BA3 CIMA Fundamentals of financial accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA BA3 Fundamentals of financial accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Refer to the Exhibit.

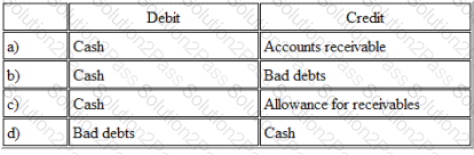

A company had previously written off one of their receivables that had been declared bankrupt. The administrators of the bankruptcy have now sent a cheque to the company for the full amount originally outstanding. The company now needs to record this receipt.

Which of the following is the correct double entry?

“To assure shareholders that the stewardship of the organization was effectively carried out.”

What does this definition describe?

Refer to the Exhibit.

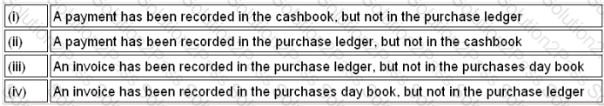

The purchase ledger control account shows a balance of £324,564, while the individual customer account balances total £328,234.

Which of the following is a possible explanation for the difference between the two?

What will be the effect on the financial statements if the closing inventory figure is decreased?

An accountant is taking on financial accounting responsibilities for company PQ. Which TWO of the following are NOT true of financial accounting?

Which THREE of the following would be shown in the statement of changes in equity?

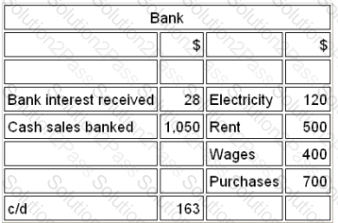

Refer to the Exhibit.

Which of the following would be the opening balance on the bank ledger account?

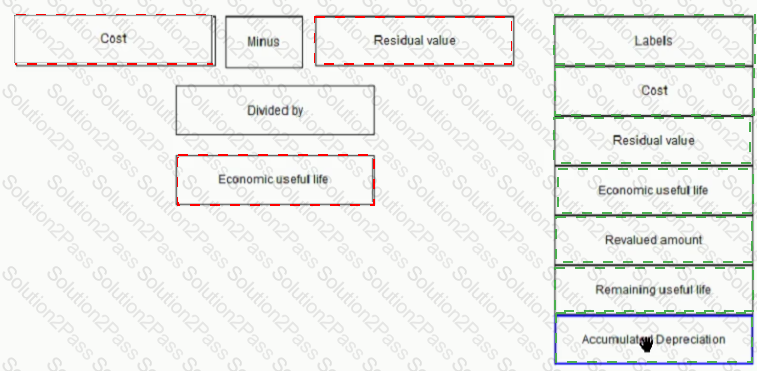

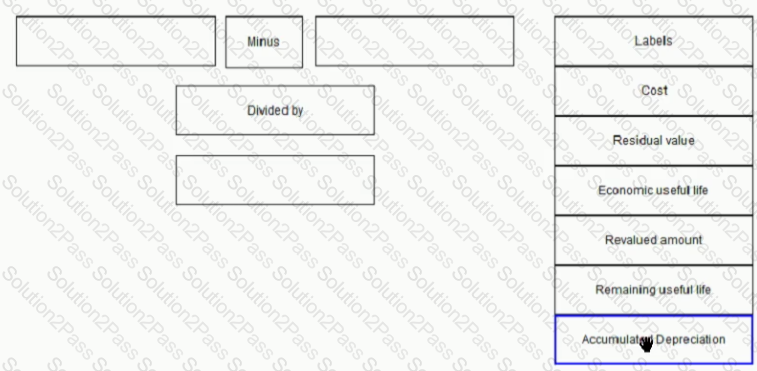

Complete the formula for depreciation of a revalued asset.

Place the relevant labels in the correct positions below.

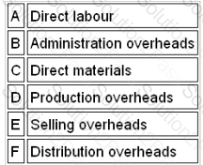

Refer to the Exhibit.

Which of the following items should be included in the valuation of inventory in a manufacturing company?

