CWM_LEVEL_2 AAFM Chartered Wealth Manager (CWM) Certification Level II Examination Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Section A (1 Mark)

A European put option can be exercised

Section A (1 Mark)

While matching orders for equity trading in NSE, which one of the following gets precedence over all the others?

Section A (1 Mark)

The profits of a controlled foreign company which are apportioned to a UK company are charged to corporation tax at the UK company's average rate of tax.

Section A (1 Mark)

Marketing relationships are:

Section B (2 Mark)

Mr. A purchased certain shares of a company during the financial year 1987-88 for a sum of Rs.1,50,000/-. A sold the shares during the financial year 2011-12 for Rs.8,10,000/- when the market is at all time high. Calculate the amount of capital gains. [CII-12-13: 852,11-12: 785,10-11:711]

Section B (2 Mark)

Differences between hedge funds and mutual funds are that

Section B (2 Mark)

How much should you pay for a share of stock that offers a constant growth rate of 10%, requires a 16% rate of return, and is expected to sell for Rs50 one year from now?

Section C (4 Mark)

The following parameters are available for four mutual funds:

Calculate Treynor’s performance index for each of the funds on the assumption that r=6% where r stands for the risk – free interest rate.

Section B (2 Mark)

In regard to moving averages, it is considered to be a ____________ signal when market price breaks through the moving average from ____________.

Section C (4 Mark)

Saurabh contributes Rs. 10,000 every year starting from the end of the 5th year from today till the end of 12th year in the account that gives a ROI of 7.75% p.a. compounded half yearly. Calculate the Present Value of his contribution today.

Section B (2 Mark)

Rakesh owes Rs. 10000 to Haresh who transfers the debt amount to Chirag. Haresh then demands the same from Rakesh, who does not have a notice of the transfer as per section 131 but still pays to Haresh. This payment is invalid &Chirag can sue Rakesh for the debt

Section A (1 Mark)

In “CAMPARI” Model, R stands for:

Section A (1 Mark)

Supporting customers through the process of selecting, purchasing, and maintaining a product or service is known as:

Section A (1 Mark)

The "lockup" problem involved in rebalancing refers to the:

Section B (2 Mark)

In the maturity stage of the industry life cycle

Section A (1 Mark)

Which of the following statements regarding debit and credit card liability is correct?

Section B (2 Mark)

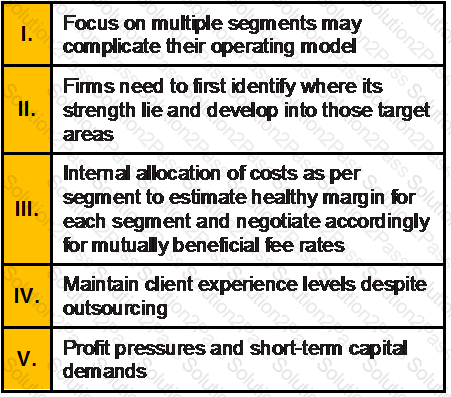

Which of the following is/are the Potential Challenges for wealth management players in India:

Section B (2 Mark)

Which of the following is a reasonable assumption to make about the understanding of a client on the Wealth planning Process?

Section B (2 Mark)

The current market price of a share of CAT stock is Rs76. If a call option on this stock has a strike price of Rs76, the call

Section A (1 Mark)

Customer service facilitation includes EXCEPT:

Section B (2 Mark)

The term “permanent establishment” includes especially:

Section A (1 Mark)

HNWI stands for

Section A (1 Mark)

A dividend paid by a company which is a resident of India to a resident of the United Kingdom may also be taxed in India but the Indian tax so charged shall not exceed __________per cent of the gross amount of the dividend.

Section C (4 Mark)

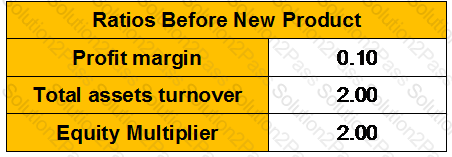

You are considering adding a new product to your firm's existing product line. It should cause a 15 percent increase in your profit margin (i.e., new PM = old PM x 1.15), but it will also require a 50 percent increase in total assets (i.e., new TA = old TA x 1.5). You expect to finance this asset growth entirely by debt. If the following ratios were computed before the change, what will be the new ROE if the new product is added and sales remain constant?

Section C (4 Mark)

Saurabh decided to invest Rs.1,00,000/- in a portfolio of equities and debt mutual funds. He invests Rs. 60,000/– in equities, and 40,000/– in debt mutual fund.

A year later, Saurabh’s portfolio worth reached to Rs. 1,35,000/– (90,000/– equity, 45,000/– debt mutual fund). During the year Rs. 2,500/– cash dividends was received on the equity and Rs. 1,000/– dividend was received on debt mutual fund. Find out Saurabh’s return on equity fund & debt mutual fund for the year?

