CWM_LEVEL_2 AAFM Chartered Wealth Manager (CWM) Certification Level II Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Section A (1 Mark)

In “Teenage Years” life stage, one learns about ___________

Section A (1 Mark)

Stock broker’s human capital is _________ to stock market as compared to a school teacher

Section B (2 Mark)

Lokesh purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-.As a CWM® calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

Section B (2 Mark)

Which one of the following statements is/are correct?

Section A (1 Mark)

Decision horizon is __________

Section A (1 Mark)

A swap that involves the exchange of one set of interest payments for another set of interest payments is called a(n)

Section B (2 Mark)

Which of the following statements are true?

Section B (2 Mark)

If Raman Industries Ltd. share price is Rs.50 and its current dividend is Rs.5/- per share which is growing at 7 percent rate per year, determine its required return?

Section A (1 Mark)

To ensure compliance under this method of lending, the current ratio of the concern should not be less that _________

Section A (1 Mark)

The fact that a consumer feels a strong moral and ethical responsibility to repay a loan on time refers to the ______________________ of that individual.

Section A (1 Mark)

Another name for open-end credit is:

Section C (4 Mark)

Read the senario and answer to the question.

If Saxena’s debentures have a balance maturity period of 15 years &the coupons are payable annually, what should be the market valuation of these debentures, if risk free interest rate is taken as the required IRR?

Section B (2 Mark)

Manav wishes to calculate that if he wants to withdraw Rs. 2,000/- every Quarter at start of the month for 6 years, then how much amount is required to be in his account today. He wants to start this withdrawal immediately and ROI is 9 % per annum compounded quarterly.

Section C (4 Mark)

A 14% semiannual-pay coupon bond has six years to maturity. The bond is currently trading at par. Using a 25 basis point change in yield, the effective duration of the bond is closest to:

Section C (4 Mark)

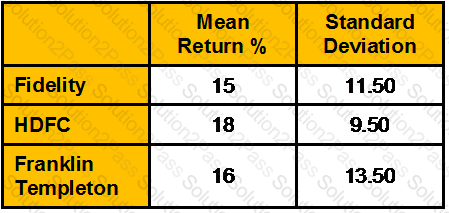

Data on following mutual funds is given below:

Risk free return is 8%. Calculate Sharpe measure.

Section B (2 Mark)

A bank recently loaned you Rs15,000 to buy a car. The loan is for five years (60 months) and is fully amortized. The nominal rate on the loan is 12 percent, and payments are made at the end of each month. What will be the remaining balance on the loan after you make the 30th payment?

Section C (4 Mark)

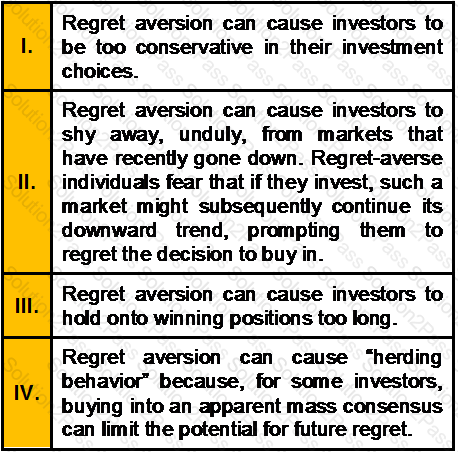

Which of the following statements is/are correct?

Section C (4 Mark)

Read the senario and answer to the question.

Saxena wants to know his income tax liability for FY 2007–08 without taking into consideration any interest income from NSC. Calculate the same including surcharge and Educational Cess.

Section C (4 Mark)

Read the senario and answer to the question.

Sajan and Jennifer want to arrange for the funds to meet marriage expenses of their children. They plan the wedding of Mark after 23 years from now and that of Stephanie after 25 years from now. To accumulate the funds for marriage, you advise to start a monthly Systematic investment Plan (SIP) immediately in Equity scheme of a mutual fund. Such SIP will continue for the next 15 years. You further advise to hold the investment in equity shares till Stephanie’s marriage to meet the wedding expenses. After meeting the expenses of Marks’ marriage, the balance fund in the quity scheme are allowed to appreciate to meet the differential expenses of Stephanie’s marriage. The amount of SIP comes to __________.

