CTEP AAFM Chartered Trust & Estate Planner® (CTEP®) Certification Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CTEP Chartered Trust & Estate Planner® (CTEP®) Certification Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Mukul purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-. Please calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

The Inland Revenue Authority of Singapore (IRAS) was established on ___________, by legislation as a statutory board under the Ministry of Finance.

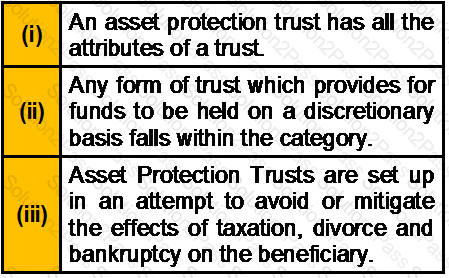

Which of the following statements about Asset Protection trust is/are correct?

There are two parties to Power of Attorney, namely, Donor and Donee.

In Singapore, the deadline for filing personal tax return is _________.

In US for year 2013, Qualifying child relief is ___________ per child and Handicapped child relief is _____________ per child.

The current GST in UK is_____________.

According to Muslim Law, the age of majority is ______________

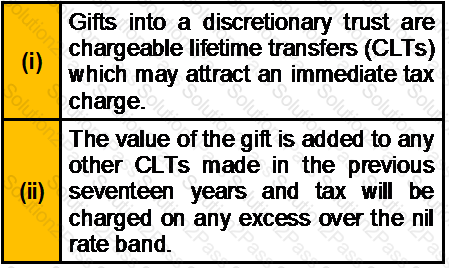

Which of the following statement(s) about Chargeable Lifetime Transfers is/are correct?

For 2013, the maximum EITC is __________ for tax payers with one qualifying child.

Which of the following statement(s) about Will is/are correct?

In US the exemption amount for Alternative Minimum Tax in the case of estate or trust is _________. The same in the case of married individuals filing a joint return and surviving spouses is ______________.

In UK, if the donor survives for _______ years after making the gift, it becomes exempt from Inheritance Taxes.

The Client wants to find out the value of estate that his spouse and each of their children would receive assuming he dies today.

A Deposit of a Will is ____________________

During the PY 2009-10 a Kariwala Charitable Trust earned an income of Rs. 7 lakh out of which Rs.5 lakh was received during the PY 2009-10 and the balance Rs. 2 lakh was received during the PY 2011-2012.In order to claim full exemption of Rs. 7 lakh in the PY 2009-10:

A Family consists of karta, his wife, four sons and their wives and children and their income is Rs. 1000000.If by family arrangement income and yield on property is settled on karta, his wife, sons & daughter in law than tax liability would be

__________________ is used to show what Inheritance tax is due when someone has died and _________________ is used to show what Inheritance tax is due from lifetime events.

Which of the following are the rights of the beneficiaries?

Where a transfer of value is from a UK-domiciled spouse to a non-UK domiciled spouse, then the exempt transfer is limited to ____________