CTP AFP Certified Treasury Professional Free Practice Exam Questions (2026 Updated)

Prepare effectively for your AFP CTP Certified Treasury Professional certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A company employs several short-term credit facilities at any one time to meet its liquidity needs and has consistently demonstrated the ability to service this debt as required. However, because of a temporary breach of a financial covenant of one agreement, all of the company’s credit facilities were declared in default. All the credit agreements must have had which of the following types of clause?

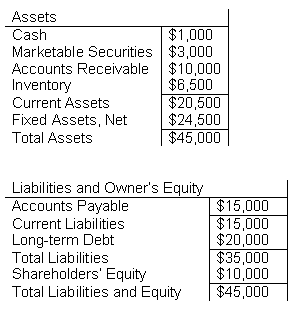

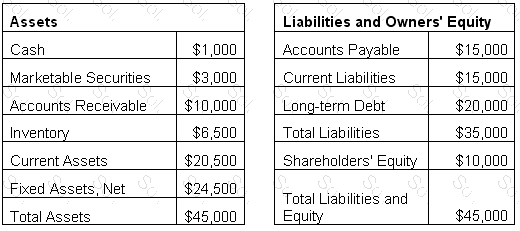

The following information about a company is at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%. The company's current ratio is:

An accounts receivable manager has been asked to accelerate cash into her company by offering trade discount terms to its customers. Her company's cost of capital is 11%. If she offers terms of 2/10, net 30 on a $50,000 invoice, what is the present value to the company if the customer accepts the discount and pays early?

MICR encoding errors may be detected by all of the following TMS modules EXCEPT:

Which of the following is normally MORE significant for a corporation?

A bank's reserve requirement on demand deposits is 10%, and its earnings credit rate is 6%. If a company uses bank services amounting to $2,600 and has an excess of $550 in earnings credit, what is the average collected balance in the account based on a 30-day month?

Capital budgeting decisions are most commonly evaluated in terms of:

A currency swap is BEST described as an:

A digital signature cannot be forged if:

In an international banking system, what role is commonly carried out by a large group of clearing banks?

Which cost benefit analysis technique uses the methodology to find where the present value of each project’s cash inflows equals the present value of each project’s outflows?

All of the following staff would be involved in the evaluation of an outsourced accounts payable solution EXCEPT:

The before-tax cost of long-term debt is 10% and the cost of equity is 12%.

The marginal tax rate is 35%. The company's weighted average cost of capital is:

Controlled disbursement notification times can be improved by which of the following?

Which method of financing would a company use to establish a wholly owned subsidiary to perform credit operations and obtain accounts receivable financing for the sale of products?

Which of the following is a disadvantage of e-commerce?

A consumer is presented with payment options from a merchant when making a purchase. The consumer does not wish to share any information that could be later used in identity theft or fraud, while the merchant requires guaranteed payments within 24 hours with no NSFs or declined payments. Which of the following options would suit both the consumer and the merchant?

When a buyer receives goods, but payment is not due to the supplier until some later date, this is defined as:

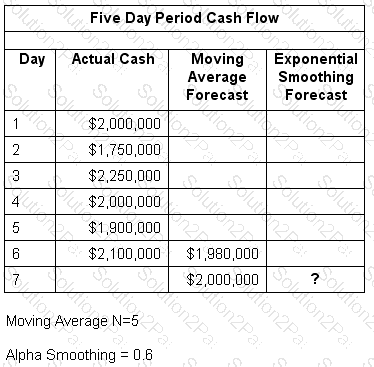

QRT Corporation uses exponential smoothing in its cash flow forecasting model. Five days are used to calculate the moving average forecast.

If the value of the smoothing constant is .60, what is the exponential smoothing forecast for day 7?

XYZ Bank would like to conduct some foreign exchange transactions with JKL Bank. JKL isn’t the most liquid and could have some credit risk. XYZ Bank should suggest which of the following in order to eliminate risk?

Company GRA has retail locations in remote areas of Montana. All banking options within the area, deemed a safe distance for making cash deposits, fail the counterparty risk assessment. Deposits would include both cash and checks. In order to achieve immediate availability of funds, what deposit method should be utilized?

Company X has asked its banking partner for a recommendation on which type of bank account would be best if it has excess funds that are not required for daily cash management. The company determined the excess cash flows by using the short-term cash forecasting distribution method. Company X will require a return on these funds. Which account is recommended?

Based on the following information, how much money will XYZ Company owe the bank for monthly service charges after the earnings credit is applied?

