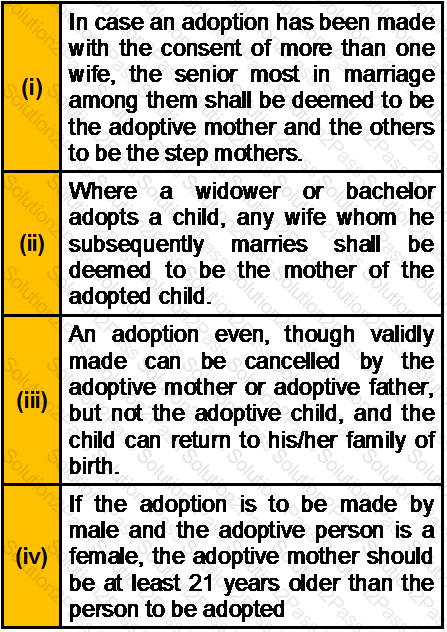

As per Hindu Adoptions and Maintenance Act, 1956, which of the following statement(s) is/are correct?

X owns a piece of land situated in Varanasi (Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-).On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.5 lakh. X does not dispute it. [CII-12-13: 852,11-12: 785,10-11:711]

Mr. Kadam is entitled to a salary of Rs. 25,000 per month. He is given an option by his employer either to take house rent allowance or a rent free accommodation which is owned by the company. The HRA amount payable was Rs. 5,000 per month. The rent for the hired accommodation was Rs. 6,000 per month at New Delhi. Advice Mr. Kadam whether it would be beneficial for him to avail HRA or Rent Free Accommodation. Give your advice on the basis of “Net Take Home Cash benefits”.

The benefits of exemption of one self occupied house is available to

Deduction under section 80RRB is allowed to the extent of:

Scholarship received by a student was Rs. 2,000 per month. He spends Rs. 15,000 for meeting the cost of education during the year. The treatment for the balance amount Rs. 9,000 is:

The income of any university or other educational institution existing solely for educational purposes and not for the purposes of profit is exempt under clause (iiiad) of Section 10(23C) if the aggregate annual receipts’ of such university or educational institution do not exceed

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be __________.