CTP AFP Certified Treasury Professional Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AFP CTP Certified Treasury Professional certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

After several internal discussions about treasury management systems (TMSes), ABC Company has determined that it has no need for customization but that it does want a backup for high priority capabilities. The company wants to reduce its IT costs and resources but still have IT support with in-depth knowledge of the solutions available. These parameters will MOST LIKELY result in what kind of TMS?

A-Plus Company has made arrangements for a new insurance broker to provide products to its employees. Historically, A-Plus Company’s employees made insurance payments via payroll deduction, but the new broker will be collecting payments from employees directly. What will the broker MOST LIKELY use to minimize collection float?

ABC Ltd. uses a third party lockbox provider to collect and clear its paper receivables. A customer disputes the price charged for a binding machine and issues a check to ABC Ltd. for 50% of the balance due, noting “paid in full” on the face of the check. The third party provider does not bring the check to ABC's attention prior to depositing it. Which regulation allows ABC to attempt to collect the remaining balance?

EML Inc., which has $600 million in outstanding debt, is preparing to issue commercial paper in excess of $100 million within the next six months. The new assistant treasurer has recently spent time getting to know the issuing and paying agent, the rating agency analyst, and the legal counsel, and has been following the financial markets. What is this is an example of?

An art history museum has recently finished renovating its new location. Before the move, the treasurer considers purchasing additional insurance to protect the art during transit. What form of additional insurance should the treasurer choose?

When a company announces a significant and unexpected dividend increase, it signals to the market that management expects:

A retail brokerage firm is MOST like which one of the following types of financial institutions?

A company in the market to purchase a treasury management system (TMS) has issued a request for proposal to evaluate various vendors. One of the evaluation factors focuses on the long-term viability of the vendor. The company may have to choose between an untested new vendor with a superior product and an established vendor with an incomplete product suite. This dimension of the RFP is measuring what type of risk?

A company has six fraudulent checks clear its primary disbursement account for a total of $7,652. The bank agrees to split the loss with the company to maintain a good relationship. As a condition of sharing the expense, the bank requires the company to establish positive pay on its disbursement accounts or have the company absorb the losses on future fraudulent payments.

If the company determines that positive pay is too expensive and decides NOT to implement it, what type of risk financing technique is the company using?

A small for-profit, start-up company is designing a retirement plan with the goal of minimizing costs and operating income volatility while providing a qualified retirement savings vehicle. Which of the following would be the BEST choice?

A treasury manager at a multinational manufacturing corporation assigned a team of analysts to re-engineer the company’s FX exposure management program. Which of the following alternatives would BEST accomplish this objective?

An analyst is performing a lease versus buy analysis on a corporate jet. In the evaluation, a cost is relevant if it is:

ABC Company, a leading provider of office supplies, has successfully implemented EDI based on a request from one of its customers. ABC will not only benefit from the strategic alliance that will result, but as more of ABC’s customers adopt the program, ABC will also experience a positive impact on its:

Which of the following is NOT true for both bankers’ acceptances and trade acceptances?

A bank is evaluating the credit risk for a company seeking to optimize costs and originate a high volume of outgoing ACH payments. What is the BEST provision the bank should establish to control its credit exposure?

Which of the following would be considered insurance risk management services?

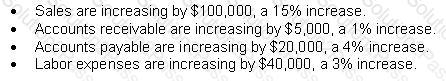

A company is experiencing the following long-term trend on a month-over-month basis:

With all other income, expenses, long-term assets and liabilities remaining stable, this trend would MOST LIKELY prompt what action by the company?

A dealer is selling securities to a client. What is the yield/price at which the dealer will sell?

Kensley Biscuit Company Ltd. decides to invest £125,000 in new packaging equipment to help it keep up with increased demand. As a result of this investment, the company’s annual profit improves by £11,763. If Kensley’s cost of capital is 8.25% and its corporate tax rate is 42%, what is its residual income (RI) from the investment?

A company is evaluating its employee healthcare expense and payroll applications. If the company wishes to provide maximum convenience to its employees, which payment method is the BEST choice?

A bank employee programs an internal payment system to transfer half a cent of each transaction to her personal bank account. What type of risk does this behavior illustrate?

Which of the following is NOT one of the three goals of a disbursement system?

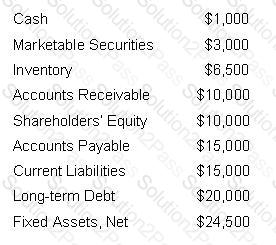

Refer to the following information about a company at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%.

What is the company's long-term debt to total capitalization ratio?

Which agency appoints the chairman and members of the Public Company Accounting Oversight Board?

Which of the following is an example of using cash forecasting for liquidity management?

Which of the following statements are true about the use of different discount rates for different types of projects?

I. Low-risk, short-term projects may be evaluated by using a short-term opportunity cost.

II. High-risk projects may be evaluated by using a discount rate that is greater than the company's normal opportunity cost.

III. A short-term investment (or borrowing) rate may be used as the company's short-term discount rate.

IV. The use of a lower discount rate for riskier projects forces riskier projects to earn higher rates of return.

The PRIMARY difference between defined benefit and defined contribution pension plans is whether the employee or the employer:

T-bill discount rate = 5.85%

T-bill face value = $100,000

Initial term = 90 days

If the U.S. Treasury was considering issuing a 91-day T-bill at the same time as this T-bill, what discount rate would cause both instruments to have the same purchase price?

Which of the following activities creates administrative costs associated with a concentration system?

Which of the following are examples of covenants in loan agreements?

I. Financial ratios

II. Corporate resolutions

III. Borrower limitations

IV. Borrower obligations

A company may choose to outsource some of its cash management processes to:

A company has transferred all treasury functions to a new office overseas. When preparing the disaster recovery plan, the treasury manager seeks to identify the mission critical functions and then determine what risks the plan should address. Which of the following risks should be the focus of the Disaster Recovery Plan?

Which of the following should NOT be a consideration when setting an optimal dividend policy?

Operational risk is defined as the risk of direct or indirect losses resulting from external events or failure of internal resources. As treasury departments maintain legacy systems that must be integrated into more complex technology, one would expect that:

Which of the following services allows a bank to match checks presented for payment against company check issuance data?

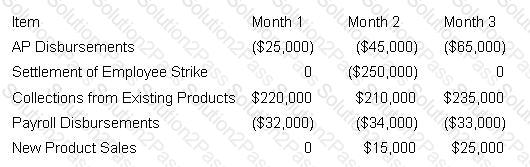

Company A anticipates the following cash inflows and outflows for the next three months:

If the company's treasurer is preparing a cash-flow projection for Month 2, and he is focusing purely on items that can be projected with a fair degree of certainty, what will the net projection be?

Which of the following types of payment transactions requires the authorization of both the initiating and the receiving party?

What type of insurance provides payments to an organization if it is unable to continue operations for some period due to an unforeseen event?

A treasurer is evaluating a project that will cost $1,000 but will return cash flows of $225, $225, $300, $750, and $750 in years 1 through 5, respectively. The company’s interest rate on its debt is 10% and its marginal cost of capital is 15%. What is the Net Present Value (NPV) of this project?

In developing treasury policies and procedures, which activity requires key controls to be in place?