Section C (4 Mark)

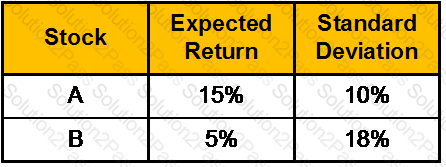

The expected return and standard deviations of stock A & B are:

Amit buys Rs.20,000 of Stock A and sells short Rs.10,000 of Stock B using all the Proceeds to buy more or Stock A. The correlation Between the two securities is .35. What are the expected return & standard deviation of Amit’s portfolio?

Section C (4 Mark)

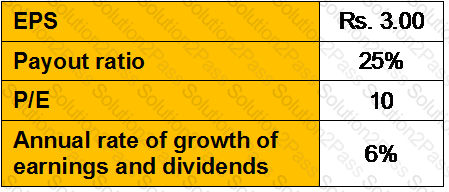

You know the following concerning a common stock:

If you want to earn 10 percent, should you buy this stock? What is the maximum price you should be willing to pay for the stock?

Section B (2 Mark)

Which of the following two outcomes is an example of Status Quo Bias:

Section B (2 Mark)

Mr.Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20000 by his employers out of which he spends Rs.18000 for shifting his family and personal effects. Which of the following is true?

Section A (1 Mark)

CRM is considered as a:

Section B (2 Mark)

____________compares the price charged for property or services transferred in a controlled transaction to the price charged for property or services transferred in a comparable uncontrolled transaction in comparable circumstances

Section C (4 Mark)

Today is 14th February 2008 Mr. Mehta is 29 years old and is salaried. His wife, Nisha is a housewife. He has started depositing Rs. 5,000 at the beginning of each year in an education fund for his new born child.

He is earning a monthly income of Rs. 53000. His expenses are Rs. 27000 p.m. He takes the help of a wealth manager to plan his investments. He has taken housing loan and outstanding amount is Rs. 1000000 and outstanding amount on car loan is Rs. 300000.He is paying an EMI of Rs. 9547 on housing loan and an EMI of Rs. 2600 on car loan at the end of each year.

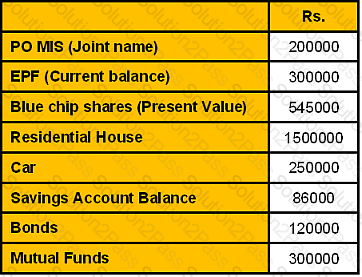

His other investments are as follows:

Mr. Mehta has joined the services after completing his education five years back. But during the previous year he works for 230 days.

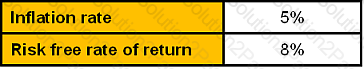

Assumptions

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Royalities are:

Section A (1 Mark)

Debt investments in real estate, such as mortgages or deeds of trust, are called income property investments.

Section A (1 Mark)

In which year can the subscriber to a PPF account take the first loan from the opening of the account?

Section B (2 Mark)

Last year, Owen Technologies reported negative net cash flow and negative free cash flow. However, its cash on the balance sheet increased. Which of the following could explain these changes in its cash position?

Section A (1 Mark)

Short-term to medium-term loans repayable in two or more consecutive payments are known as:

Section A (1 Mark)

The CDO structures which are used by asset management companies, insurance companies and other investment shops with the intent of exploiting a mismatch between the yield of underlying securities and lower cost of servicing the CDO structures are called___________.

Section A (1 Mark)

A firm in an industry that is very sensitive to the business cycle will likely have a stock beta ___________.

Section B (2 Mark)

If the currency of your country is depreciating, the result should be to ______ exports and to _______ imports.

Section A (1 Mark)

After originally investing Rs10,000 and selling your investment for Rs 12,000, you reinvest the total amount and tell yourself that you will not be concerned if you lose Rs 2,000 in this new investment. You are likely demonstrating which type of judgment error?

Section A (1 Mark)

Your client Mr. Singhania expressed his intention to write his will in his own handwriting such a will which is wholly in the handwriting of the testator is renown as:

Section B (2 Mark)

Mr. Dinesh is aged 35 years and has a wife aged 30 years old and two small children. His parents are also dependent on him and has a house against which he has taken a housing loan. What is the most important insurance cover required by him at this stage?