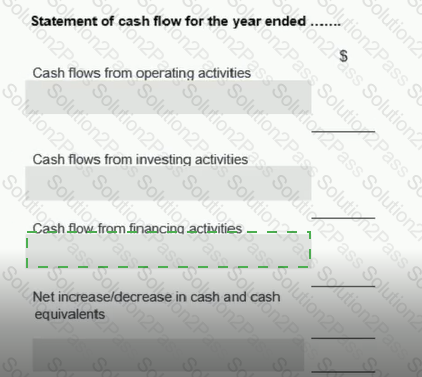

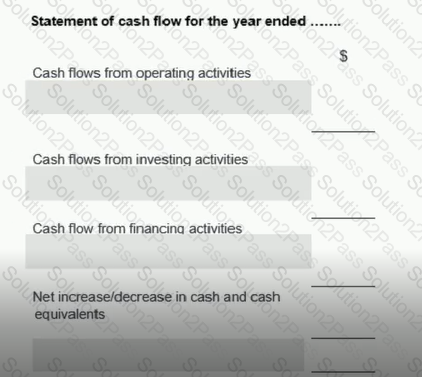

In which section of the statement of cash flow would cash from share issues be included? Select one of the following

Statement of cash How for the year ended.......

A company has receivables of $60,000, which represents 60 payables days, and payables of $45,000, which represents 45 payables days.

What would be the effect on cash, if receivable days and payables days were reduced to 55 days and 40 days respectively?

Which of the following are relevant to the total working capital days ratio calculation?

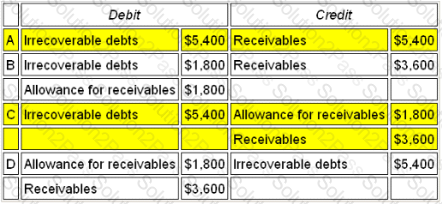

Refer to the Exhibit.

Ax minster Limited is calculating its irrecoverable debt charge and allowance for receivables for inclusion in its year-end accounts. The current allowance for receivables is $28,600 and it is estimated that this needs to be raised to $30,400. There are also bad debts of $3,600 which should be written off.

Which is the correct entry to be made to the accounts to record these transactions?

The correct entry to be made to the accounts to record these transactions is:

The Subscriptions Receivable account of a club commenced the year with subscriptions in arrears of £250 and subscriptions in advance of £375.

During the year £62,250 was received in subscriptions, including £200 of the arrears, and £600 for next year's subscriptions. Subscriptions still owing at the end of the year amounted to £180.

The amount to be taken to the Income and Expenditure for the year is

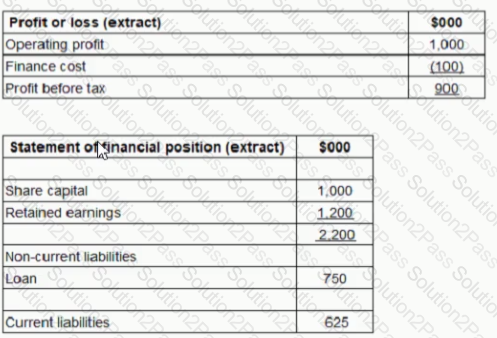

The following are extracts from CD's financial statements for the year to 31 December 20X2:

What is the return on capital employed percentage (ROCE) for CD for the year ended 31 December 20X2?

A company uses the reduced balance method of depreciation for its company vehicles. The vehicles are depreciated at a rate of 30% per annum.

On 31 March 2003 the company purchased a number of vehicles with a total cost of $200,000. The company's year-end is 31 December and it is company policy to charge a full year's depreciation in the year of acquisition.

The carrying value of the vehicles at 31 December 2006 will be

Which of the following statements about revenue is CORRECT?

Which of the following would require an adjustment to be made to the cash book?

(a) Unpresented cheques

(b) Receipts not yet credited by the bank

(c) A dishonoured cheque

(d) Bank charges

An error of commission occurs where.

W and Partners has an opening capital balance at 1 January of £14,640 credit.

During the period there was an increase in assets of £6,820 and an increase in liabilities of £5,400.

The balance on the capital account at the end of the period is: