CTP AFP Certified Treasury Professional Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AFP CTP Certified Treasury Professional certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A company determines that no combination of risk control or financing techniques will produce an adequate, risk-adjusted rate of return on manufacturing a new product. It decides to discontinue the product line. This is an example of:

For a retirement plan to be qualified under ERISA, employer and employee contributions must be:

An internal auditor discovers that employees can enter and approve their own wire transfers. This practice violates what internal control?

A company with a relatively poor credit rating borrows most of its funds with short maturities. They may want to change its exposure to interest rates to more correctly reflect the long-term nature of the projects it is funding. Or, they may believe that long-term interest rates are going to rise, causing it to seek protection against the impact of higher interest rates on its balance sheet. Which of the following would be a solution?

The treasurer of a corporation is negotiating with one of his/her suppliers to allow the corporation to have 30 days to pay the supplier’s invoices. The treasurer is arranging:

The CFO of a growing company has decided that it would be prudent to insure the company against potential loss from dishonest acts of employees. The treasurer has been given the responsibility of selecting and negotiating the type and amount of protection required. After analyzing the overall risk to the company, the treasurer decides that the greatest exposure to this type of risk is within the cash management function of the company. The MOST appropriate type of protection would be:

A company enters into a cash flow hedge to offset fluctuations in the value of foreign currency transactions occurring in two years. How should the company record the gains and/or losses on the cash flow hedge in the current year?

The rate of interest commercial banks charge their best credit rated customers is called the:

One of the KEY risks associated with a company’s use of financial institutions is the possibility that:

An accounts payable manager has been mandated to accept all trade discount opportunities with an effective cost of discount above 25%. An invoice has been presented and approved for payment with terms of 3/5, net 30 days. What is the difference between the effective cost of discount offered, and the 25% rate set by the company?

Establishing the authority to open bank accounts is the responsibility of:

Which of the following statements is typically true about a net settlement system?

A treasurer is monitoring the yield curve through a service provider (like Reuters) and notices that it is moving from downward sloping to upward sloping. Based on this information, the treasurer should consider:

Banks often control information flow, records and assets, therefore it is critical that banks have:

A company invests all of its short-term excess cash in T-bills on a daily basis. To prevent delays in processing its outgoing wire transfers, the company may ask its cash management bank to establish a:

If the Federal Reserve Board increased the discount rate, you would expect:

The key parties involved in a disaster recovery plan are generally classified as internal resources or external counterparties. When evaluating the risks of both parties, which of the following can be assumed?

Which of the following could be considered a weakness of a forecast derived by regression analysis?

A large U.S. company is planning to fund its Canadian subsidiary. Currently, the Canadian dollar is trading at CAD 1.25 per U.S. dollar, and the U.S. dollar is expected to depreciate in the near term. To manage this FX exposure, what technique should the company implement?

In order to increase liquidity, ABC Motor Company bundled its customers’ installment payments and resold them to other investors. This is known as:

A multinational company owns a United Kingdom subsidiary that has total assets equal to £1 million and intercompany loans due to the parent company equal to $1 million. It would like to undertake a balance sheet hedge of the U.K. subsidiary’s GBP liability because it expects a depreciation of the pound. Given these circumstances, which of the following actions would be appropriate?

A company is interested in lowering its overall banking costs, managing netting, pooling, re-invoicing, and centralizing FX exposure at headquarters. Which of the following options will accomplish this?

The combination of difference in condition (DIC) insurance and umbrella insurance:

What is one chief advantage of issuing short-term securities in book-entry form?

A large retailer is preparing to accept credit cards and anticipates monthly credit card sales of $1,000,000. If the terms with the acquiring bank include bundled allocated fees of 6% and the retailer wishes to delay fee payment as long as possible, what should the retailer do?

JMW Company processes its consumer payments using a lockbox provider. On average 35% of its remittance advices contain encoding errors. JMW Company’s cost for the lockbox provider to process these payments will be least impacted if it uses:

A small regional bank is losing market share in fiduciary services and the CEO has decided to scale back the trust department. Which of the following is considered a core service of a trust department?

XYZ Inc. is a publicly traded company with revenues of $1B and an operating profit of 7.5%. The treasury organization consists of a treasurer and an assistant treasurer. The assistant treasurer is responsible for the creation and approval of all payments. The treasurer is responsible for compilation of the financial statements. Under Section 404 of the Sarbanes-Oxley Act, what should be viewed as a concern?

Which of the following is true of return on investment (ROI)?

A company has six fraudulent checks clear its primary disbursement account for a total of $7,652. The bank agrees to split the loss with the company to maintain a good relationship. As a condition of sharing the expense, the bank requires the company to establish positive pay on its disbursement accounts or have the company absorb the losses on future fraudulent payments.

What type of risk financing technique is the bank using?

What do MOST companies try to maintain due to the signaling effect and clientele effect?

Treasury management systems and ERP systems allow companies to do all of the following EXCEPT:

Money market funds are able to obtain very competitive trading terms because:

Which of the following is a characteristic of MOST mutual funds?

Company XYZ is conservative when investing in their short-term portfolio. XYZ is looking to add the following money market instruments in their own country: a reverse re-purchase agreement, a floating-rate note, and a negotiable certificate of deposit. What types of investment risks are associated with these instruments?

Two months after a government overthrow, the new Minister of Industry and Culture took over the country’s largest steel company and compensated the owners at 50% of book value. What is the government’s action called?

Securities sold by companies in an initial public offering (IPO) arE.

A manager has prepared an analysis of five investment alternatives. Prior to selecting which alternative to invest funds in, the manager calculated the anticipated return for all options. The manager is only going to invest in one alternative. The four investments that are not chosen are:

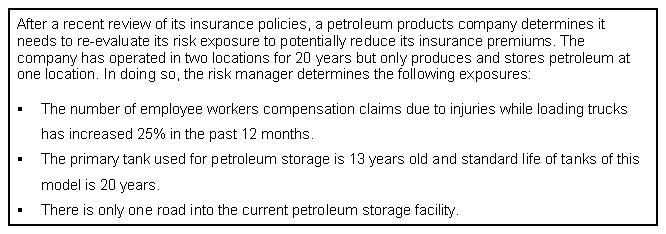

Given the above information,

if the risk manager adds a tank at its second facility, what loss control technique is being used?

Recently LEW Utilities, a local utility company, began using the company processing center method to process customer payments. Prior to this change, it used its local depository bank’s lockbox to process the payments. The PRIMARY advantage of the new method is to: