BA2 CIMA Fundamentals of management accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA BA2 Fundamentals of management accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

The staffing policy for a supermarket is to have one cashier station open for every forecasted 20 customers per hour. Cashiers are hired by the hour as and when required, and do not perform any other duties.

The cost of the cashiers in relation to the number of customers would be classified as which type of cost?

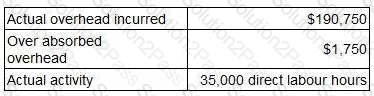

A company absorbs production overhead using a direct labour hour rate. Data for the latest period are as follows:

What is the overhead absorption rate per direct labour hour? Give your answer to one decimal place.

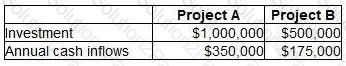

A company is appraising two projects. Both projects are for five years. Details of the two projects are as follows.

Based on the above information, which of the following statements is correct?

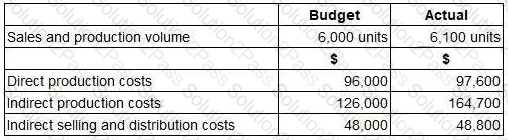

A company uses standard absorption costing. Budgeted and actual data for the latest period are as follows.

What was the production overhead absorption rate per unit?

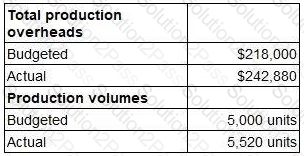

A company uses an integrated accounting system. The following data relate to the latest period.

At the end of the period, the entry in the production overhead control account in respect of under or over absorbed overheads will be:

The International Federation of Accountants (IFAC) stated that it was important that “accountants in business” should understand what the drivers of stakeholder value are. Which of the following statements is valid?

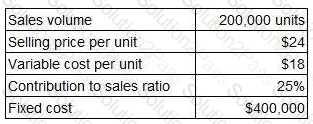

An organisation produces and sells a single product. The organisation’s management accountant has reported the following information for the most recent period.

Which TWO of the following statements are valid? (Choose two.)

Which of the following is a relevant cost?

A company has three production departments X, Y and Z, and one service department.

The service department’s overhead has been apportioned to the production departments in the ratio 3:2:5. As a result of this apportionment, $2,070 was given to Department Y.

What is the amount of service department overhead that would have been apportioned to Department Z? Give your answer to the nearest dollar.

In a company that manufactures many different products on the same production line, which TWO of the following would NOT be classified as indirect production costs? (Choose two.)

Which of the following is NOT a characteristic of useful operational level information?

A company’s management accountant wishes to calculate the present value of the cost of renting a delivery vehicle. There will be five annual rental payments of $5,000, the first of which is due immediately. The company’s discount rate is 12%.

Which TWO of the following are valid ways to calculate the present value of the rental payments? (Choose two.)

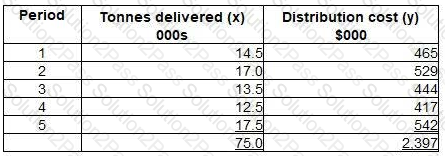

The following data are available for a delivery company. The table shows the number of tonnes delivered (x) and the associated distribution cist (y) in recent periods.

Further analysis of this data has determined the following:

∑xy = 36,427∑x2 = 1,144

Using least squares regression analysis, calculate the variable cost per tonne delivered. Give your answer to the nearest cent.

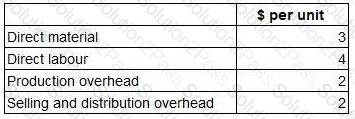

A company produces a single product for which the following cost data are available.

Analysis by the management accountant has shown that 100% of direct material cost and 50% of direct labour cost are variable costs. 50% of production overhead and 100% of selling and distribution overhead are variable costs.

What is the marginal cost per unit?

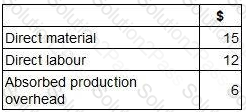

A new product requires an investment of $200,000 in machinery and working capital. The total sales volume over the product’s life will be 5,000 units. The forecast costs per unit throughout the product’s life are as follows:

The product is required to earn a return on investment of 35%.

What unit selling price needs to be achieved?

Which of the following statements relating to risk and uncertainty is correct?

A company has spent $5,000 on a report into the viability of using a subcontractor. The report highlighted the following:

A machine purchased six years ago for $30,000 would become surplus to requirements. It has a written-down value of $10,000 but would be resold for $12,000.

A machine operator would be made redundant and would receive a redundancy payment of $40,000.

The administration of the subcontractor arrangement would cost the company $25,000 each year.

Which THREE of the following are relevant for the decision? (Choose three.)

The year-to-date results at the end of month 9 included sales revenue of $3,600,000 and variable costs of $2,100,000.

During month 10, sales revenue was $450,000 and variable costs were $270,000.

What year-to-date contribution to sales ratio (C/S ratio) would be reported at the end of month 10?

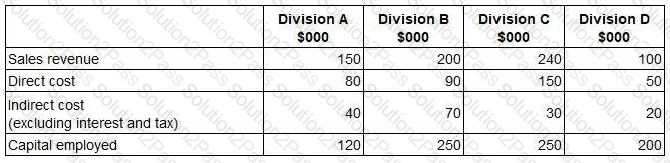

An organisation’s management report contains the following data:

Which division has the highest operating margin percentage?

According to CIMA’s Code of Ethics, CIMA members should not allow bias, conflict of interest of the influence of other people to override their professional judgement.

This is an example of: