BA2 CIMA Fundamentals of management accounting Free Practice Exam Questions (2025 Updated)

Prepare effectively for your CIMA BA2 Fundamentals of management accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

The decision rule to use when determining the optimal production plan if there is a scarce resource is:

The following costs are incurred by a company which owns a five star hotel. Which THREE of the items would normally be classified as variable costs?

In investment appraisal, the internal rate of return is

C Ltd produces a chemical in a single process. Information for this process last month is as follows:

(a) Opening work in progress - 10000 kg valued at £10000 for direct material and £7500 for conversion costs.

(b) Materials input - 25000 kg at £1.10 per kg.

(c) Conversion costs - £17000

(d) Output during the month - 23000 kg.

(e) There were 7500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(f) Normal loss for the month was 10% of input and all losses have a scrap value of 80p per kg.

What was the value of normal loss during the month?

Within a relevant range of output, the variable cost per unit of output will:

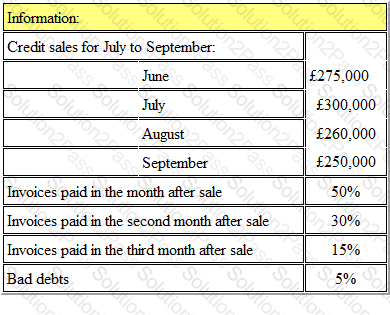

Refer to the Exhibit.

The following details have been extracted from the receivables collection records of SBC:

The amount budgeted to be received in September from credit sales is, to the nearest £000:

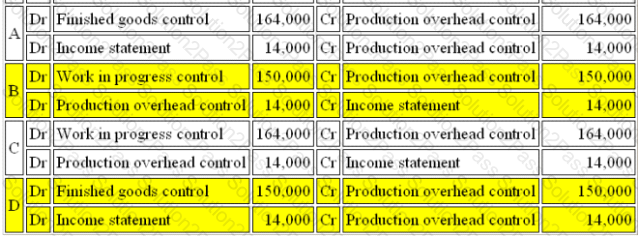

Refer to the exhibit.

WS operates an integrated accounting system. Transactions relating to production overheads for the month of May were as follows:

Indirect Material costs were $15,000

Indirect Labour Costs were $45,000

Production overheads of $58,000 were incurred during the period.

Depreciation of factory machinery amounted to $32,000.

Overheads costs absorbed by production using a standard absorption rate was $164,000 for the period.

What are the correct entries to record the absorption of production overheads for the period?

The correct set of entries to record the absorption of production overheads for the period is:

The standard labour cost for 1 component is $15.00 (5 hours at $3 per hour). Last month, 6,000 hours were worked at a cost of $17,000 to produce 1,100 components. The labour efficiency variance was:

Apex Plc has budgeted to sell 8,000 units of A in the year. Opening inventory of A is estimated at 1,000 units and the company plans to reduce inventory levels of all products by 15%.

What will be the production budget (in units) for the year?

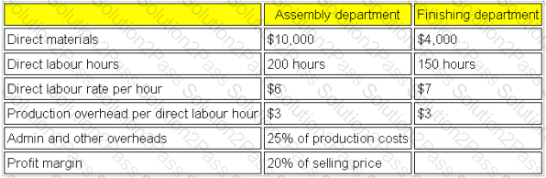

Refer to the exhibit.

The following information relates to Job 123:

The selling price to the customer for Job 123 is:

A company uses an integrated accounting system.

The accounting entries for the sale of goods on credit would bE.

A company operates an absorption costing system. Overheads are absorbed using a pre-determined absorption rate using labour hours.

Actual labour hours were 10% below budget for the period and overheads incurred were 10% above budget for the period. This would result in:

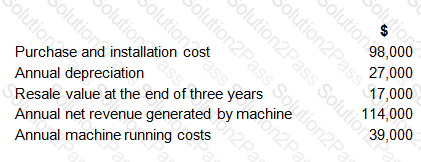

Refer to the exhibit.

A company is considering purchasing a machine that will have a useful life of three years after which time it will be sold. Relevant cash flows relating to the purchase and operation of the machine are as follows.

The annual cost of capital is 14%.

The net present value of the investment in the machine is, to the nearest whole $:

A company operates a full cost system of pricing. Production overheads are absorbed using a pre-determined absorption rate of £3.50 per machine hour. The direct production cost of product A is £15 per unit and it utilises 6 machine hours per unit. The mark-up for non-production costs is 10% of total production cost. The company wants to make a 25% return on sales revenue for all products.

The required selling price for Product A, to two decimal places, is:

The principal budget factor can be defined as:

The wages of a machine operator who is paid a guaranteed minimum wage plus a bonus for each unit produced would be described as A.

An increase in the selling price per unit, will cause the point at which the line plotted on a profit/volume (PV) graph intersects the horizontal axis to:

Refer to the Exhibit.

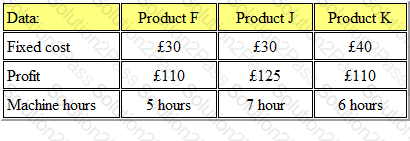

Zepher Ltd. manufactures three products, which require the same type of machine. The following fixed cost and profit per unit is available:

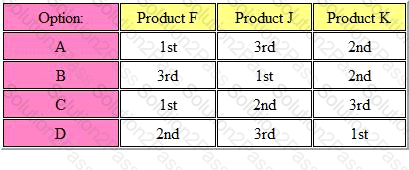

In a period in which machine hours are in short supply, which of the following options is the rank order of production?

Answer is:

Refer to the exhibit.

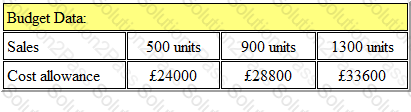

Budget information for 'Crome Ltd' is as follows:

The budgeted cost allowance for the sale of 1000 units would be:

Refer to the exhibit.

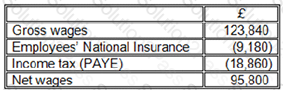

DS is manufacturing company that uses an integrated accounting system. The following payroll data is available for the month of August:

The Employers' National Insurance for the period was $13,790. An analysis of the wages is as follows:

Which of the following factors affect the budgeted cash flow:

(a) Funds from the issue of share capital

(b) Bank Interest on a long term loan

(c) Depreciation on fixed assets

(d) Bad debt write off