Section C (4 Mark)

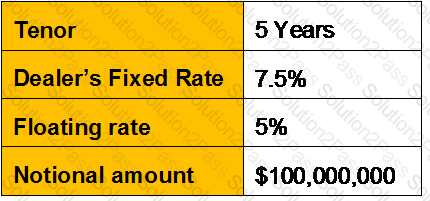

Assume the following;

With this agreement, every 6 months, the transfer of funds takes place between fixed rate payer and floating rate payer.

What would Net Cash flows after 6-months from the initiation date?

Section A (1 Mark)

The risk that occurs when the index used for determination of interest earned on the CDO trust collateral is different from the index used to calculate the interest to be paid on the CDO trust is known as______________.

Section A (1 Mark)

An appealing feature of options on futures contracts is that:

Section C (4 Mark)

Mr. A bought XYZ Ltd. For Rs. 3850 and simultaneously sells a call option at an strike price of Rs. 4000. Which means Mr. A does not think that the price of XYZ Ltd. will rise above Rs. 4000. However, incase it rises above Rs. 4000, Mr. A does not mind getting exercised at that price and exiting the stock at Rs. 4000 (Target Sell Price = 3.90% return on the stock purchase price). Mr. A receives a premium of Rs. 80 for selling the call. Thus net outflow to Mr. A is (Rs. 3850 – Rs. 80) = Rs. 3770. He reduces the cost of buying the stock by this strategy.

What would be the Net Payoff of the Strategy?

• If XYZ closes at 3350

• If XYZ closes at 4800

Section B (2 Mark)

Payment of Gratuity Act 1972 is applicable to

Section A (1 Mark)

Manoj owns five hundred shares of ABC Ltd. Around budget time, he gets uncomfortable with the price movements. Which of the following will give him the hedge he desires (assuming that one futures contract = 100 shares) ?

Section A (1 Mark)

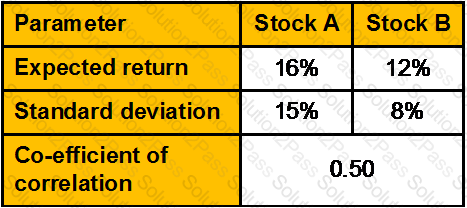

From the following data calculate the expected rate of return of a portfolio in which A and B has weights equally:

Section A (1 Mark)

Which of the following is not true in respect of CIBIL?

Section A (1 Mark)

The use of P/E ratios to select stocks suggests that

Section C (4 Mark)

Read the senario and answer to the question.

Portfolio A had a return of 12% in the previous year, while the market had an average return of 10%. The standard deviation of the portfolio was calculated to be 20%, while the standard deviation of the market was 15% over the same time period. If the correlation between the portfolio and the market is 0.8, what is the Beta of the portfolio A?

Section A (1 Mark)

In case of non-resident, who is carrying on shipping business, his Indian income shall be presumed to be:

Section A (1 Mark)

Which of the following is an effective strategy in times of falling interest rates?

Section B (2 Mark)

Expenses are 10% of the gross (office) premium. Pure premium is Rs. 200. Calculate office premium.

Section A (1 Mark)

The covariance of the market returns with the stocks returns is 0.007. The standard deviation of the market is 7% and standard deviation of stock’s return is 10%. What is the correlation coefficient between stocks and market returns?

Section B (2 Mark)

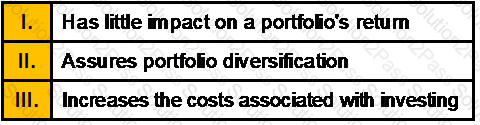

An Asset allocation policy

Section A (1 Mark)

The price that the buyer of a call option pays for the underlying asset if she executes her option is called the

Section C (4 Mark)

Mr. Raman Gehlot, aged 55 years, is owner of midsized business firm. His family consists of his wife Anupama, aged 55, son Nishant aged 29 and daughter Nivedita aged 27. His wife is a housewife and social worker. Both of their children are happily married and well settled. The couple anticipates their life expectancy to be 75 years each.

The gross annual income of Raman for the previous year 2010–11 is expected to be Rs. 9,60,000. The couples’ household expenses are estimated to be Rs. 4,90,000 p.a. Taking into account incidental expenses of another Rs. 85,000 the net expenses of the family are estimated to be Rs. 5,75,000 for the previous year 2010–11. Thus they achieved a net surplus of Rs. 3,85,000 during the year. Raman has a net saving of Rs. 12,00,000 which he would like to invest for his post retirement purposes at the beginning of the year.

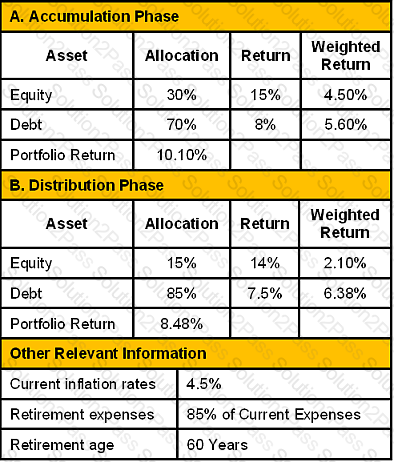

Currently Raman has approximately 5 years left for retirement and thus he is not very aggressive in his investments. The returns of his portfolio based on asset allocation during the accumulation and distribution phase are calculated as below:

Section A (1 Mark)

A person saves Rs. 5,000/- every quarter for 9 years @ 15 % per annum compounded Quarterly. What amount would he be having after 9 years ?

