BA3 CIMA Fundamentals of financial accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA BA3 Fundamentals of financial accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Which TWO of the following are features of a private limited company?

The double entry system underpins all accounting records

Which of the following combinations represent debit balances?

An organization's trial balance at the end of the month was out of agreement, with the debit side totaling £500 less than the credit side. A suspense account was opened for this amount.

During the next month, the following errors were discovered:

(a) The purchase returns day book had been under cast by £50

(b) Rent payable of £400 had been credited to the rent receivable account

(c) A non-current asset, with a net book value of £700 had been disposed of at a loss of £80; all entries had been correctly recorded except that the sale proceeds had been omitted from the disposals account.

Following the correction of these errors, the balance on the suspense account would be.

A company that is VAT-registered has sales for the period of $245,000 (excluding VAT) and purchases for the period of $123,375 (including VAT). The opening balance on the VAT account was $18,000 credit. The VAT rate is 17.5%.

What will be the closing balance on the VAT account at the end of the period?

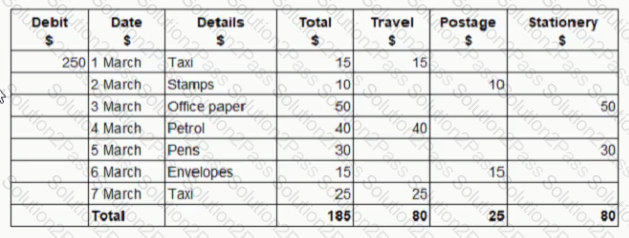

GH operates an imprest system for petty cash, maintaining a float of $250 The following petty cash book extract is available for a week in March 20X6:

How much does GH need to transfer from the bank account at the end of this week In order to maintain the imprest system?

Which of the following is not a correct definition of the accounting equation?

Your organization owed VAT of $22,700 at the beginning of the month.

During the month, it sold standard-rated goods with a net value of $600,000. Its purchases and expenses during the same month amounted to $188,000 including VAT. It paid VAT to the Revenue and Customs, of $33,400. The VAT rate is 17.5%

At the end of the month, the balance on the VAT account was:

The profit earned by Subramanian in 2006 was £ 50,000. He injected new capital of £12,000 during the year and withdrew goods for his private use that cost £4,000.

If net assets at the beginning of 2006 were £10,000, what were the closing net assets?

Which of the following explains the concept of capital maintenance?

Principles based accounting uses a conceptual basis to provide guidelines for preparing financial statements.

Which ONE of the following is an example of this approach?

A club receives subscriptions during 2006 of £4600. Of these £500 related to subscriptions in respect of 2005 and £400 related to subscriptions in advance for 2007.

The accounts for 2005 included an accrual of £600 for subscriptions in arrears; the balance of £100 which has still not been received, should be written off.

The figure for subscriptions in the income and expenditure account for 2006 will be

Entity V has a cost of sales of £23,850 for last year. Entity V's opening inventories for the year were £15,800, and its closing inventories were £3,570. Entity V had a gross profit margin of 240% for last year.

What was Entity V's inventories turnover figure to the nearest whole number for last year?

The concept of stewardship refers to which ONE of the following?

Company P are looking to create a balance sheet. Which of the following should be included in this document?

A sole trader made a net profit of $8000 for the year.

During the year, inventory increased by $500, receivables decreased by $800 and payables increased by $2400.

This would result in:

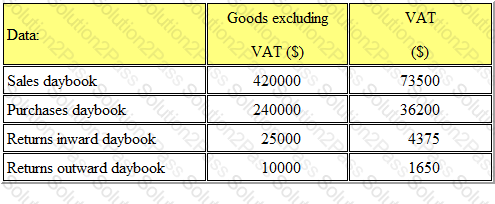

Refer to the Exhibit.

The following totals appear in a company's daybooks for the month of May. VAT is recoverable on all purchases which were in respect of goods for resale.

Opening inventory was £350,00 and closing inventory was $37,500.

The gross profit for the period was

The financial accounts, as prepared by the directors of a company, are required to show a 'true and fair view'. This means that:

In a cash flow statement, which one of the following would not be found under the section "cash flows from financing activities"?

Entity HJ is a small business. In the period. Entity Hj earned revenue of £24,300, had opening inventories of £1,500 and closing inventories of £8,000. Purchases came to £13,200.

What was Entity Hj's gross profit or loss for this period?

A company has a receivables balance at the end of the year of £120,000. The company maintains an allowance for receivables at 3% of closing receivables. The opening balance on the allowance was £ 2,880. During the year bad debts of £ 3,000 were written off

The total charge for bad debts for the year is £