BA1 CIMA Fundamentals of Business Economics Free Practice Exam Questions (2025 Updated)

Prepare effectively for your CIMA BA1 Fundamentals of Business Economics certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Which of the following is not a source of long-term capital for a company?

Which ONE of the following financial instruments is NOT issued for long term borrowing by the issuer?

Which one of the following methods of government borrowing is most likely to be inflationary?

The sale of:

Diseconomies of scale

Lenders normally wish to offer their funds for the short term, but most borrowers prefer to borrow over the long term. Resolving this mismatch is known as:

All of the following are examples of not-for-profit organizations except one. Which ONE is the exception?

Which of the following is not a reason for a firm to issue bonds rather than ordinary shares to raise additional finance?

Identify the source of funds most appropriate for a growing company to use which wishes to borrow funds long-term to pay for initial marketing research and promotion?

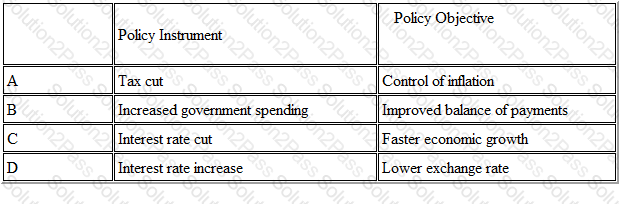

Which of the following pairings of policy instruments and policy objectives is correct?

If a country were to join a currency union (for example, the European single currency, the Euro), its businesses would experience all of the following except which one?

The real rate of interest is

Calculate the yield to an investor available from the following commercial bill:

Face value$100,000

Market price$98,500

Maturity90 days time

Which THREE of the following processes are likely to occur during a recession?

Which of the following businesses is least likely to benefit from an appreciation of Country A's currency against Country B's currency?

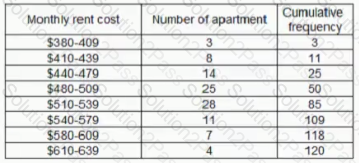

The following table provides the frequency distribution and cumulative frequencies of the cost of monthly rent for 120 apartments. What is the percentage of apartments whose monthly rent is less than $510?

If country A imposes a quota on imports from country B, what is the direct effect of the quota?

Which TWO of the following business costs are directly affected by a rise in the interest rate*? D The cost of procuring equity finance

A forward exchange contract would be appropriate (or a company that

A car dealer uses the following trend equation to estimate the number of cars sold each quarter

Y = 120 + 3t

Where y = number of cars sold each quarter and t = time period expressed in units

What is the forecasted number of cars sold in period 12. if there is an additive seasonal factor of 55?

Dividend income from shares held overseas is recorded in which of the following balance of payments components?