Section C (4 Mark)

Ms. Sonali Briganza is 22 years old. She is currently earning a salary of Rs.5,00,000/- per annum and saves 20% of her salary every year. If her salary increases by 10% every year and she is able to get a return of 11% p.a. compounded annually throughout her investment horizon what would be the corpus of funds available at her age 58.

Section A (1 Mark)

In …………………without delivery possession of the mortgaged property, there mortgager binds himself personally to pay the mortgage money

Section A (1 Mark)

_____________ is defined as the transfer of services to private enterprise in US.

Section A (1 Mark)

To try to develop a property’s competitive edge, an investor should consider which of the following?

Section A (1 Mark)

Income accruing in Sri Lanka and received there is taxable in India in case of

Section B (2 Mark)

Which of the following factors affect the price of a stock option?

Section B (2 Mark)

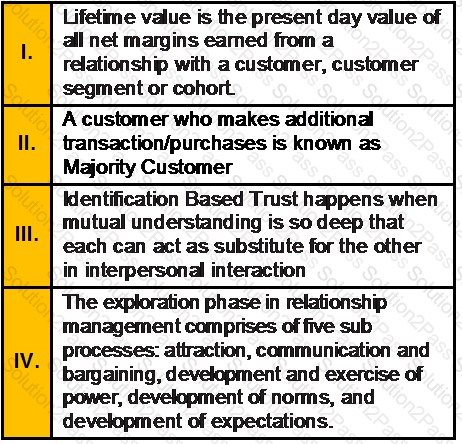

Which of the following statements is/are correct?

Section B (2 Mark)

As a result of a lawsuit, Catherine was awarded $300,000 for compensatory damages and $400,000 for punitive damages. What is the taxable income resulting from this suit?

Section B (2 Mark)

From the following data in respect to the property price, calculate the value of the property for your client Mr. Nitin Sharma, as per the capitalization rate.

Section B (2 Mark)

You purchase one ILM 70 call option for a premium of Rs6. Ignoring transaction costs, the break-even price of the position is

Section A (1 Mark)

In marine insurance claims, insurable interest must shown to exist at the time of

Section A (1 Mark)

____________is the reasonably probable and legal use of vacant land or an improved property that is physically possible, legally permissible, appropriately supported, financially feasible, and that results in the highest value.

Section B (2 Mark)

Consider a one-year maturity call option and a one-year put option on the same stock, both with striking price Rs45. If the risk-free rate is 4%, the stock price is Rs48, and the put sells for Rs1.50, what should be the price of the call?

Section C (4 Mark)

National City Corporation, a bank holding company, reported earnings per share of Rs2.40 in 1993, and paid dividends per share of Rs1.06. The earnings had grown 7.5% a year over the prior five years, and were expected to grow 6% a year in the long term (starting in 1994). The stock had a beta of 1.05 and traded for ten times earnings. The treasury bond rate was 7%.

Estimate the P/E Ratio for National City Corporation and the long term growth rate that is implied in the firm's current P/E ratio.

Section C (4 Mark)

Read the senario and answer to the question.

Harish wants to go abroad on a family vacation tour in January next year. A tour operator is offering him a package in which he has to pay only Rs. 20,000 on 1st January, 2011 which is 10% upfront amount, while the remaining amount is to be repaid in 36 EMIs of Rs. 7,500 each, first EMI payable on 1st February, 2011. Harish wants to know the annual effective rate of interest which he may incur in subscribing to this offer.

Section B (2 Mark)

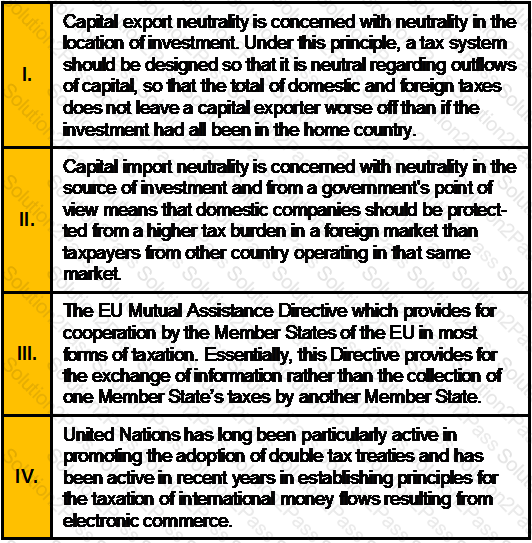

Which of the following statements with respect to International Taxation Structure is/are correct?

Section B (2 Mark)

Miss Femina aged 17, is married to Mr. Masculine. Her mother alone is alive income by way of interest on loans, of Miss Femina will be:-