Section B (2 Mark)

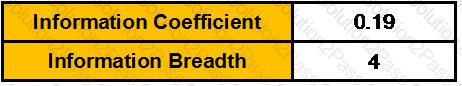

Calculate the Information Ratio from the following data:

Section A (1 Mark)

Why is the price/yield profile of a callable bond less convex than that of an otherwise identical option-free bond? The price:

Section A (1 Mark)

Limited growth prospects are indicated by

Section B (2 Mark)

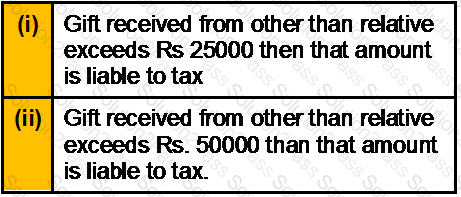

Which one of the above statements is/are incorrect?

Section B (2 Mark)

Total income of an individual including long-term capital gain of Rs. 50,000/- is Rs.1,60,000/-, the tax on total income for the assessment year 2012-13 shall be: CII-12-13: 852,11-12: 785,10-11:711]

Section B (2 Mark)

The following is not a capital receipt

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable income is:

• $ 81250 in SGD and he is a Singapore citizen

• £ 67158p.a (only employment)and he is a UK citizen

Section A (1 Mark)

An option which gives the holder the right to sell a stock at a specified price at some time in the future is called a

Section A (1 Mark)

A market timing approach that increases the proportion of funds in stocks when the stock market is expected to be rising, and increases cash when the stock market is expected to be falling is a:

Section A (1 Mark)

Pure premium and Loss Ratio methods are two methods to determine

Section A (1 Mark)

A muslim gentleman can leave his will, bequeathing all his properties to someone often than his legal heirs to the extent of…………….

Section A (1 Mark)

The________________ deals with the double-edged enigma of why individuals like dividends (in developed country where dividends are taxable) and why this method of income distribution persists in light of quite burdensome double taxation.

Section A (1 Mark)

……………………is a gift in the form of a single transfer to the same person of several things of which one is and the others are not burdened by an obligation, the done can take nothing by the gift unless he accepts if fully.

Section B (2 Mark)

Which of the following statement is/are correct?

Section C (4 Mark)

Mr. XYZ is bullish on Nifty when it is at 4191.10. He sells a Put option with a strike price of Rs. 4100 at a premium of Rs. 170.50 expiring on 31st July. If the Nifty index stays above 4100, he will gain the amount of premium as the Put buyer won’t exercise his option. In case the Nifty falls below 4100, Put buyer will exercise the option and the Mr. XYZ will start losing money. If the Nifty falls below 3929.50, which is the breakeven point, Mr. XYZ will lose the premium and more depending on the extent of the fall in Nifty.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3400

• If Nifty closes at 4800

Section A (1 Mark)

Which one of the following has not caused the huge growth in hedge funds and private equity?

Section B (2 Mark)

Asset allocation policy

Section B (2 Mark)

Reliable ltd. has current earnings per share of Rs. 5. Assume a dividend – payout ratio of 50 percent. Earnings grow at a rate of 9 percent per year. If the required rate of return is 14 percent, what is its current value?

Section A (1 Mark)

The slope of the CML is the:

Section B (2 Mark)

Calculate the duration of a 10 year annual annuity that has a yield of 7%.

Section B (2 Mark)

Suppose that Chicken Express, Inc. has a ROA of 7% and pays a 6% coupon on its debt. Chicken Express has a capital structure that is 70% equity and 30% debt. Relative to a firm that is 100% equity-financed, Chicken Express’s Net Profit will be ________ and its ROE will be ________.

Section A (1 Mark)

Following is/ are the component(s) of Personal Financial Statements

Section B (2 Mark)

Under the Payment of Gratuity Act, 1972, where the employee employed in a seasonal establishment is deemed to be in continuous service for such period if he actually worked for not less than __________% of the number of days on which the such establishment was in operation during such period.