Average Ledger Balance $500,000

Deposit Float$10,000

Reserve Requirement10%

Earnings Credit Rate5%

Monthly Service Charges$5,000

Days in month30

An intern was hired by the Vice President of Accounts Payables to process the electronic payments that come through the bank. The intern is responsible for manually entering payee information into the system at each step of the process. The VP directed the intern to enter the information as fast as possible without mistakes to optimize the number of transactions that could be processed. Instead of manually entering information the VP should have utilized:

A North American service company has autonomous offices in different geographic regions each handling their own sales and accounts receivables deposits to local banks which primarily consist of checks. By implementing a lockbox collection system, what objective in its collection policy would it have met?

Customers of an electronic trading firm are experiencing problems with the online trading platform. The company IT department discovered that although display of market data is in the proper place, there are no tags being used to populate specific information in the necessary fields. The company is MOST LIKELY experiencing a problem with:

Which institution or accord was approved in 2009 to strengthen the regulatory capital framework for banks by focusing on minimum capital requirements, supervisory review and market discipline?

ABC Company’s Treasury department outsourced its overnight investment duties to XYZ Money Management. XYZ placed the funds received from ABC into corporate commercial paper, which has recently gone into default after numerous ratings downgrades. The investment policy of ABC Company states that all investments must be in investment grade commercial paper; however, the agreement gives XYZ the ability to make exceptions with the approval of the Treasurer of ABC Company. The Treasurer was never notified of the ratings downgrades. What role or responsibility, if any, was violated with regards to the investment policy?

An individual has just inherited several million dollars and has decided to purchase the stock of a telecommunications company to diversify his portfolio. Before purchasing shares, he would like to do some company-specific research to determine which company to select. Examples of the information the individual wishes to obtain are financial statements and disclosures, company organizational structure, code of conduct, pending litigation, and profiles of the board of directors. Who would be the BEST person to contact to obtain all this information?

The Treasury Manager of a chain of department stores wants to develop a medium-term forecast. Management plans to open two new stores, and anticipates same-store sales to increase by 15%. Which of the following items can be predicted with the highest degree of certainty?

The Treasurer for XYZ Manufacturing, Inc. recently exchanged a portion of its euro holdings into U.S. dollars to purchase gas futures contracts. This was done in anticipation of an assumed rise in gas prices due to the continued weakening of the U.S. dollar. Which of the following types of risk is being mitigated?

USA Tires, LLC is a U.S. company that manufactures a high performance tire. It has $500 million in annual domestic sales. Customer A is located 50 miles from the USA Tires warehouse. Customer A orders 1,000 high performance tires per month at a price of $50 per tire. It has credit terms of 30 days. Customer B is located 40 miles from the USA Tires warehouse. Customer B orders 1,000 high performance tires per month at a price of $60 per tire. Customer B has credit terms of 20 days. Which legislation is being violated in the scenario?

RAL Industries is a manufacturing company that currently has locations in the United States and Latin America and has just completed an acquisition of a company located in Europe. As a result of the acquisition, they have a large number of financial service providers. In an effort to reduce the number of providers and services used globally, RAL has decided to develop a formal selection process to consolidate its many global banking services. In order to reduce the amount of time the selection process takes, determine which services providers can offer, and the number of providers involved in the process, what should RAL Industries issue?

Which of the following is an example of a Eurobond?

ABC Company, a publicly held U.S. multinational, owns several manufacturing plants in Latin America as well as several ships to transport its products globally. 60% of its sales are from its euro-based subsidiaries. The company uses various derivative instruments to mitigate exposure to fluctuations in fuel prices and FX rates. The hedging deals are long-term and placed with many counterparties. ABC Company is also a net borrower and has a syndicated credit facility in place. Which of the following actions to mitigate counterparty risk would MOST benefit the company?

A treasury manager has $5 million that is not needed for 6 months. The treasury manager has decided to invest the funds in a liquid instrument, using the current portion of a 5-year AA rated corporate bond that is subject to U.S. Securities and Exchange Commission (SEC) regulations. In what market would the treasury manager purchase this investment?

Economists are forecasting a rise in gas prices within the next 3 months. Charged with the task of establishing a risk mitigation approach for the company, the CRO has determined that the company has considerable exposure to fluctuations in gas prices. In coming to this conclusion, the CRO:

Based on the following information, what is the required collected balance to cover all monthly service charges?

Deposit Float$10,000

Reserve Requirement5%

Earnings Credit Rate15%

Monthly Service Charges$6,000

Days in month30

XYZ Corporation uses ABC Bank for their lending and treasury management. In addition, the bank serves as bond trustee for XYZ Corp. If XYZ Corp. becomes distressed, this relationship could create a conflict of interest for the financial institution. What barrier prevents a financial institution from sharing confidential information between divisions?

An electronics manufacturer is attempting to protect itself from financial losses due to projected high warranty claims costs for one of its technically complex products. What kind of assessment should the company perform to determine the appropriate external insurance coverage that would protect it from the claims?